In this week’s Week in Review: UK government may scrap HFSS ad ban, Roku reworks content discovery, and Bridgepoint backs MiQ.

Top Stories

UK Government Considers Scrapping HFSS Ad Ban

The UK government, under the leadership of new Prime Minister Liz Truss, is considering scrapping plans which would severely limit ads for foods which are high in fat, salt, or sugar (HFSS).

The proposal, developed as part of an overall anti-obesity campaign, would ban TV ads for HFSS foods before the watershed, and would impose a total ban for HFSS food ads online. This has proven unpopular with some in the ad industry, who have complained such a law would harm ad revenues for publishers, without having much of an impact on obesity.

But the government has launched a review of its overall anti-obesity strategy, partly in response to the cost of living crisis.

“We have always been clear that, based on that Government’s own evidence, the restrictions would do nothing to address the problem of childhood obesity that all of us want to solve, but would have a damaging impact on businesses,” said Richard Lindsay, director of legal & public affairs at the IPA, a trade association. “That we are still waiting for a Government consultation to provide details of the restrictions just adds to the uncertainty for businesses.”

Roku Upgrades Content Discovery with ‘The Buzz’

Roku upgraded its OS and streaming devices this week, with a big focus on content discovery. Roku OS version 11.5 features a content aggregation tool known as ‘The Buzz’, which includes video clips, trailers, interviews and other media designed to help users discover new content.

The upgrade also adds a Continue Watching feed to the home screen, allowing viewers to resume playback across HBO Max, Netflix, Paramount+ and The Roku Channel. In addition, a centralised Save List provides a single destination for previously saved content from multiple streaming channels.

The announcement chimes with a OnePoll and Plex study released this week, suggesting that US consumers struggle with content discovery. The report found that over two-thirds of US streaming viewers find their watchlist “nearly impossible” to get through. Half of the respondents reported difficulty finding what streaming platform a piece of content is available on, averaging 30 minutes spent flipping through four different streaming services before deciding on what to watch. According to the survey, more than half end up giving up and turning off the TV.

Bridgepoint Takes Majority Stake in MiQ

Private equity firm Bridgepoint has taken a majority stake in ad tech company MiQ, the two companies announced this week. The investment, when it was first reported by Insider, was said to value UK-based MiQ between $900 million and $1 billion, making this one of the biggest European ad tech transactions of recent years, according to Insider. It comes five years after ECI took a minority stake in the company, which reported a 240 percent increase in US revenue since 2017.

MiQ says that Bridgepoint was selected due to its cultural and strategic alignment, and its ability to strengthen MiQ’s rapid growth trajectory through its experience in product development strategies and assisting businesses with their global expansion plans. MiQ, with this new backing, is now looking at potential M&A deals to power further growth, according to Digiday.

The Week in Tech

Twitter Allegedly Knew of National Security Breaches, Approves Musk Takeover

Twitter whistleblower Peiter “Mudge” Zatko appeared in front of the Senate Judiciary Committee on Tuesday. He alleged that Twitter was informed of Chinese government agents working at the social media firm, among other security breaches, possibly caused by a desire to maximise advertising revenues from the Chinese market. The same day, Twitter shareholders approved Elon Musk’s proposed $44 billion takeover deal. Its future will be determined at trial in October.

🍿

— Elon Musk (@elonmusk) September 13, 2022

PubMatic Acquires SPO Specialist Martin

PubMatic will acquire measurement and reporting platform Martin, as per a definitive agreement announced this week. The company said the acquisition comes in response to growing demand from buy-side customers looking to take advantage of PubMatic’s omnichannel inventory. The move deepens the sell-side platform’s (SSP) investment in supply path optimisation (SPO), reducing the number of intermediaries involved in programmatic deals. Read more on VideoWeek.

Outbrain Launches Optimisation Platform for Media Groups Content recommendation provider Outbrain has launched a new platform called Keystone. According to the company, the user experience optimisation technology allows large media groups to personalise navigation for individual internet users, thereby serving multiple business objectives: advertising, subscriptions, e-commerce and events. “Publishers can rely on Keystone to make the most of their audiences while guaranteeing them editorial content and a quality experience,” said Outbrain co-founder and co-CEO Yaron Galai. “This technology allows them to offer their users a tailor-made experience and thus accelerate the diversification of revenues, key to their future growth.”

The ARF Launches Study into Attention Metrics

The Advertising Research Foundation, an influential ad research body founded by the ANA and 4As, has announced it is launching a study into the reliability and validity of attention measurement tools. At a time when agencies are increasingly incorporating attention metrics into their media buying, the ARF’s study aims to lay out the scientific grounding behind these metrics. Read more on VideoWeek.

AppLovin Steps Aside for Unity/ironSource Deal

AppLovin has withdrawn its takeover offer for Unity Software. Unity rejected the $17.54 billion bid last month, having agreed in July to buy AppLovin rival IronSource for $4.4 billion. The AppLovin offer was contingent on Unity dropping the ironSource acquisition. Unity can now proceed with the IronSource acquisition, designed to boost its ad tech that suffered under Apple’s privacy changes.

Google Hit by Fresh and Ongoing Antitrust Lawsuits

UK and EU law firms announced plans to file lawsuits against Google, seeking €25 billion in compensation for publishers. These come in addition to multiple cases accusing Google of abusing its position in the digital advertising business. A federal judge ruled on Tuesday that Google must face all but one antitrust allegation brought by the Texas attorney general. The tech giant also lost most of its first round battle against a €4.3 billion EU fine targetting its power over the Android ecosystem. EU regulators broadened the scope of their investigation to incorporate a Portuguese probe alleging that the company “has used information not accessible by competitors” to direct auctions in Google’s favour, and “has possibly limited the development of competing auction technologies.”

The Week in TV

Netflix Expects Ad Tier to Reach 40 Million Viewers in One Year

Netflix estimates its ad tier will reach about 40 million viewers globally (13.3 million in the US) by Q3 2023, according to The Wall Street Journal. In meetings between Netflix, Microsoft and ad buyers, the streaming giant told advertisers it expects to have 4.4 million viewers (1.1 million in the US) at the end of 2022. The report noted the figure counts viewers rather than subscribers, and is therefore higher. The projections covered launch markets including Brazil, Mexico, Japan, the UK, France, Germany, Korea, Spain, Italy, Australia and Canada.

FOX Chooses Comscore Currency for Local TV Transactions

FOX Television Stations (FTS) and Comscore announced a partnership that will see the former using the latter’s currency in local TV transactions. Comscore said its solution combines viewership information with household-level consumer and demographic behaviour data, enabling buyers and sellers to access advanced and relevant metrics. Tom Fleming, SVP of Station Sales at FTS, added: “By partnering with Comscore for local TV measurement, FTS can now use significantly larger data sets and even more precision to ensure that linear advertisers are strategically paired with their consumers.”

Advertising Layoffs Coming to Warner Bros. Discovery

Warner Bros. Discovery (WBD) intends to lay off “hundreds of people” from ad sales teams, Axios reported on Tuesday. The move forms part of the recently merged company’s efforts to recoup $3 billion from losses incurred in the merger. Other cost-saving measures include merging the HBO Max and Discovery+ streaming services, removing content from HBO Max and halting production on originals in some parts of Europe.

Canal+ Raises Stake in MultiChoice

Canal+ has raised its stake in MultiChoice, from 20.12 percent to 26.26 percent. The French media company first acquired 6.5 percent of the South African pay-TV operator’s equity in 2020, and has been growing its share ever since. Pushing its stake beyond 35 percent would trigger a mandatory buyout offer to other shareholders.

Showtime Could be Folded into Paramount+

Rumours circulated this week that Paramount could fold its Showtime streaming service into Paramount+. Showtime exists as a standalone streamer in the US, but internationally its content is offered on Paramount+. The proposal is the latest in a trend for ‘hard bundling’, with Warner Bros. Discovery combining HBO Max and Discovery+, and suggestions that Hulu be rolled into Disney+. Meanwhile Paramount+ launched in Italy on Thursday, joining the UK, US, Canada, Latin America, the Caribbean, Australia and South Korea.

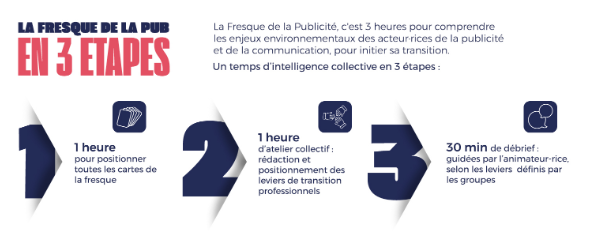

TF1 PUB Launches Environmental Workshop for Advertising

TF1 PUB has launched La Fresque de la Publicité, a three-hour workshop designed to help advertising professionals understand the environmental impact of the sector. Following a pilot phase, education specialists Youmatter and environmental consultant Mathieu Jahnich have made the course available industry-wide. TF1 also deployed a Climate and Advertising roadmap, including the creation of a ‘Change Makers’ group of TF1 PUB employees, implementation of a carbon calculator for advertisers, and an EcoFunding advertising fund.

Activist Investor Steps Back from Urging Disney to Sell ESPN

Disney investor Dan Loeb appeared to retreat from his push for Disney to sell ESPN. Last month the Third Point founder urged the company to spin off ESPN in order to alleviate debt. Disney CEO Bob Chapek then told the FT the conglomerate had been “deluged” with interest from players looking to buy the sports network, and hinted at plans to restore its growth trajectory. Loeb tweeted his support for the strategy on Sunday.

We have a better understanding of @espn‘s potential as a standalone business and another vertical for $DIS to reach a global audience to generate ad and subscriber revenues. We look forward to seeing Mr. Pitaro execute on the growth contd. https://t.co/Gobvf8KS2w

— Daniel S. Loeb (@DanielSLoeb1) September 11, 2022

Western Europe SVOD Subs to Reach 238 Million in Five Years

Western Europe will reach 238 million SVOD subscriptions by 2027, according to Digital TV Research, up from 165 million at the end of 2021. Of the projected total, 62 million subscribers will come from Netflix and 46 million from Disney+, an increase of 3 million and 20 million respectively. The study forecast Western European SVOD revenues to hit €24.6 billion in 2027.

Broadcasters Suspend Advertising After Queen’s Death

British broadcasters introduced advertising blackouts following the Queen’s death this week. ITV, Channel 4 and Sky paused adverts on their main channels, though ads continued on some digital channels. Ad breaks will additionally be suspended on Monday for the Queen’s funeral. Twitter also pulled UK ads for 48 hours and Snapchat for 24 hours, alongside outdoor advertising companies Clear Channel UK and JCDecaux, national publishers Reach and News UK, and commercial radio owner Bauer.

TelevisaUnivision Completes Pantaya Acquisition

TelevisaUnivision announced on Tuesday it has completed its acquisition of Pantaya. In May the Mexican-American media company revealed plans to buy the Spanish-language streaming platform. The deal adds Pantaya’s content library to TelevisaUnivision’s ViX and ViX+ streaming services, serving culturally relevant programming for Hispanic audiences.

The Week for Publishers

Minute Media Launches its Own Supply-Side Platform

Publishing group Minute Media, owner of titles including The Players’ Tribune, 90min, and mental floss, this week announced the launch of its own supply-side platform (SSP). The company says the move will create a more efficient and direct connection between publishers and brands working within the programmatic advertising ecosystem – it will be open to other publishers, as well as being an access point to Minute Media’s inventory for buyers.

The Athletic Begins Running Ads

The Athletic, a sports publishing brand owned by The New York Times, has begun running ads for the first time, Adweek reported on Monday. The subscription-funded site has never turned a profit, thanks in part to its strategy of bringing in high-profile sports journalists to fuel its growth. The Athletic is aiming for double-digit CPMs according to Adweek, which it hopes will help it turn a profit.

TikTok Launches BeReal Clone ‘TikTok Now’

TikTok this week launched ‘TikTok Now’, a new feature which prompts users one per day to post a photo or video using both their front and back phone cameras – a format made popular by rival social app BeReal. TikTok has of course been on the receiving end of similar treatment for the past few years, with pretty much every social platform launching a TikTok-like video feed. It’s a dog filter-eat-dog filter world out there.

Reach’s Journalist Strike Had Minimal Impact on Traffic

Strikes by journalists at UK publishing group Reach had minimal impact on traffic across sites, according to Press Gazette. Reach’s traffic sat at over 17 million on Wednesday 31st August, when journalists walked out, which was actually above traffic on the previous Wednesday.

EU Wants Increased Scrutiny Over Editorial Independence and Media Plurality in Merger Decisions

The EU is working to limit harmful impacts on editorial independence and media plurality by media mergers and acquisitions, via its new Media Freedom Act. The proposed rules would introduce stricter standards for media companies buying out smaller rivals, in response to media mergers in Hungary and Poland which have given those country’s governments a firm grip on the national media.

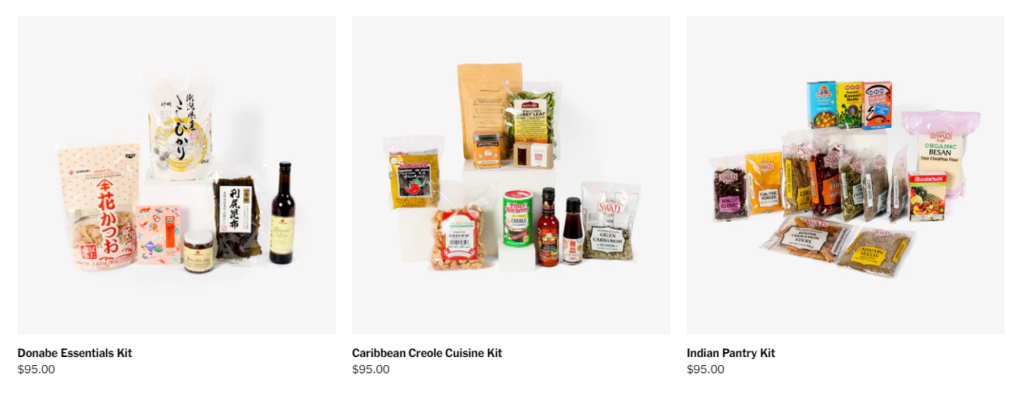

New York Times Sells Recipes Kits

The New York Times has begun selling at-home cooking kits as part of its revenue diversification strategies. The recipe kits contain niche ingredients selected by professional chefs relating to a particular cuisine, as well as recipes and access to video tutorials.

Citibank Partners Yahoo to Enhance Public Literacy on Personal Finance

Yahoo has partnered with Citibank to launch a new personal finance hub, Life and Money, which is geared towards diverse audiences, according to ExchangeWire. The hub will be hosted on Yahoo Finance in Singapore.

The Week For Agencies

Publicis Board Backs Sadoun for Another Four Years

The Publicis Group supervisory board has voted to renew chairman and CEO Arthur Sadoun’s mandate for another four years. “The Supervisory Board would like to express to Arthur Sadoun its great satisfaction with the exceptional performance of the Groupe in recent years,” said Maurice Lévy, chairman of the supervisory board. “The results achieved after bold moves such as the creation of the Marcel platform, the repositioning of Publicis Sapient and the acquisition and successful integration of Epsilon command admiration.”

Omnicom Retains SC Johnson Global Media Account

Omnicom has retained global media duties for FMCG brand SC Johnson following a competitive review which included WPP, AdAge reported this week. SC Johnson’s global ad spend sits at around $1 billion, according to AdAge.

Agencies Report Challenging Market in 2022

RSW/US an outsourced business development firm for marketing agencies found in its 2022 Agency New Business Report that agencies are facing a more challenging landscape his year when it comes to winning new business. Forty-three percent of agencies surveyed said obtaining new business this year is either harder or a lot harder than the previous year, and agencies overall say they are investing less in finding “new” new business.

We Are Social Wins Starbucks’ Creative Account in EMEA

Starbucks has awarded its EMEA creative and strategy account to We Are Social following a competitive pitch process. The account has been held by Iris for the past five years.

Havas Launches New Podcast Challenging Industry to “Do Better”

Havas has launched a new podcast called ‘Advertising Will Save Us’, which it says is designed to address common criticisms of the ad industry and challenge it to do better. The podcast will be hosted by Dan Lucey, chief creative officer of Havas New York and Myra Nussbaum, president and chief creative officer of Havas Chicago.

General Motors Signs Up for NBCUnified

NBCUniversal this week announced that General Motors (GM) will become the first brand to integrate with NBCUnified, its holistic first-party data and identity platform. The integration with NBCUnified will bring together GM’s data on its consumer automotive profiles and overlap them with NBCUnified’s first-party data on consumer media consumption preferences, according to NBCU.

Hires of the Week

Karen Blackett Promoted to WPP UK President

WPP has promoted GroupM CEO Karen Blackett to president of WPP UK. She becomes the agency’s first UK president, as its second-largest market now requires full-time focus, according to WPP CEO Mark Read. “Karen is one of the most admired figures in our industry and the kind of collaborative, people-focused leader who is perfect for this role,” he added.

M7 Group Appoints CFO Frederic Berardi

Canal+ subsidiary M7 Group has appointed Frederic Berardi as CFO and Board Member. He has spent 11 years in various CFO/COO/CEO positions at Canal+ International in Poland, Vietnam, Senegal and now Luxembourg. “I am very excited to take on this new role and support M7 at its evolution into a premium content and streaming provider with a strong European appeal,” said Berardi.

Publicis Expands International Leadership Roles

Publicis Groupe has reshuffled its executive team, expanding the remits of three CEOs. Loris Nold (previously CEO for APAC & MEA) becomes chief executive of EMEA; Jane Lin-Baden (formerly CEO of Publicis Groupe North Asia) moves to chief executive for APAC; and Monica Gadsby (CEO for Latin America) adds oversight of Brazil to her responsibilities.

Joseph Pergola Becomes Connatix CFO

Connatix has named Joseph Pergola as its first CFO. Pergola brings more than 20 years of experience, having served at Integral Ad Science, Amazon, Audible, Criteo, The Weather Company, Yahoo and Time Warner. His appointment follows investment in Connatix by Court Square Capital Partners in July 2021, and recent expansion in Chicago and London.

Claire Blunt Named Future COO

Future Publishing has announced Claire Blunt as its new COO. She joins from the Guardian Media Group, where she worked as Chief Advertising Officer and CEO of International. Prior to the Guardian, Blunt was Chief Financial, Operations & Data Officer for Hearst Europe, having joined Hearst as UK CFO in 2015.

This Week on VideoWeek

Gaming Companies Are Levelling Up Their Ad Offerings, read on VideoWeek

The VideoWeek Guide to DMEXCO 2022, read on VideoWeek

Discovery Leaves Joyn as ProSieben Takes Full Control, read on VideoWeek

Google Faces €25 Billion “Anticompetitive Conduct” Lawsuit, read on VideoWeek

Introducing the Future of Measurement Guide 2022, read on VideoWeek

PubMatic’s Martin Acquisition Aims to Boost Transparency for Buyers, read on VideoWeek

The Advertising Research Foundation is Putting Attention Metrics to the Test, read on VideoWeek

Ad of the Week

Ikea, Bring Home to Life