In this week’s Week in Review: Snap’s Q2 results spark further panic for ad-funded tech, WarnerBros. Discovery’s JV with BT gets regulatory approval, and the latest IPA Bellwether report shows stagnating ad budgets.

Top Stories

Snap’s Ad Sales Struggle Amid Slowing Demand

Snap’s stock fell by 25 percent last night after the social media company posted disappointed Q2 financial results, with the company seeing a slowdown in advertiser demand. Snap posted 13 percent revenues growth year-on-year, significantly below its previous forecast of 20-25 percent growth.

The company warned earlier this year that it had seen a worse-than-expected deterioration in the ad market, which itself sparked a drop in share prices for advertising-dependent companies across the tech sector. And in Q2, the tough market continued to weigh on Snap’s revenues.

In part, Snapchat executives say the app is feeling the effects of Apple’s privacy changes, which have limited its ability to run effective direct-response campaigns. But now, wider macroeconomic conditions are causing a further fall in advertiser demand.

“We’re seeing these various headwinds put pressure on the earnings of a wide variety of companies, and this is directly impacting the demand for advertising,” said Derek Andersen, Snap’s CFO. “Specifically, advertising spending, in particular, auction-driven direct response advertising is among the very few line items in a company’s cost structure that they can reduce immediately in response to pressure on their top line or their input costs. As a result, as many industries and verticals have come under top line or input cost pressure, advertising spending has been amongst the first areas impacted.”

UK Regulator Gives Green Light to BT Sports’ JV with WarnerBros. Discovery

The UK’s Competition and Markets Authority, the country’s antitrust regulator, has given the green light to BT Sports’ proposed joint venture with WarnerBros. Discovery.

The joint venture will see the two businesses work together on a new sports’ broadcasting business, which will combine BT Sports with Discovery’s Eurosport, creating a significant challenger to Sky in the UK. Based on the two companies’ existing rights deals, the JV will host the UEFA Champions League, UEFA Europa League, the Premier League, Premiership Rugby, UFC, the Olympic Games, tennis Grand Slams, cycling Grand Tours and the winter sports World Cup season.

“Combining the capabilities, portfolios and scale of BT Sport and Eurosport UK will be a big win for fans in the UK & Ireland, offering a new destination that will feature all the sport they love in one place,” said Andrew Georgiou, future board member of the JV and president and MD of Warner Bros. Discovery Sports Europe. “We now look forward to closing the transaction and having the opportunity to further engage all stakeholders in the process of forming and developing the JV.”

Bleak Outlook for Ad Spend in IPA Bellwether Report

Ad spend forecasts have fallen despite continued growth in UK marketing budgets during Q2, according to the IPA Bellwether Report. The survey showed that 24.2 percent of companies raised their marketing expenditure over the period, while 13.4 percent registered budget cuts. The net balance of +10.8 percent was down from +14.1 percent in Q1.

The report showed media budgets stagnate with a 0 percent net balance. Online and video advertising saw growth of 4.4 and 0.8 percent respectively, representing significant slowdowns from 18.6 and 9.0 percent in Q1.

The study added that economic headwinds have caused S&P Global Market Intelligence to downgrade its 2022 ad spend growth forecast from 3.5 to 1.6 percent. Inflation, business costs and the risk of recession are among the factors “likely to spill over into 2023,” leading S&P to cut its 2023 ad spend growth forecast from 1.8 to 0.8 percent.

“Amid a deteriorating economic outlook for UK businesses, sustained growth in total marketing activity is encouraging,” said Joe Hayes, Senior Economist at S&P and author of the Bellwether Report. “However, the stagnation in main media marketing budgets is a disappointing result from the Q2 survey and suggests concerns around the outlook are weighing on decision making. Risks are clearly skewed to the downside as the intensifying cost of living crisis weighs on disposable incomes, while firms face difficult decisions regarding their spending at a time when their cost burdens continue to inflate.”

The Week in Tech

Virgin Media O2 Bids to Buy TalkTalk

Virgin Media O2 has offered £3 billion to acquire its rival TalkTalk. The Salford-based telecoms and pay TV company has been in play since April, according to the Guardian, when it was revealed to have been approached several times regarding a sale. The potential takeover by Virgin Media O2 aims to create a new “national champion” to challenge BT and Sky.

InfoSum Launches Platform Sigma

InfoSum this week announced the launch of Platform Sigma, a set of enhancements to its data collaboration tools which it describes as “the most significant update in InfoSum’s history”. InfoSum says that through Platform Sigma, businesses will be able to collaborate across unlimited datasets, regardless of size, format, or location, unlocking advanced planning, measurement, and analytics.

Médiamétrie Plans to Start Measuring Streaming Audiences in 2024

TV measurement company Médiamétrie expressed plans to start measuring audiences on Netflix and other streaming services that currently measure their viewership themselves. “It’s a mess,” said Médiamétrie CEO Yannick Carriou. “Today, some media create their own ecosystem of audience indicators. It’s out of the question to let players measure themselves when they compete with traditional channels on the advertising market. Within two years, we will be able to measure the audiences of the platforms with as much precision as those of TV and publish them every day, whether the platforms collaborate with us or not!”

House of Representatives Committee Approves Landmark Privacy Bill

A House of Representatives committee has approved a bill to create the first US privacy law limiting the collection of personal information by tech giants. The House Energy and Commerce Committee approved the bill by a margin of 53-2, sending it to the House floor while a companion bill goes to the Senate. “People need more control over their information online,” said Representative Cathy McMorris Rodgers. “They’re looking to us, their elected representatives, to act. The American Data Privacy and Protection Act includes the most robust privacy protections to date in the United States.”

Connatix Opens UK Office

Video technology company Connatix on Tuesday announced the opening of its new UK office. The expansion follows investment from private equity firm Court Square Capital Partners. “At Connatix, we work with over 3,000 publishers and more than 1,000 advertisers worldwide,” said Connatix President and CRO Jenn Chen. “Expanding our UK presence is a natural step as the company continues to scale its global business to meet rapidly growing demand.”

Google Cuts Fees for App Developers Using Rival Payment Systems

Google is cutting fees for app developers that use rival payment systems on its Google Play App Store. Positioning itself to comply with the EU’s Digital Markets Act, the tech giant announced it will cut fees from 15 to 12 percent for non-gaming developers switching to alternative billing systems. This freedom will eventually be extended to gaming apps, the company confirmed in a blog post.

UK Government Introduces AI Regulation

The UK Government has published new regulation around artificial intelligence. The proposals anticipate advancement in AI development stemming from the Data Protection and Digital Information Bill. The regulation includes guidance for businesses on fair and transparent use of AI systems that are safe for consumers and free from unfair biases.

CMA to Reconsider Meta/Giphy Case

Meta’s forced sale of Giphy was put on pause this week when an appeal judge sent the case back to the Competition and Markets Authority (CMA) for further review. In 2021 the CMA made the unprecedented move of ordering Meta to unwind its takeover of the GIF search engine. Now the Competition Appeal Tribunal has ruled that the watchdog failed to consult properly and must reconsider its decision.

Report Shows Advertisers Spending Up to 10 Percent of Budgets on Clickbait

Advertisers are spending around 10 percent of their budgets on clickbait sites, according to research by DeepSee, Jounce Media and Ebiquity. The latter found that its clients had spent $115 million on “made for advertising” inventory between January 2020 and May 2022. “It’s so blatant, it’s such a big number, we feel it’s a prerogative for brands to make sure that they address this,” Ebiquity chief product officer Ruben Schreurs told Marketing Brew. “Exclude this activity and make the effort to understand which properties are misbehaving.”

AdPlayer.Pro Surpasses 52 Million Daily Served Impressions

Video ad tech provider AdPlayer.Pro surpassed 52 million daily served impressions in Q2 2022, the company announced on Tuesday, citing its recent expansion of direct partnerships with publishers in several growing market verticals. The company also upgraded its functionality in Q2, releasing out-stream ad format variations that enable publishers to set custom ad breaks for InPage, InView and out-stream video ad units that can be integrated into their digital properties.

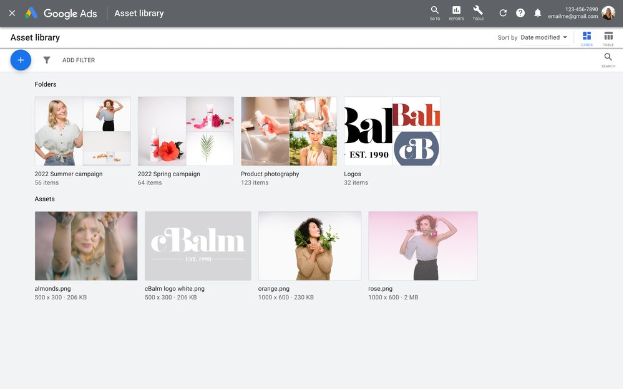

Google Ads Introduces Asset Library and Video Creation Tool

Google this week added a pair of products to Google Ads. The Asset Library allows users to view, import and organise creative assets in a centralised environment, while the new video creation tool enables fast production using templates made for YouTube. Google also introduced a text-to-voiceover feature with seven English voices available, along with Filipino, French, Hindi, Indonesian, Korean, Malaysian, Mandarin, Spanish and Swedish.

MELON Raises $5 Million Seed Round

Metaverse studio MELON secured $5 million in a funding seed round, the company announced on Wednesday. The developer builds metaverse experiences for clients such as Mattel, Chipotle and the NFL. Its investors include Crush Ventures, Gaingels, Comcast Spectacor and an SPV led by Matt Finick (who joins MELON’s board), as well as health care investor Paul Yook and former VICE Media CCO Spencer Baim.

Alkimi Exchange Lists on Crypto Platform Uphold

Decentralised ad exchange Alkimi Exchange became listed on multi-asset trading platform Uphold this week. The company aims to equalise the value exchange between publishers, advertisers and users. “Alkimi’s mission to provide a more cost-effective, transparent and greener advertising to solve the plethora of issues currently facing the programmatic ecosystem aligned with Uphold’s values so it seemed an obvious partnership for us at Alkimi,” said Alkimi Exchange CEO and Co-Founder Ben Putley.

The Week in TV

Disney Secures $9 billion in Upfront Ad Sales

Disney announced that it has secured $9 billion in advertising commitments for 2022-23. The record figure was credited to high demand for live events and the upcoming ad-supported tier of Disney+. The conglomerate said Disney+, ESPN+ and Hulu brought in 40 percent of the total commitments. According to Reuters, Disney is pursuing sports and live events “in an attempt to cushion advertising sales that’s under pressure from record inflation and geopolitical turmoil.”

Viaplay Buys Premier Sports

Viaplay Group has agreed to acquire UK sports streamer and TV channel operator Premier Sports, a move designed to boost Viaplay’s live sports streaming offering ahead of its UK launch. Premier Sports’ UK sports rights include La Liga, Scottish Cup, Scottish League Cup and Coppa Italia football; United Rugby Championship, Rugby Football League and Top 14 rugby; NASCAR motorsport; and the Elite Ice Hockey League.

Advertising and Subscription Models Won’t Work for the BBC says Lords Report

A new report released by the UK’s House of Lords this week claims that advertising and subscription-based funding models for the BBC won’t work, and that the government must look to alternative solutions as it considers the broadcaster’s future. The Lords report says that there are flaws in the current license fee model, and that there is a case for wholesale change in the way the organisation is funded. Read the full story on VideoWeek.

Ofcom Seeks Evidence on PSB Advertising Rules

Ofcom is considering reforming the rules around advertising on public service broadcasters (PSBs). The watchdog asked for evidence from broadcasters, advertising and sales organisations into whether the strict rules (introduced over 30 years ago) around advertising on PSBs remain justified in the current climate of competition from non-PSBs and streaming services. “We need to strike the right balance between protecting viewers’ interests and sustaining our traditional broadcasters, which includes helping them compete with global streaming platforms,” the regulator said.

US Court Overturns FCC Rules Requiring Broadcasters to Identify Sponsors

A US Court has overturned rules implemented by the Federal Communications Commission (FCC) that would force broadcasters to disclose sponsorship from foreign governments. The FCC introduced the rules in the wake of the Russian invasion of Ukraine, claiming that Chinese and Russian governments were “secretly leasing air time to broadcast propaganda on American radio.” The US Court of Appeals for the District of Columbia struck down the new rules. FCC Chairwoman Jessica Rosenworcel said: “The principle that the public has a right to know the identity of those who solicit their support is a fundamental and long-standing tenet of broadcasting.”

TF1 PUB Extends Solidarity Advertising Solution

TF1 PUB and Goodeed extended their “solidarity advertising” solution to the TF1 INFO digital news website. Created in 2020 for TV advertising, the format allows video ads to promote a social or environmental cause, with each impression generating a charity donation. Also this week, TF1 is looking to sell its influencer marketing agency YKONE. The French broadcaster entered exclusive negotiations with Future Technology Retail (FTR) with a view to sell its stake in the company, which launched in 2008, integrated into TF1 Group in 2018 and has since expanded into 12 territories.

The Week for Publishers

The Guardian Posts Highest Revenues Since 2008

The Guardian and The Observer have reported a cash surplus for the first time in a generation, and posted its highest revenues since 2008, in its recent earnings statement. For the year to April 3rd, Guardian Media Group posted £255.8 million. The strong revenues mark the continued success of The Guardian’s voluntary donations strategy.

YouTube Doubles Down on Commerce with Shopify Partnership

YouTube this week announced a new partnership with ecommerce company Shopify to launch YouTube Shopping. YouTube Shopping will allow all merchants who are signed up with Shopify to sell their products on YouTube through live streams, videos, and a store tab. Read the full story on VideoWeek.

TikTok, Instagram, and YouTube are UK Teenagers’ Top News Sources

UK teenagers most frequently turn to TikTok, Instagram, and YouTube for news, according to Ofcom’s News consumption in the UK 2021/22 report which was released this week. Twenty-nine percent of 12-15 year olds use Instagram for news, while 28 percent use YouTube, and 28 percent use TikTok. ITV is the most used established news service, with 25 percent saying they get news from ITV’s various services.

Informa Buys Industry Dive for £323 Million

B2B publishing group Informa this week agreed a deal to buy business publisher Industry Dive, owner of 27 specialist titles under the ‘Dive’ brand, for £323 million. Informa says it will roll out new ‘Dive’ publications for uncovered industries, while also expanding the events part of Industry Dive’s business.

Euromoney Accepts £1.7 Billion Takeover Bid from Private Equity Groups

Financial publisher Euromoney has accepted a £1.7 billion takeover bid from private equity groups Astorg and Epiris, a deal which will split the business into two parts. Astorg will take control of the Fastmarkets part of the business, while Eprisis will take over the rest, according to the FT.

Reach Opens Voluntary Redundancy Round for Journalists

UK publishing group Reach has opened a voluntary redundancy round for journalist staff, amid challenging conditions for the company. The move is an effort to cut costs, and Reach is also putting a hiring freeze in most areas of the company, as the slow advertising market takes its toll on the publisher.

Twitch Launches Closed Beta for Charity Tool

Live streaming platform Twitch has launched a closed beta for a new built-in fundraising tool, which will make it easier for creators to conduct charity live streams. The new feature, ‘Twitch Charity’ will allow streamers to select a charity and set fundraising goals within the tool, and then viewers can choose to donate directly while watching the live stream.

The Week For Agencies

Publicis Lifts Full Year Guidance After Strong Q2

While parts of the industry are feeling the impact of the current economic turmoil, Publicis Groupe actually raised its full year guidance after a strong Q2. The agency group now expects 6-7 percent organic revenue growth this year after beating expectations for the first half of the year, up from a previous forecast of 4-5 percent. Publicis reported organic revenue growth of 10.4 percent for the first half of the year.

Omnicom Reports 11.3 Percent Organic Growth in Q2

Omnicom posted its Q2 financial results this week, reporting 11.2 percent organic growth for the quarter. Organic growth for Omnicom’s advertising and media segment specifically was 8.2 percent. “We performed well on every metric this quarter, led again by double-digit organic revenue growth,” said John Wren, Omnicom’s chairman and CEO. “The changes we have made in our portfolio are delivering better results for our clients as we are uniquely qualified to help them digitally transform their business, navigate complexity, and expand in high-growth areas like retail media and e-commerce.”

GroupM Plans to Launch its Own Carbon Calculator

WPP’s media arm GroupM this week introduced a new global framework for reducing ad-based carbon emissions to zero by 2030. After conducting research into existing methodologies for measuring and reducing ad-based carbon emissions, GroupM has formulated its own practices to power “what we believe to be the industry’s most robust global carbon calculator,” which will be made available to GroupM clients later this year. Read the full story on VideoWeek.

In-Housing On the Rise Amid Client Dissatisfaction

A new WFA survey released this week found that in-housing is on the rise, as brands are increasingly dissatisfied with their agency roster structures. Eighty percent of respondents now have an in-house agency set-up of some shape or form, up from 57 percent in 2020, and a further 13 percent say that they are considering establishing one.

MediaCom UK Launches New Data Practice

MediaCom UK is launching a new integrated data practice, which will provide expertise, advice and planning to help MediaCom’s clients get the most out of their data. The new unit will be made up of a 16-strong team, and will draw expertise from the wider GroupM organisation, according to Decision Marketing.

Accenture Agrees to Buy The Stable

Accenture this week agreed a deal to buy The Stable, a commerce agency focused on helping consumer brands build and operate their own digital commerce channels as well as manage their brand and sales performance across North American retailers. The Stable will be integrated into Accenture Song, Accenture’s recently rebranded media arm.

Stagwell Buys Apollo Program

UK agency group Stagwell added to its roster this week with the acquisition of Apollo Program, a consumer behaviour data company, in order to boost its data offering. Apollo will be folded into the Stagwell’s Marketing Cloud unit, according to Digiday.

S4 Capital Cuts Earnings Outlook

S$ Capital’s share price slid this week after the business cut its earnings forecast, down to £120 million core earnings for the year from £160 million. The company attributed the cut to the costs associated with its rapid hiring.

Hires of the Week

Pinterest Appoints YouTube’s Head of Original Content

Pinterest this week appointed Nadine Zylstra as global head of programming and originals, a newly created content development and distribution role. Zylstra previously worked as global head of originals at YouTube, head of kids and learning originals at YouTube, and VP of Sesame Street production and programming for Sesame Workshop.

Christina Hanson Named CEO of OMD USA

Omnicom agency OMD USA promoted Christina Hanson to CEO, replacing John Osborn after five years in the role and 30 at the company. Hanson has served as global chief strategy officer since 2018, having first arrived at OMD in 2005 then working across the UK, US and EMEA.

Laura Maness Picked as Grey Group CEO

WPP agency Grey Group has named Laura Maness as global CEO. Maness joins from Havas where she served as New York CEO. She becomes the sixth CEO at the 105-year-old agency, and the first woman to hold the role.

BARB Taps Matt Laycock as Audiences Director

Matt Laycock has been appointed Audiences Director at BARB. The newly created position oversees the TV measurement firm’s audience-reporting solutions, to ensure they continue to meet the expectations of the UK TV and advertising industry. Laycock’s appointment follows research management roles at InSites Consulting, Disney and Channel 4.

This Week on VideoWeek

Clean Rooms are Starting to Tackle their Interoperability Problem, read on VideoWeek

Advertising and Subscription Models Won’t Work for the BBC says Lords Report, read on VideoWeek

GroupM Wants to Fix the Industry’s Carbon Calculator, read on VideoWeek

YouTube Doubles Down on Commerce with Shopify Partnership, read on VideoWeek

Netflix Hopes for Stronger Things with Microsoft Ad Tier, read on VideoWeek

No Longer a Novelty, Attention Metrics are Now Fully Ingrained in Agencies’ Planning and Measurement, read on VideoWeek

Garden Party 2022 in Pictures, read on VideoWeek

Ad of the Week

Peloton, Such a Great App, Maximum Effort