In this week’s Week in Review: Retailers cut ad spend on YouTube, Mediaocean and Operative partner for TV buying automation, and European TV executives feel positive about the impact of OTT. To receive an update on the industry’s top stories every Friday, sign up to the weekly Video Round-Up.

Top Stories

Retailers Cut YouTube Spending by Twenty Percent

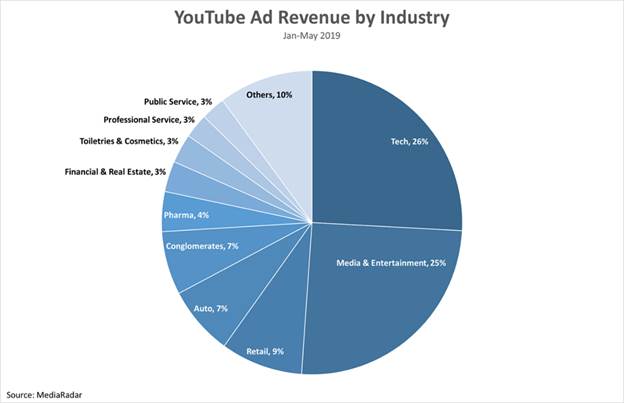

Retailers’ spending on YouTube ads dropped by twenty percent in one year, according to a study from MediaRadar released this week. Comparing spending between January and May this year with the same period last year, the study found that this drop was felt across the entire category, with only thirteen percent of retail companies advertising on YouTube raising their spending during this time. The findings might appear an indication that YouTube’s numerous brand safety scandals are causing advertisers to leave the platform though. But MediaRadar CEO Todd Krizelman told Adweek he believes the change is due to retailers’ own difficult financial positions leading to spending cuts.

Tech companies meanwhile are the biggest spenders on YouTube, accounting for 26 percent of ad revenues, while media and entertainment is just behind at 25 percent. Both of these categories’ spending was broadly consistent.

MediaOcean and Operative Announce Pilot for TV Sales Automation Software

Ad tech companies Mediaocean and Operative this week announced a pilot of their buying tools designed to automate some of the lengthy manual processes involved in TV buying. The tools developed by the two companies automate the assembly of RFPs (requests for proposals), and processing of insertion orders. NBCUniversal is signed on to the pilot, alongside several unnamed media agencies and agency holding companies.

The two say their software saves up to 40 percent of the time it currently takes to assemble and renegotiate RFPs and to process and upload details of an insertion order. “This next phase of our partnership with Mediaocean will deliver the first premium automated buying and selling platform outside of the walled gardens,” said Lorne Brown, CEO Operative. “We plan to extend the pilot to more agencies and publishers to quickly achieve scale across channels.”

European Pay TV Executive Positive on Future of OTT

European pay TV executives are by and large positive about their ability to respond to the rise in over-the-top (OTT) services, according to a report released by NAGRA and MTM. Only 26 percent of those surveyed believed that the growth of paid OTT services will have a negative impact on the European pay-TV industry over the next five years. Meanwhile 79 percent believe that the major OTT subscription services, like Netflix and Amazon Prime, can be a valuable part of the pay TV offering.

However the majority do believe OTT’s growth will see a culling of some linear channels, with 94 percent of those surveyed predicting that by 2024, European markets will carry around twenty percent fewer linear pay TV channels than today.

The Week in Tech

LiveRamp Set to Buy Data Plus Math

Identity resolution specialist LiveRamp announced on Monday it has agreed a deal to buy media measurement company Data Plus Math for $150 million in cash and stock, an acquisition which will bolster LiveRamp’s capabilities in the linear and streaming TV space. LiveRamp says the acquisition will enable advertisers to better tie their TV and digital investments to real-world outcomes, including website visits, app downloads, store visits and offline purchases. “This also ensures the advertiser is able to accurately measure ad effectiveness,” said Allison Metcalfe, GM of LiveRamp TV. “After years of wanting something different, the industry is eager to embrace innovative ways to prove ROI.” Read the full story on VAN.

Comscore Raises $20 Million

Measurement and research company Comscore announced this week it has secured an investment in its commons stock worth $20 million, with the potential to increase the figure to $50 million within 12 months. “This transaction strengthens our balance sheet and positions us to pursue our refocused growth strategy while providing the flexibility to better apply resources to meet our business objectives, and ultimately drive long-term value for our stockholders,” said interim CEO Dale Fuller.

Pixability Announces PixabilityONE

Video advertising software and insights business Pixability this week announced launch of PixabilityONE, which the company describes as “a software platform powered by data science, used for running campaigns across the premier video advertising destinations: YouTube, Facebook, Instagram and Connected TV”. The PixabilityONE platform can be used by brands and agencies as a self service solution to run their own campaigns, and is also used for all campaigns that Pixability manages for brands such as Puma, Ford, KIND, L’Oreal and Bose.

“With PixabilityONE, we can, for the first time, run in-house campaigns across major video ad channels through one platform. At the same time, the platform also delivers campaign performance that’s well above what we see when we run campaigns individually on native platforms,” said Mark Williams VP of Distribution from Fullscreen, a partner of Pixability.

Taptica International Rebrands to Tremor International

Tremor International this week announced that it has rebranded, changing its name from Taptica International to Tremor International. Tremor International will function as the parent company for three separate divisions: recently acquired Tremor Video (branded video advertising) and RhythmOne (media), as well as Taptica (performance advertising). “The new branding and structure better reflect our stronghold in the video advertising space,” said Ofer Druker, CEO of Tremor International. “It also reinforces our ability to address the significant opportunity in Advanced TV, bringing increased scale, audience targeting and ad formats to clients.”

SpotX and Mediaocean Announce Integration

SpotX this week announced an integration with Mediaocean which the two say will empower linear TV media buyers to transact premium video supply at scale in a brand-safe environment with real-time, actionable insights. SpotX is now available through Mediaocean’s Connect Partner Platform via the Spectra OX, Spectra DS local systems, and Prisma.

Streamanity Video Service Secures Investment from Calvin Ayre

Streamanity a video platform built on Bitcoin SV [BSV], this week announced an investment from entrepreneur Calvin Ayr. Streamanity is designed to help creators monetise their content directly from viewers, by allowing video creators to earn BSV directly from viewers who watch their videos. “Content is king, and Streamanity is empowering video content creators to be new kings for the Bitcoin era,” said Ayr. “Streamanity understands why Bitcoin’s original design, stable protocol, and massively scaled blockchain, now back in the form of Bitcoin SV, can be used to change the online video economy. They add another sector to the diverse ecosystem of applications on BSV.”

The Week in TV

Comcast Confirms It’s Pulling The Office from Netflix

Following rumours earlier this year, it was confirmed this week that Netflix will lose the US version of the massively popular ‘The Office’ from its library in 2021, as the show is pulled onto Comcast’s own upcoming streaming service. The move is significant as a Nielsen report cited by the Wall Street Journal claims that The Office is Netflix’s most streamed show.

We’re sad that NBC has decided to take The Office back for its own streaming platform — but members can binge watch the show to their hearts’ content ad-free on Netflix until January 2021

— Netflix US (@netflix) June 25, 2019

European Commission Set to Approve Vodafone/Liberty Global Deal

The European Commission is set to authorise Vodafone’s proposed plans to buy out Liberty Global’s German and central/Eastern European assets after Vodafone offered concessions, Reuters reported this week. Vodafone reportedly offered to give rival telco Telefonica Deutschland access to its merged high-speed broadband network, on order to assuage the EC’s competition concerns. The final decision is expected to be made by July 23rd.

French Broadcasters Bring Salto to Competition Authority

TF1, France Télévisions and M6 this week brought their proposal for a joint streaming service, Salto, to the French competition authority this week. The three see a joint subscription video on-demand (SVOD) platform as necessary to compete with Netflix, but the proposal must first be cleared by the French competition authority, who will assess the service’s impact on France’s television market.

The Week in Publishing

Instagram Enables Ads on its Explore Page

Instagram announced this week that it will begin running ads on its ‘Explore’ page, a page designed for users to discover content from accounts they’re not subscribed to. The ads, which will be either photos or video, will appear once a user clicks on a specific post and then begins scrolling through the discovery feed of content generated by that post. Instagram’s director of business product marketing Susan Buckner Rose told The Verge that the Explore feed was chose as its where “people come to discover new accounts or people or brands that they don’t already follow”.

Ozone Project Opens Up to Self-Serve Buying

The Ozone Project, a joint sales venture between four UK publishers, announced this week that it will begin selling ads on a self-serve basis via an integration with OpenX. Previously the platform, a collaboration between Guardian News & Media, News UK, Reach and Telegraph Media Group, had operated as a managed service meaning Ozone controlled the ad buy, pacing, and delivery. But commercial director Danny Spears told Campaign that the new self-serve option “allows the buyer to take complete control over that pacing and optimisation”.

OpenX has been running as a closed test partner since September last year. Spears said Ozone is looking to add more ad tech partners in the future.

Growing Digital Revenues Can’t Prevent £11.5 Million Loss for The Evening Standard

UK newspaper The Evening Standard reported this week that it made an £11.5 million loss in its financial year ending September 2018, as it struggles with a difficult advertising market. The paper saw digital revenues grow by 29 percent, driven by 48 percent growth in its global audience, but the rise wasn’t enough to avert the overall losses. Total revenues however were up two percent year-on-year, resulting in a five percent cut in its operating loss.

YouTube to Allow Users to Override Recommendations

YouTube announced this week it will give users more control over which content appears in their recommended feed, as the company has come under criticism for how content gets recommended to users. The platform is introducing new feeds based around topics and related videos, designed to give users better ways to find new content they’ll be interested in. Perhaps more significantly though, users will also be able to tell YouTube to stop recommending videos from specific channels, and learn more about why specific content was recommended to them.

The Week for Agencies

Omnicom Wins Holding Company of the Year at Cannes

Omnicom was awarded ‘Holding Company of the Year’ for the second consecutive year at the Cannes Lions festival last Friday. Omnicom’s win last year ended a seven year streak for WPP, and the company repeated that success this year, placing ahead of Interpublic Group in second and WPP in third. “It’s truly an honour to win the most creative holding company for the second year in a row,” said John Wren, Chairman and CEO of Omnicom Group. “However, it’s important to remember that holding companies don’t win awards, people do. I want to congratulate all of our people on their tireless efforts to create exceptional work for our clients.”

P&G Continues Ad Spend Pullback

P&G chief brand officer Marc Pritchard spoke further about his company’s cutting back on ad spending this week. Pritchard told the FT that the business has already reduced spending by close to $1 billion in fees and production over the past four years, and that the money had been reinvested in other creative partnerships. He also spoke about his changing views on advertising generally, telling Ad Age that “we’re here to reinvent advertising as we know it,” suggesting that P&G’s marketing could revolve around micro-messages built into consumers’ daily habits rather than standard ads.

Internet Giants are Driving US Ad Market

Ad Age released its annual ‘Ad Age Leading National Advertisers report’ this week, in which it found that internet companies are driving growing ad spend in the US. Seven of the ten companies with the highest US ad spend growth are internet plays according to the report, with Facebook’s spend up 236 percent and Netflix’s up 70 percent. The report also found that for the first time, all of FANG (Facebook, Amazon, Netflix and Google) are top 100 US advertisers.

Hires of the Week

Disney Poaches Matt Brodlie from Netflix

Disney has hired Matt Brodlie, previously Netflix’s director of original film, as its new SVP of international content development. The role will see Brodlie take charge of developing content for international audiences on Disney’s upcoming Disney+ streaming platform.

Apple Hires Publicis CCO Nick Law

Nick Law is set to leave his role as chief creative officer at Publicis Groupe, joining Apple as vice president of marcom integration, Adweek reported this week.

This Week on VAN

Rewarded Video Has Hit the Mainstream says Activision Blizzard’s Carroll, read more on VAN

LiveRamp Set to Buy Data Plus Math, read more on VAN

Traditional Brands Going DTC are Having a Cold Shower Moment says MediaCom’s Brennan, read more on VAN

Lack of Clarity on Consent has Boosted the Walled Gardens in Europe says VideoAmp’s Jay Prasad, read more on VAN

Ad Tech’s Independence From Media Still Matters says Telaria’s Zagorski, read more on VAN

Smart TV Manufacturers are the Sleeping Giants of OTT says SpotX’s Buckley, read more on VAN

Advertisers Want Local Solutions for Global KPIs, read more on VAN

How IBM Gets Consumers to Spend Four Minutes with Display Ads, read more on VAN

Content Targeting is a Silver Bullet for Brands’ Biggest Problems, read more on VAN

Brands Are Asking Agencies to Shift Display Budgets into Video, read more on VAN

How Blockchain Can Help Advertisers Navigate a Cookieless World, read more on VAN

Xandr Will Retain AppNexus’ Spirit of Independence says CMO McDonald, read more on VAN

Ad of the Week

The Mount Pearl Anthem, Target