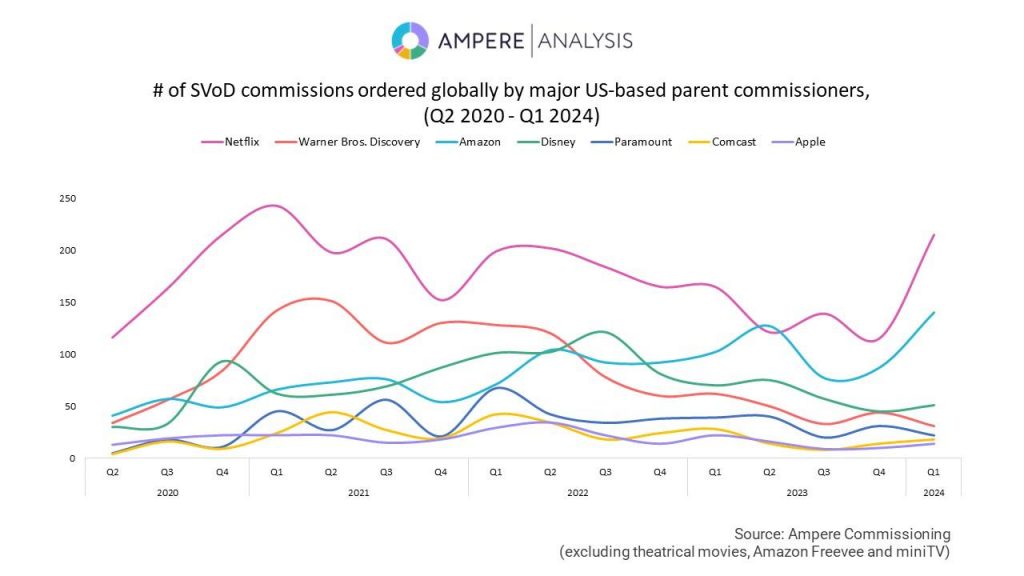

After a year that saw content spending depressed by falling share prices and Hollywood strikes, the SVOD giants appear to have reclaimed their throne as the biggest hitters in original content. According to research from Ampere Analysis, Netflix and Amazon Prime Video accounted for more than half (53 percent) of global streaming commissions in the first quarter of 2024.

The report noted that the duo have been challenged in recent years by studio-backed SVOD services, such as Disney+ and Warner Bros. Discovery’s Max. But in Q1 2024, Netflix ordered its highest number of new titles since Q3 2021, while Prime Video recorded its highest-ever quarter in terms of original commissions.

The findings come during a period of stagnating subscriber numbers across the SVOD sector. Research by Antenna suggests the churn rate among streaming services has increased threefold over the past four years. And Netflix has not been immune to the cost pressures facing consumers; in Q1 2022, the company lost 200,000 customers, mostly in the US and Canada.

At the start of last year, Ampere forecast a fall in content spending across TV and streaming during 2023, marking the end of a ten-year spending splurge by media companies.

Globalising content

But while their studio-backed rivals have pulled back on original content, Netflix and Prime Video have been able to lean on their global user bases, gearing their commissioning strategies to fuel growth outside the US market.

Ampere found that during Q1 2024, the pair ordered the majority of their titles from outside the US. Their international content spend has increased steadily over the past few years, according to the research, and is forecast to continue rising in pursuit of ongoing international expansion.

For Netflix, that spending has been particularly focused on Western Europe and Asia Pacific. The report revealed that during Q1, the company’s Western European orders were almost on par with North American titles for the first time, led by commissions from the UK, Spain, and Germany.

Meanwhile in Asia Pacific, Netflix ordered nine titles from Thailand during the quarter. The streaming giant is also looking to compete with Amazon in India, which is forecast to become Netflix’s largest subscriber hub in the region, with a particular focus on commissioning Crime & Thriller content.

International immunity

The research follows the release of Netflix’s own viewing figures for H2 2023, whose top-five titles included French show Lupin, German thriller Dear Child, and UK series Who is Erin Carter?. The streaming company also revealed that non-English content made up nearly one-third of all viewing during the six-month period; the most-watched non-English content was Korean (9 percent), Spanish (7 percent) and Japanese (5 percent).

With their global user bases and healthy balance sheets, Netflix and Amazon were also arguably more insulated from last year’s Hollywood strikes than some of the major film and TV studios – an ironic twist considering Netflix was one of the major targets of the demonstrations themselves. While Bloomberg suggests Netflix cut more than 100 shows from its programming slate last year, the streaming giants appear to have been able to recover more quickly than businesses dependent on linear schedules and theatrical releases.