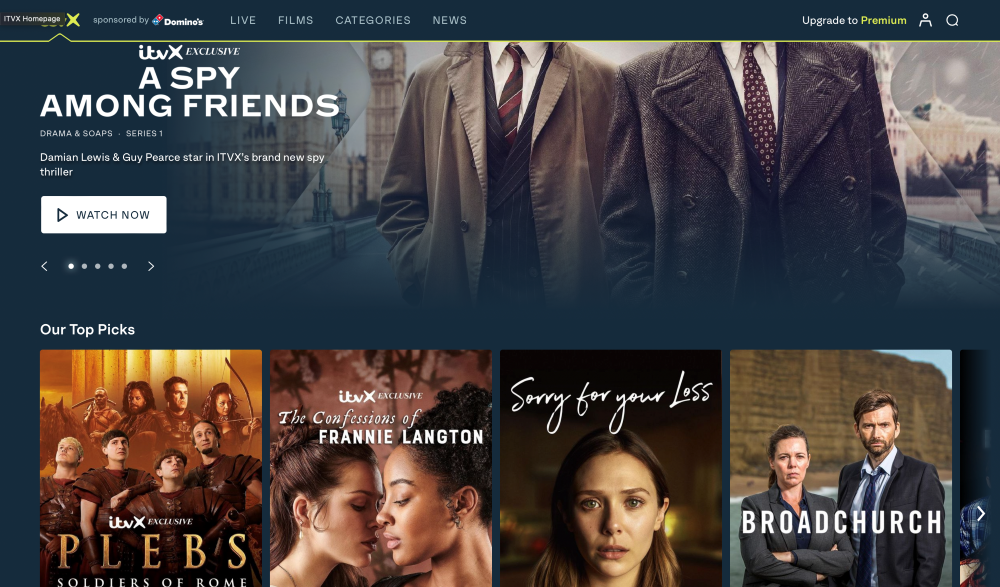

If TV’s spending splurge is over, no one told ITV. While broadcasters are expected to spend 3 percent less on programming this year, ITV plans to pour £160 million into content for its new streaming service ITVX – and intends to maintain that level of annual investment through 2026.

Since ITVX launched in December, the broadcaster has reported a 55 percent YoY rise in streaming hours, alongside a 65 percent increase in online users. And since the unseasonal World Cup was responsible for around half of those streams, ITV hopes its hefty content investment can keep those viewers on side.

Investors are less optimistic, questioning the wisdom of such a spending commitment in a period of slowdown for the TV advertising sector. In its last earnings report (Q3 2022), ITV’s ad revenues were down 14 percent YoY, and Citi expects a further 5 percent fall this year. Despite receiving a bump from the streaming results, ITV’s share price has halved over the course of CEO Carolyn McCall’s five-year tenure.

“While investors are already alarmed by the group’s plans to increase content spend coupled with the negative trends in linear TV advertising revenue, the crowded nature of the streaming market means that platforms with a higher content spend tend to see higher levels of engagement,” comments Neil Anderson, Analyst at Ampere Analysis.

Islands in the Stream

This is where ITVX aims to outperform its predecessor ITV Hub, whose 1,500 hours of content were dwarfed by the likes of All 4 (15,000 hours) and BBC iPlayer (14,200 hours) – not to mention its history of crashing during key moments in international football matches or important arguments on Love Island. And while ITVX is not immune to technical glitches, the new service seemed to perform well through the World Cup after some teething problems.

As for the content side, ITVX is 10 times the size of ITV Hub, taking the BVOD service from a pure catch-up proposition to a destination to discover new content. But despite ITVX rivalling All 4 in terms of sheer programming volume, the Channel 4 streamer has had eight years to establish itself, leaving ITVX with a catch-up proposition of its own.

ITV’s streaming MD Rufus Radcliffe addressed this point in December, telling the FT: “I don’t recognise that we’re late … In terms of viewing behaviour, and where it’s going, this feels like the right time to take this to the next stage.” Indeed, an Ofcom report last year found 90 percent of younger viewers bypassing broadcast TV and heading straight to streaming services – but ITV Hub was not necessarily one of them, trailing both All 4 and iPlayer on 16-34 audiences, according to Kantar.

Part of that investment then aims to make ITVX a bigger draw for young viewers. In September, ITV media and entertainment MD Kevin Lygo called the new service an opportunity to commission “niche shows”, unconfined by the “all things to all people” mandate of its flagship channel. He compared the offering to ITV2, where Love Island attracts over one million young viewers. “I’m not sure it would be appropriate for ITV, which has a public remit and could scare people,” Lygo added.

But that risk could extend to ITVX, argues Ampere’s Anderson: “Older viewers could be alienated if they feel that ITV has taken its eye off programming for its most reliable audience in pursuit of younger audiences that are increasingly abandoning traditional broadcast.”

It is worth noting though that ITVX is not explicitly targeting young audiences, and is not taking content spend from linear budgets. It will also bring its streaming originals to the broadcast channels 6-9 months after their launch on ITVX.

The Chase is on

When it comes to streaming audiences however, ITVX is not merely competing with the UK broadcasters, but global streamers such as Netflix – which the Ofcom report highlighted as the go-to destination for young adults, and expects to spend $17 billion on content this year.

That said, Ampere forecasts the streaming giant to lose a further 200,000 UK subscribers in 2023, as spending-conscious consumers turn to free services. “ITV will be hoping that its free ad-funded platform will resonate with viewers at a time where many are forced to cancel subscriptions due to cost-of-living pressures,” says Anderson.

Meanwhile BARB figures suggest that Netflix is not currently penetrating UK viewing at the rate SVOD evangelists may have anticipated. ITV captures almost 15 percent of monthly viewing, compared with nine percent for Netflix, maintaining the broadcaster’s edge when it comes to advertising reach. And with the large content offering and targeting options available, ITVX “has also landed really well with advertisers,” ITV’s McCall said in a statement, though exact numbers are undisclosed until the company’s financial results in March.

In November the commercial broadcaster also launched a retail media product called Matchmaker, with Tesco’s data firm Dunnhumby and Boots Media Group signed up as launch partners. ITV said that advertisers using its programmatic platform Planet V can target category shopper audiences watching content on ITVX, potentially unlocking value from the service’s enriched user data.

“Advertisers could have greater opportunities to access more targetable BVOD audiences if ITV can significantly increase the depth of engagement achieved on ITV Hub and attract harder-to-reach younger audiences to ITVX,” says Anderson.

The addition of 20 FAST (free ad-supported streaming TV) channels, including at least two dedicated to Love Island, could provide advertisers with more access to those younger audiences. Currently including The Chase and Hell’s Kitchen, these 24-hour channels can be dialled up and down according to consumption and seasonality, for example the World Cup Classics channel that ran during the tournament.

“ITV’s heritage in daytime television means they are well positioned to launch FAST channels – offering a lean-back tailored linear experience with a programmed line-up of content,” notes Anderson. “It could be a good way of squeezing more advertising revenue out of a large library of content.”