Pluto TV and Channel 5’s catch-up service My5 are to merge in the UK, parent company Paramount announced this morning.

Due to launch in 2024, the new offering will combine Pluto TV’s free ad-supported streaming TV (FAST) channels with on-demand content from Channel 5. Paramount said the product incorporates BVOD, FAST, AVOD and live TV.

The announcement also suggests considerable technological investment, enabling greater personalisation for both advertising and content. Improved access to data should allow advertisers to more effectively target campaigns, and viewers to receive relevant programme recommendations.

Paramount added that the service would seek to bring in titles from other companies, while emphasising the broadcaster’s commitment to UK content. The US firm said Channel 5 has grown its audience share over the last four years, with My5 growing its viewing hours over the last three years.

“We’re proud of the huge success and growth in viewing that we have seen on our BVOD service, My5,” said Maria Kyriacou, President, Broadcast & Studios, Paramount International Markets. ”As we look ahead to an IP-delivered future, this is the right time for us to fully leverage the Paramount ecosystem and combine the reach and scale of our free-to-air network in the UK with the global success of our FAST service, Pluto TV.”

Take Five

While Paramount’s shift to IP delivery chimes with consumers’ broad migration from linear to streaming, it is worth noting that Channel 5 viewing is still almost entirely linear. According to Ofcom, 96 percent of Channel 5 viewing in 2022 was via linear TV, versus 4 percent on My5.

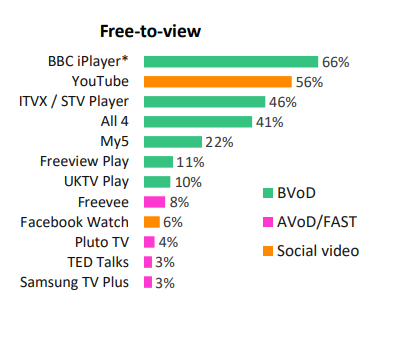

My5 also falls behind its commercial BVOD rivals in terms of regular viewers, based on Ofcom’s Media Nations report. Around 22 percent of UK viewers use My5, according to the survey, around half that of All 4 (41 percent) and ITVX (46 percent).

But the BVOD service is still more popular than its FAST stablemate in the UK. The same Ofcom survey showed just 4 percent of consumers using Pluto TV in the past three months. But FAST is set to accelerate in the UK as linear viewing continues to decline and SVOD services grow more expensive. Against this backdrop, Omdia forecasts the FAST market to surpass $500 million in UK revenues by 2028.

Folding My5 into Pluto TV could be designed to pull viewers into the FAST ecosystem where content can be easily monetised without massive outlays. Viewing sessions also tend to be longer on FAST channels than BVOD due to the linear-like experience, with Pluto TV claiming CTV viewers watch an average two hours per session.

There are also echoes of the broadcaster’s move in the US to merge Paramount+ with Showtime, removing the standalone Showtime app as will presumably happen to My5 in the UK. But seeing how Channel 5’s public service broadcasting (PSB) commitments fit into the FAST environment could prove an interesting challenge for Paramount and the UK regulators.

“As an early pioneer of FAST globally, we’ve seen incredible growth and excitement for Pluto TV in markets around the world,” said Olivier Jollet, EVP and General Manager Pluto TV, Paramount International Markets. “By joining forces with our leading BVOD platform in the UK, we are offering audiences, partners, and clients a supersized free streaming destination that we know they’ll love.”