Video and TV viewing declined in 2022, according to Ofcom research published today, but the UK broadcasters maintained their dominant share of consumption, with their streaming (BVOD) services capturing more viewing time.

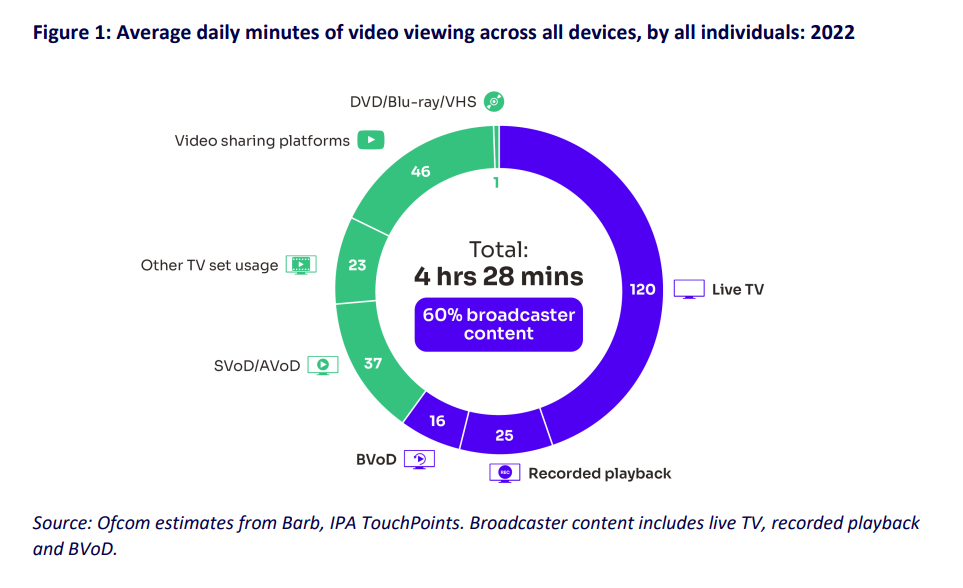

The annual Media Nations report revealed that UK viewers spent an average 4 hours 28 minutes watching content across all devices, down 12 percent on the previous year. The report notes that viewing was boosted in 2021 due to ongoing lockdown restrictions. But broadcast TV viewing has been in steady decline, falling by 12 percent YoY in 2022. The decrease was steeper among younger audiences, as viewers aged 4-34 reduced their broadcast TV consumption by 21 percent.

Perhaps more surprising is that older viewers, who have so far continued to watch linear TV, turned away from the incumbent broadcasters for the first time last year. According to Ofcom, over-64s watched 8 percent less broadcast TV in 2022 than 2021. And the research suggests older audiences are increasingly adopting SVOD services, with their take-up of Disney+ rising from 7 percent in 2022 to 12 percent in 2023.

Regardless, the broadcasters still make up 60 percent of total viewing, across their linear and on-demand services. BVOD consumption has risen from 4 percent of total broadcaster viewing in 2017, to 10 percent in 2022. But this growth has not been enough to offset the decline in linear, according to Ofcom, which continues to account for 90 percent of total broadcaster viewing.

Nevertheless, the report picks out BVOD as one of the only areas where viewing increased in 2022, the other being video sharing platforms. Ofcom found that 91 percent of over-15s use YouTube and Facebook, while TikTok’s popularity grew from 36 percent of internet users in 2022 to 45 percent in 2023.

Ad-verse conditions

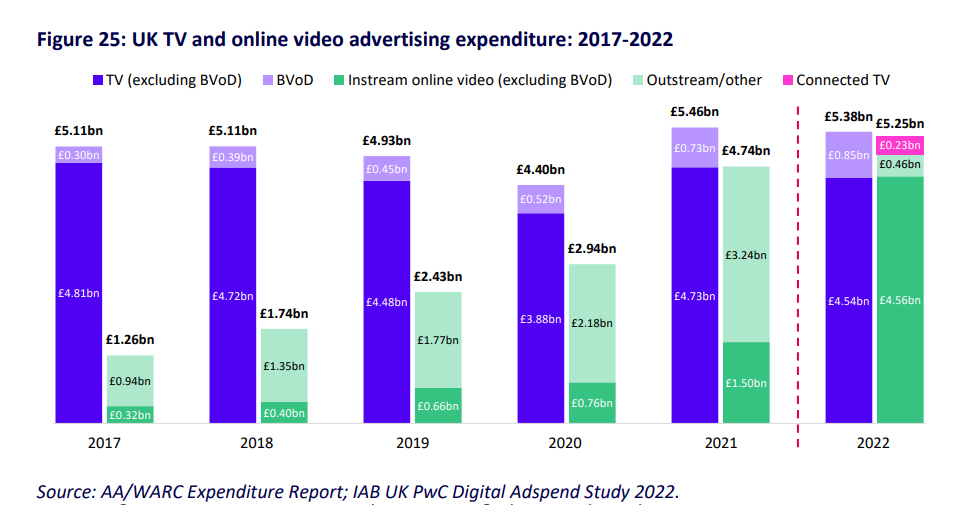

On a commercial level, online video services saw their market share rise to 36 percent in 2022, up from 15 percent in 2017. This contributed to a 4.5 percent increase in total commercial TV and online video revenue, reaching £17.3 billion in 2022.

But the fall in broadcaster viewing and a challenging advertising market caused decline in the commercial TV sector. The ad-funded PSBs and pay-TV channels saw their combined revenues fall 1.8 percent to £11.1 billion, with combined revenues at ITV, Channel 4 and Channel 5 totalling £2.3 billion.

In line with last week’s Advertising Association/WARC report, the research saw TV ad spend fall 1.4 percent in 2022, reaching £5.4 billion. And though BVOD spend was up 15 percent YoY (18.7 percent in the AA/WARC findings), this was not enough to offset a 4 percent decrease for linear TV.

Running out of stream

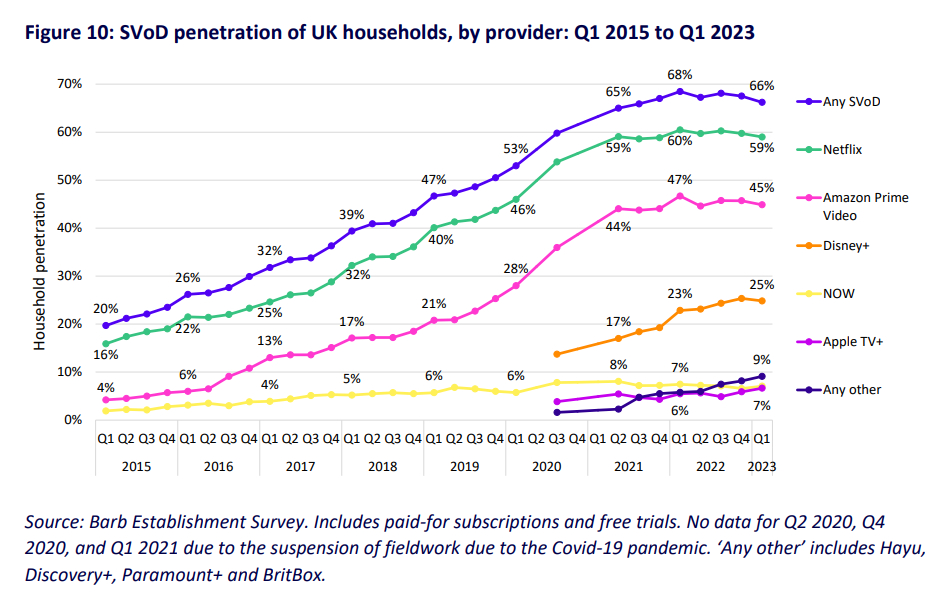

There were stronger signs for the SVOD sector, whose revenues rose 21.5 percent YoY to hit £3.3 billion in 2022, partially driven by rising membership fees. But those same price increases have caused households to cut back on SVOD subscriptions, according to the report, with SVOD penetration potentially reaching saturation in the UK.

The number of households subscribing to at least one SVOD service has fallen from 68 percent in Q1 2022 (during the pandemic) to 66 percent in Q1 2023 – hardly a massive drop but enough to indicate that “overall SVoD household penetration has plateaued,” according to Ofcom.

Netflix remains the dominant SVOD service in 59 percent of households, followed by Amazon Prime Video at 45 percent, then Disney+ at 25 percent. But all three lost subscriber households in Q1 2023. Only Apple TV+ gained subscribers over the course of the year, growing its volume of subscriber homes by 2 percent YoY (the report does not explicitly mention Ted Lasso).

Ofcom notes that the slowdown in SVOD uptake “has not yet had an adverse impact on revenue growth”. Netflix accounted for half of all SVOD revenue in 2022, with the four largest services (Netflix, Amazon Prime Video, Disney+ and NOW) taking a 93 percent market share. Netflix is the third most popular viewing destination after BBC One and ITV1, according to the report, with its ad-supported tier adopted by 13 percent of UK online adults.