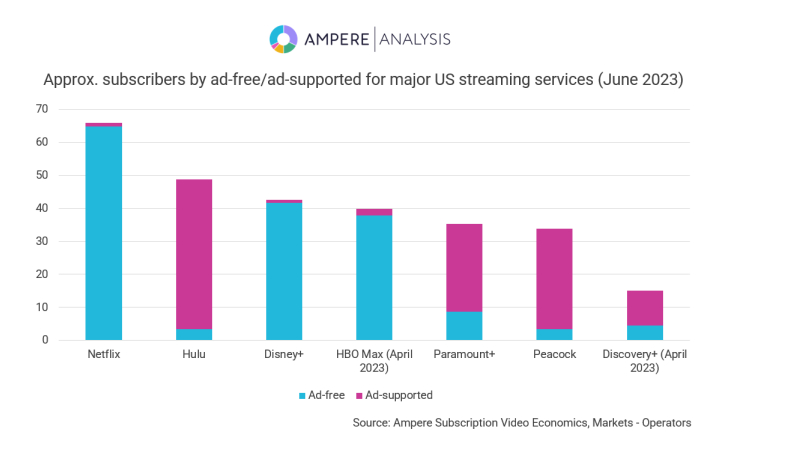

Ampere Analysis revealed this week that 100 million US consumers now subscribe to ad-supported tiers on streaming services. And the AVOD tiers will earn more than $10 billion in combined ad revenues in 2027, according to the research firm.

The research shows that subscriptions are concentrated in streaming businesses whose ad offerings have been around a while – and the longer the tier has existed, the more customers it has.

Hulu has carried ads since 2010, and Ampere estimates that more than 90 percent of Hulu subscribers are on the ad-supported plan, to the tune of 45 million subscribers.

NBCU’s Peacock launched with ads in 2020, amassing around 30 million ad-supported subscribers. Then comes Paramount+, which has gained more than 25 million ad-supported subs since arriving in 2021.

Prior to the launch of combined streaming service Max, Warner Bros. Discovery (WBD) had approximately 10 million ad-supported subs on Discovery+, and 2 million on HBO Max.

And now that Netflix and Disney+ are in the AVOD business, their ad tiers are gathering pace in the US. Having both launched at the end of last year, around 2 percent of Netflix and Disney+ subscribers are on the ad-supported plans, representing 1 million and 800,000 subs respectively.

Netflix said in January that it wants its ad business to be as large as Hulu – and while its figures are some way off Hulu’s 45 million subs, it should be noted that Hulu launched as an AVOD service and only introduced an ad-free option in 2015. In 2019 the Disney-owned streaming service said 70 percent of its customers were on the ad-supported offering, now climbing to 90 percent by Ampere’s estimates.

Catch up

Ampere estimates that Netflix generated around $16.5 million from advertising in Q1 2023. This is expected to grow to over $4.1 billion in 2027, accounting for roughly 10 percent of its total revenue base. The forecast represents a downgrade from this time last year, when Ampere predicted Netflix would make $5.5 billion in annual advertising income in 2027.

While the ad-supported offering is driving ARPU in the US, Netflix said in last month’s earnings call that ad revenue “isn’t material” in relation to its overall business. Ampere’s projections are still four years down the line, but were initially stipulated on “high CPMs” in the US and Europe; last year the analysts noted that “launching an ad tier may not be worthwhile in regions where CPMs are low.”

Now Netflix is reportedly lowering CPMs from around $45-55 to $39-45 in order to attract more advertisers, bringing its pricing more in line with rival streaming services. The company is also looking to sell ads through more partners, amid reports of discontent among Netflix execs around Microsoft’s ad sales for the AVOD offering. This expansion could help the streaming giant close the advertising gap over the coming years.

Netflix has also scrapped its cheapest ad-free offering in the UK, US and Canada, as the company looks to improve monetisation following the introduction of paid password sharing. “Removing the ad-free Basic tier shows that the ad-supported tier generates a positive income per subscriber base,” comments Orina Zhao, Senior Analyst at Ampere. “Since customers are now forced to either take the ad-supported tier or higher priced ad-free tiers, Netflix is aiming to further increase its revenue output to better fund content investment and future growth.”

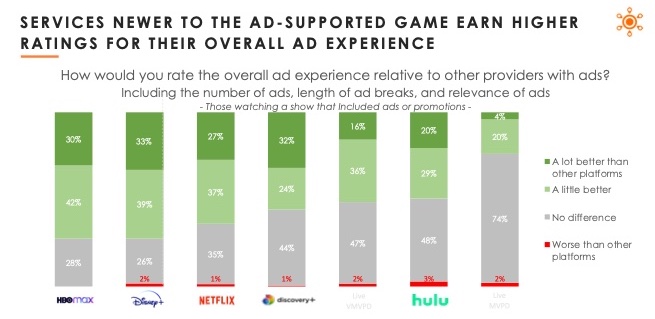

And as the Ampere research shows, there is clearly appetite for ad-supported tiers in the US. This is also borne out by Hub Entertainment Research’s semi-annual consumer survey, which asked 3,063 TV viewers about their attitudes to advertising.

According to the findings, 59 percent of consumers would choose to watch ads if it means saving $4-$5 per month. And interestingly, where the longer-standing AVOD services have had time to gain more customers, the newer arrivals are said to deliver a better ad experience; 33 percent said the Disney+ ad experience was a lot better than competitors, versus 27 percent for Netflix, and 20 percent on Hulu.

European attitudes

Meanwhile European consumers could be adopting the ad-friendly mindset, as the cost-of-living crisis forces cutbacks in household spending. Ampere finds high rates of willingness to opt for lower-priced, ad-supported streaming services in Italy (49 percent), UK (43 percent), Poland (43 percent) and Spain (43 percent). However, there is less appetite for the cheaper ad offerings in Germany (37 percent), France (36 percent) and the Nordics (21-31 percent).

Ampere’s Orina Zhao notes that Netflix has increased prices in the UK twice in the past two years, potentially making the ad-supported offering more desirable. “The UK also has a very competitive SVOD market, so consumers might welcome more, cheaper options that provide the same content so as to maintain several SVOD accounts.”

Netflix also has about 10 million subs each in France and Germany, its largest European markets after the UK. And according to Ampere, the German market is well served by local content. “Netflix has a higher percentage of local and EU content on its platform in Germany than any other EU market,” says Zhao. “Better content provision and relatively stable growth show that consumers in France and Germany are relatively satisfied with the three-pronged standard subscription tiers.”

She adds that the ad-supported tier has yet to launch in the Nordics, but expects most customers to stay within their existing tiers.