Netflix’s password sharing crackdown has been more heavily trailed than most TV shows, and this week the policy finally kicks in across its largest markets. Initially planned for Q1, the roll-out was pushed back over fears of a “cancel reaction” among password sharers; indeed, in Latin America the SVOD service lost 450,000 subs during Q1 under the new policy.

And Netflix still anticipates a backlash, warning pay-TV operators of the changes last week, in case they are faced with an even more unusually high volume of calls than usual. Companies such as Sky, Virgin Media and BT offer Netflix through bundles, making it hard for customers to cancel the Netflix portion of the package. “Netflix will want to ensure that key distribution partners aren’t at risk of losing customers as a consequence of these moves,” explains Toby Holleran, Research Manager at Ampere Analysis.

The crackdown has proved effective in reducing password sharing, according to Ampere, with Spain and Canada seeing a 20 percent reduction in password sharing after the policy came into force in February. But Kantar revealed that Spain lost over 1 million subs during the quarter, a churn rate the company is keen to avoid in the US, home to almost 30 percent of Netflix subscribers.

“Netflix has given itself an opportunity to receive feedback both in some smaller markets, and from various commentary on social media etc so that they at least have some forewarning on potential roadblocks,” notes Ampere’s Holleran. “This extra time will also give Netflix additional opportunity to test out messaging around the account-sharing measures and minimise any negative reaction.”

For example the policy was originally said to require users to log into their Wi-Fi once a month, a rule Netflix retracted amid concerns from people who travel for work or can’t remember their Wi-Fi password. Instead the system uses “information such as IP addresses, device IDs and account activity” to ensure devices are part of the subscriber’s household – and users can pay to add an extra member to their account.

Share or shaft?

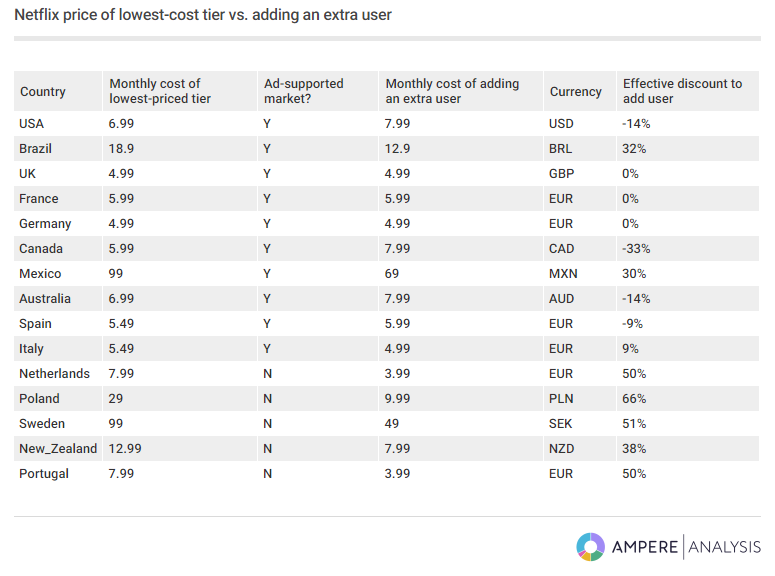

Ampere found that in most markets, that fee for adding an extra user is lower than signing up for the cheapest tier – and much cheaper in markets where password sharing is particularly prevalent, such as Poland and Sweden, neither of which have the cheaper ad-supported tier available. “Netflix is likely trying to keep churn to a minimum in such markets where it is yet to launch the ad-supported tier,” observes Holleran.

Where the cost of adding an extra user is more expensive (US, Canada and Australia) or the same (UK, France and Germany) as signing up for the ad-supported plan, the company looks to be pushing the AVOD tier – which the company says delivers higher average revenue per user (ARPU) than its ad-free plan, especially in the US.

While cost is a major imperative, Holleran also suggests that social factors could drive password sharers (in those ad-supported markets) to sign up for their own accounts, instead of splitting bills and arguing over who watched more episodes of Selling Sunset that month. “As well as being quite inconvenient in adding a billing relationship between friends, it also means that if one person no longer wants Netflix for whatever reason, they then have that relationship with their friends to navigate, rather than a relationship directly with Netflix,” comments Holleran.