In this week’s Week in Review: ITV’s digital sales growth supports falling ad revenue, the DOJ launches a review of big tech’s market power, and influencer fraud is set to cost advertisers $1.3 billion this year. To receive an update on the industry’s top stories every Friday, sign up to the weekly Video Round-Up.

Top Stories

ITV Ad Sales Fall, but Online Revenues Rise 18 Percent

ITV reported total ad sales down five percent year-on-year in its H1 financial results this week, with total external revenue down seven percent. But CEO Carolyn McCall remained upbeat, describing the results as “a good performance”. While the drop in ad revenue was steep, the fall was due at least in part to high sales last year generated by the FIFA World Cup. And ITV’s online revenues have continued to grow healthy, rising by 18 percent in H1, driven primarily by ITV’s on-demand platform ITV Hub.

McCall said ITV will continue to focus on its digital offerings to drive growth. “BritBox is set to launch in Q4, as is our new programmatic addressable advertising platform, and we are accelerating our digital and data capabilities,” she said.

Justice Department Launches Wide-Ranging Antitrust Investigation into Big Tech

The US Department of Justice (DOJ) revealed this week that it is launching a wide ranging antitrust review of the practices of market-leading online platforms. “The Department’s review will consider the widespread concerns that consumers, businesses, and entrepreneurs have expressed about search, social media, and some retail services online,” the DOJ said in a statement. There had been rumours recently that the DOJ and the Federal Trade Commission were considering launching investigations, and had carved up the big four of Google, Apple, Amazon and Facebook between them. But according to the Wall Street Journal, this review is designed to go “above and beyond” those original plans.

As BBC technology reporter Dave Lee commented, one of the interesting things about this review is it’s non-specificity. “What will make these firms nervous is that the DoJ isn’t looking at any specific allegation, but instead embarking on a look at how the companies came to power, and what they’ve done to remain there,” said Lee.

Influencer Fraud to Cost Advertisers $1.3 Billion

Influencer fraud, where wannabe social media influencers buy fake followers in order to secure deals with brands, will cost the industry around $1.3 billion this year according to research from cyber-security company CHEQ. With influencer marketing spend set to reach $8.5 billion this year, that would make 15 percent of all influencer marketing spending wasted. CHEQ’s chief strategy officer Daniel Avital told Campaign that the growth in fraud is being driven by the institutionalisation of influencer fraud, with standard market rates emerging for fake followers on platforms like YouTube and Instagram. The growth of influencer tech is also opening the door for more fraud, according to Avital.

The Week in Tech

Duopoly Report Strong Q2 Despite Antitrust Woes

Both Google and Facebook posted strong Q2 results this week despite the looming threat of regulatory oversight both at home and abroad. Facebook’s revenues reached $16.9 billion, up 28 percent year on year. Profits hit $2.6 billion, despite the fact the company paid a $2 billion charge as part of its $5 billion settlement with the US Federal Trade Commission. Google meanwhile posted revenues of $38.9 billion, with Google’s ad sales up 19 percent year-on-year to $32.6 billion

Xandr Ramps Up Community’s Reach with A+E, AMC and Cheddar

AT&T’s advanced advertising arm Xandr announced this week that A+E Networks, AMC Networks and Cheddar have all joined Community, its video marketplace which was launched earlier this year. The additions are significant not only in the amount of inventory the three will add to Community, but in how they broaden Community’s inventory well beyond AT&T-owned WarnerMedia’s media businesses. Read the full story on VAN.

Dstillery Shuts Down its DSP

Dstillery has stopped operating a demand-side platform, and has transitioned to become a data company, according to AdExchanger. The company reportedly shuttered the DSP on July 1st, and will now focus on selling custom audience segments through other DSPs. CEO Michael Beebe told AdExchanger that the costs associated with connecting new inventory sources, improving the supply chain and adding features became too high for the relatively small company, leading to the transition.

IAB UK Calls on Members to Take Action Following ICO RTB Report

Trade body IAB UK called on its members involved in real-time bidding (RTB) to review their current practice following the release of UK regulator the ICO’s report into ad tech and RTB. “Highlighting key areas of concern in regards to RTB, data security and GDPR compliance, the report makes it clear that the ICO will not hesitate to take regulatory action if companies do not respond accordingly. The industry now has just months to address the points raised and make any necessary changes to the way it operates,” said IAB UK. The trade body said its members should:

- Review the legal bases relied on for data processing

- Read the ICO’s updated cookie guidance and ensure practices are in line

- Ensure a Data Protection Impact Assessment (DPIA) has been carried out

The Week in TV

AT&T Doubles Down on OTT as TV Subscription Woes Continue

AT&T lost a record 778,000 TV subscribers in the second quarter this year, meaning it’s shed about 2.3 million video customers over the past year. But the company is continuing to focus more on its OTT offerings. AT&T says it will launch another new OTT service, AT&T TV, for beta testing in Q3 this year. This will sit alongside existing services DirecTV Now, Watch TV, and the upcoming HBO Max.

ProSiebenSat.1 Considers International Rollout of Joyn

German broadcaster ProSiebenSat.1 is considering an international rollout of Joyn, the streaming service it launched with Discovery earlier this year, according to CEO Max Conze. Joyn was originally conceived as a German equivalent of Hulu in the US, but now the company is looking abroad, Conze told German publication WirtschaftsWoche. The strategy isn’t clear yet, but could involve granting licenses abroad, or launching national versions of Joyn in other countries with different partners.

iflix Eyes an IPO and Raises $50 Million to Take on Netflix in Southeast Asia

Netflix competitor iflix, Southeast Asia’s largest digital entertainment service, this week announced the finalisation of a new round of “well in excess of $50 million” (precise amount was not disclosed) investment with a view to pushing the company towards a prospective IPO. The round was led by Fidelity International, a global asset manager and the round also featured a number of the region’s top media companies including Indonesia’s MNC, Japan’s Yoshimoto Kogyo, and South Korea’s JTBC. Read the full story on VAN.

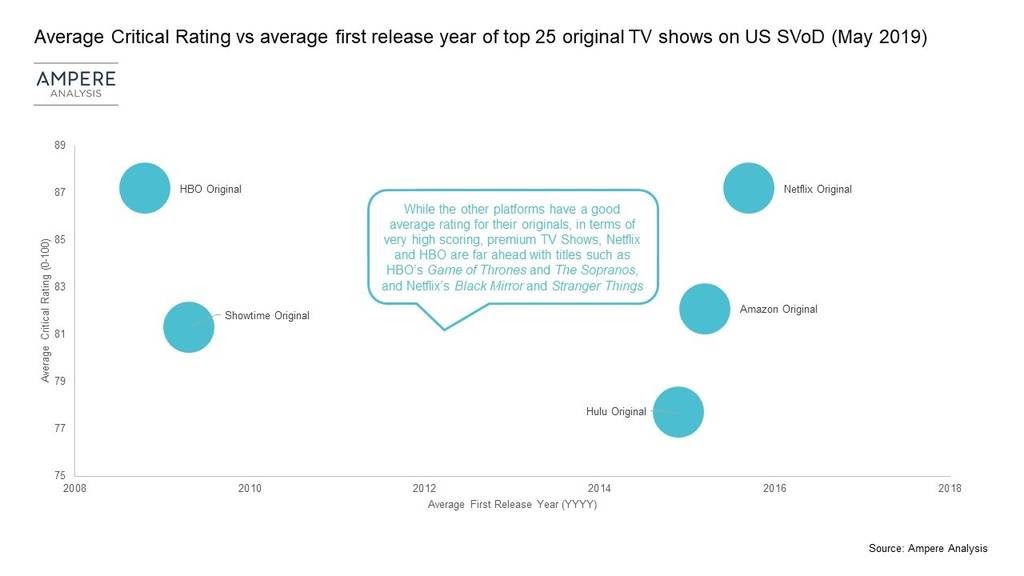

Netflix and HBO Lead the SVOD Content Wars for Critically Acclaimed TV Shows

Netflix and HBO are “significantly outperforming” their rival subscription video on-demand (SVOD) platforms in the US when it comes to producing critically acclaimed original TV shows, according to new research from Ampere Analysis. The two services’ top 25 most critically acclaimed shows received notably higher average ratings than those produced on Amazon, Hulu and Showtime, though in Netflix’s case this seems have come at the cost of a somewhat spray-and-pray approach. Read the full story on VAN.

Pluto TV Launches Three ‘Pop-Up’ Channels Dedicated to Popular Shows

Viacom-owned digital TV platform Pluto TV today announced the launch of three new ‘pop-up’ channels each dedicated to a specific show; SpongeBob Squarepants, The Hills, and Teen Mom. The channels, which will be available in Germany and Austria, will each continuously run back-to-back episodes of each show, and are designed to appeal to the most dedicated fans. Read the full story on VAN.

The Week in Publishing

Snap Stocks Soar by 19 Percent as Turnaround Continues

After being beset with stalling user growth and an unpopular redesign last year, Snapchat’s turnaround continued this week as it posted bumper Q2 results in which user numbers and revenues beat expectations. Snap reported daily active user figures in Q2 of 203 million, well ahead of a predicted 191.7 million according to Bloomberg. Revenues meanwhile rose 48 percent year-on-year to $388 million. “Following last year’s substantial product evolution, we believe that we are now better positioned for long-term success,” said CEO Evan Spiegel. Snap’s share price has so far risen over 19 percent since the results were announced.

Gaming and Esports Pay Off for MTG

Swedish media giant Modern Times Group (MTG) announced this week that the company has seen 14 percent sales growth in esport and gaming, the two verticals the company has been investing heavily in in recent years. On the esports side, MTG’s owned & operated (O&O) divisions saw sales up 15 percent. Last year MTG took their investment in Turtle Entertainment, the world’s largest esports company and operator of the leading esports brand ESL, to 82.5 percent. Turtle Entertainment covers a broad field of services in gaming technology, event management, advertising and TV production.

Facebook and Instagram to Restrict Alcohol and Tobacco Content

Facebook and Instagram are further restricting sales and exchanges of alcohol and tobacco products, according to CNN, with the two now prohibiting all private exchanges of these products. Brand which post content related to the sale of these products will now have to restrict that content to over 18s. Regular users meanwhile will still be able to post content related to tobacco and alcohol unrestricted, as will influencers – though a spokesperson said the company’s influencer policy is currently under review, CNN reported.

The Week for Agencies

IPG Beats Q2 Estimates, but Forecasts a Tricky H2

Interpublic Group beat analyst expectations in its Q2 financial results this week, with net organic revenue up three percent. International organic revenue rose 6.5 percent, comfortably above expectations of around 3.1 percent. But despite the healthy results, IPG’s shares fell by over four percent once the results were announced (though they have since bounced back). Chief executive Michael Roth said the company is keeping its full year guidance unchanged despite the strong results, as tough market conditions are expected in Q2.

Unilever Hails Effectiveness of Programmatic Media Buying

Unilever CEO Alan Jope said the FMCG giant’s shift towards data-driven marketing and programmatic media buying has delivered a “significant step up” in marketing effectiveness and ROI, according to Marketing Week. He acknowledged however one key difficulties with the approach, saying that “the bottleneck on great work is having warm bodies to run digital campaigns”.

Diageo Raises Marketing Spend by Eight Percent

Drinks brand Diageo revealed it has raised its total marketing spend by eight percent over the past year to £2 billion, while global net sales rose by six percent to £12.9 billion. While many agencies are predicting tough H2s with tricky market conditions and belt tightening at brands, stories cases like Diageo’s will be a little welcome news.

Hires of the Week

Christian Juhl Picked as GroupM Global CEO

WPP this week named Christian Juhl as the new global chief executive officer of GroupM. Juhl, currently CEO of GroupM agency Essence, will succeed current CEO Kelly Clark on October 1st.

605 Names Tom O’Sullivan Vice President of Sales

605, an independent TV measurement firm, this week announced the addition of Tom O’Sullivan as VP of Sales. O’Sullivan will be responsible for managing and developing 605’s partnerships with advertisers and agencies, TV/cable networks, MVPDs, publishers and other media companies.

This Week on VAN

iflix Eyes an IPO and Raises $50 Million to Take on Netflix in Southeast Asia, read more on VAN

Xandr Ramps Up Community’s Reach with A+E, AMC and Cheddar, read more on VAN

Smart TV Advertising Isn’t Truly Smart… Yet, read more on VAN

Pluto TV Launches Three ‘Pop-Up’ Channels Dedicated to Popular Shows, read more on VAN

Netflix and HBO Lead the SVOD Content Wars for Critically Acclaimed TV Shows, read more on VAN

Ad of the Week

Old Spice, Next Episode, Wieden+Kennedy Portland