The decline in linear TV viewing is well-documented, but new research from WARC suggests that advertisers risk withdrawing their investment in the channel too quickly.

‘The Future of Media 2024’ report charts the gradual decline in linear viewing. In the UK, broadcast TV’s reach fell from 83 percent to 79 percent in 2022, according to Ofcom. Meanwhile in the US, linear TV fell below 50 percent of total TV viewing for the first time in July 2023, per Nielsen data.

As a result, marketers are seemingly questioning the value of linear TV advertising. Kantar has suggested that linear is no longer a “preferred” channel for marketers, while WARC found that 39 percent of marketers are planning to decrease their investment.

But the report noted counter trends that cast doubt on the wisdom of withdrawing from the previously dominant marketing channel.

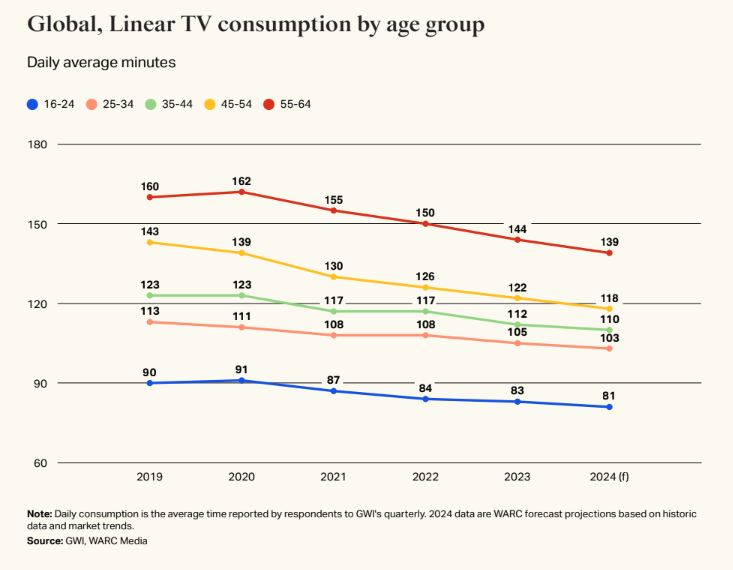

Firstly, the decline in viewing is not as steep as the prevailing narrative might suggest. WARC forecasts linear consumption to fall by 1.9 percent in 2024, a shallower drop than 2023, when viewing decreased by 2.7 percent. So although linear viewing is in continued decline, that decline is not accelerating, at least according to WARC’s projection.

Secondly, people will continue to spend more time with linear TV than streaming video, music or podcasts, according to the forecast. This is not true for younger audiences (16-24) however, who will spend more time with streaming video than linear TV. Social media also overtakes linear TV for consumers under 55.

Stemming the tide

But while the fall in consumption is arguably gradual, ad spend is dropping more sharply. WARC found that linear TV spend decreased by 5.4 percent in 2023, double the rate of decline in viewing. The report suggested several reasons for this outpaced reduction in ad spend.

The first is the rise of ‘pureplay’ internet channels, namely search, social media and retail media. Advertisers have shifted their investment towards these channels over the past eight years, causing an 18.8 percent reduction in the share of spend going to ‘total video’ (linear and CTV). So despite double-digit growth in CTV spend, this has not been enough to offset a 20 percent decrease in linear spending.

The second is price inflation, with linear advertising costs rising sharply since the pandemic. But this varies significantly by market and audience, according to WARC. In the UK, linear CPMs have hovered around $3 (the report uses dollars for the sake of comparison) for the last three years, compared with the US, where CPMs hit $78 in 2023. And in the US, this rises to almost $200 to reach audiences aged 16-34 on TV.

And as younger viewers drift towards VOD and CTV viewing, this creates challenges for media buyers planning video campaigns. Video channels are typically made up of a mixture of ‘light’ and ‘heavy’ viewers, with light viewers usually proving harder to reach. “By trying to reach these audiences it is difficult to avoid over-serving advertising to heavy viewers,” says the report.

The other challenge is avoiding excessive frequency across video channels, according to WARC. The video ecosystem comprises an increasing number of “walled garden platforms”, each with their own proprietary media and ad delivery platforms.

“Building plans that can deliver de-duplicated reach becomes very difficult,” comments Dave Morgan, CEO of Simulmedia. “Running campaigns without delivering – and paying for – massive amounts of wasted frequency is even harder.”

“We hear a lot about ‘linear is dead,'” concludes Dave Campanelli, EVP/Chief Investment Officer at Horizon Media. “People are still watching linear TV. They tend to be older, but they are still watching linear TV. And it’s 50 percent of this whole pie. Our budgets need to represent that, depending on your age segment and who you’re going after.”