As the cold winter nights start to draw in, so do forecasts of a different nature. Advertising agencies begin their winter updates for the ad market this week, opening with Magna, the media and marketing solutions division of IPG Mediabrands.

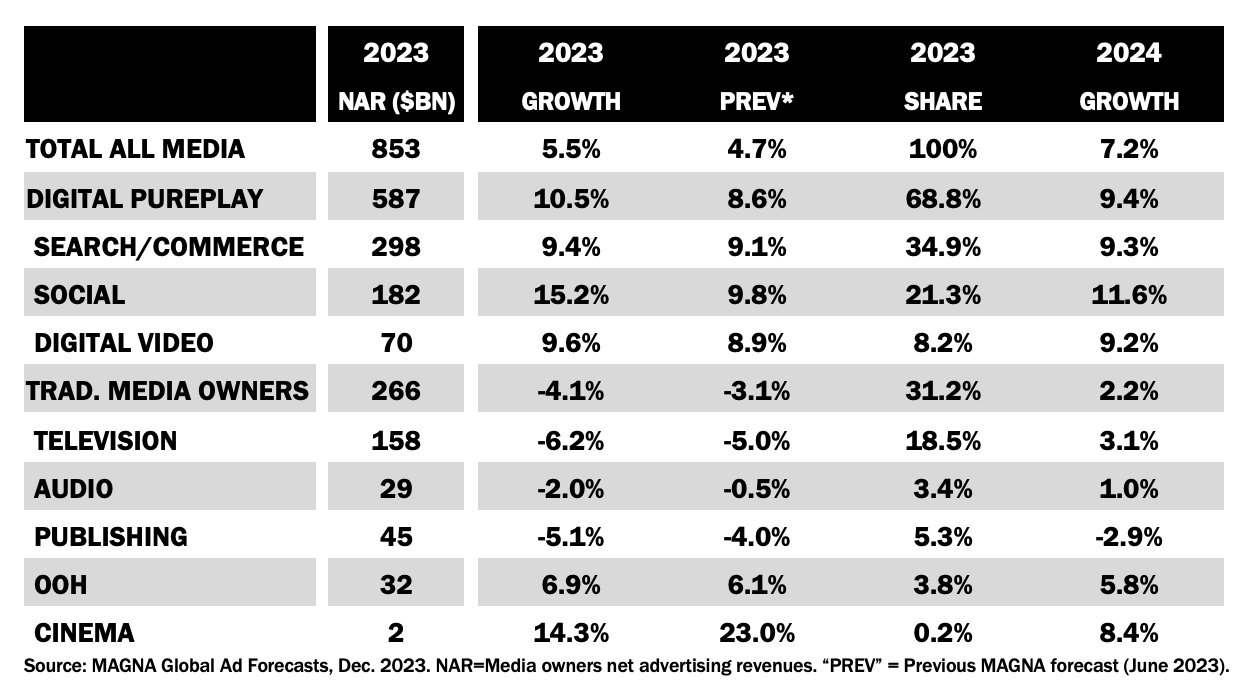

Despite a “slow, uncertain macroeconomic climate”, Magna notes that digital is on track to drive modest market growth this year. According to the media agency, full-year global ad spend will increase by 6 percent YoY, reaching $853 billion for 2023. That growth is fulled by an 11 percent rise in digital formats, hitting $587 billion in ad spend. Magna forecasts digital video to grow by 9.6 percent YoY, to reach $70 billion.

Social media is also accelerating, according to the report, with most ad spend concentrated in Meta and TikTok. The sector is due to grow 15 percent this year, reaching $182 billion. Meanwhile short-form video (YouTube and Twitch) will gain 9 percent, totalling $70 billion in 2023. However, search remains the most popular ad format, climbing 9 percent this year to approach $300 billion.

But total growth is being dragged down by “traditional” media channels. It is worth noting that Magna includes broadcasters’ digital ad sales, including VOD, under traditional media. This sector is headed for a 4 percent decline for a total $266 billion, according to the forecast, with TV set to shrink by 6 percent to $158 billion, as budgets continue their shift to digital.

The decline in publisher and broadcasters’ linear channels means traditional media sales now make up less than one-third of total global media spend. Nevertheless, TV remains the largest sector for global ad investment, despite its ongoing contraction. For example, digital video’s projected $70 billion total is below 44 percent of TV’s $158 billion.

And there are silver linings on the horizon for TV next year, with the US presidential election, the Paris Olympics, and Euro 2024 all expected to lift spending on traditional channels.

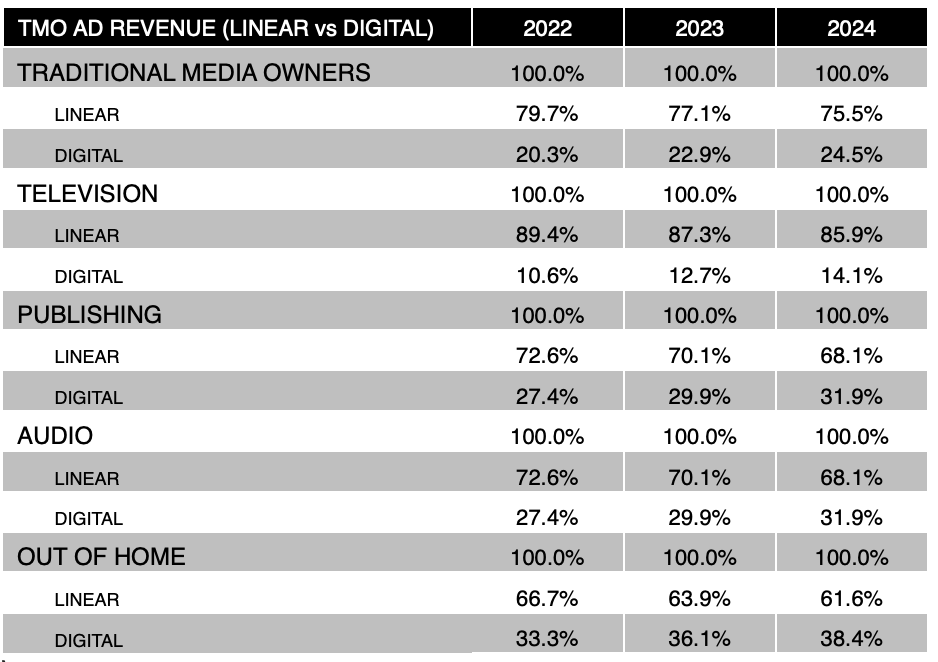

Digital vs linear

The report also breaks down media owners’ revenue splits between linear and digital channels. According to the report, digital will make up almost 25 percent of total sales in 2024. And publishers are making the transition faster than broadcasters, owing to the size of the traditional TV market. Digital will account for 29.9 percent of publisher revenues this year, rising to 31.9 percent in 2024. For broadcasters, digital will comprise 12.7 percent of global revenues this year, climbing to 14.1 percent next year.

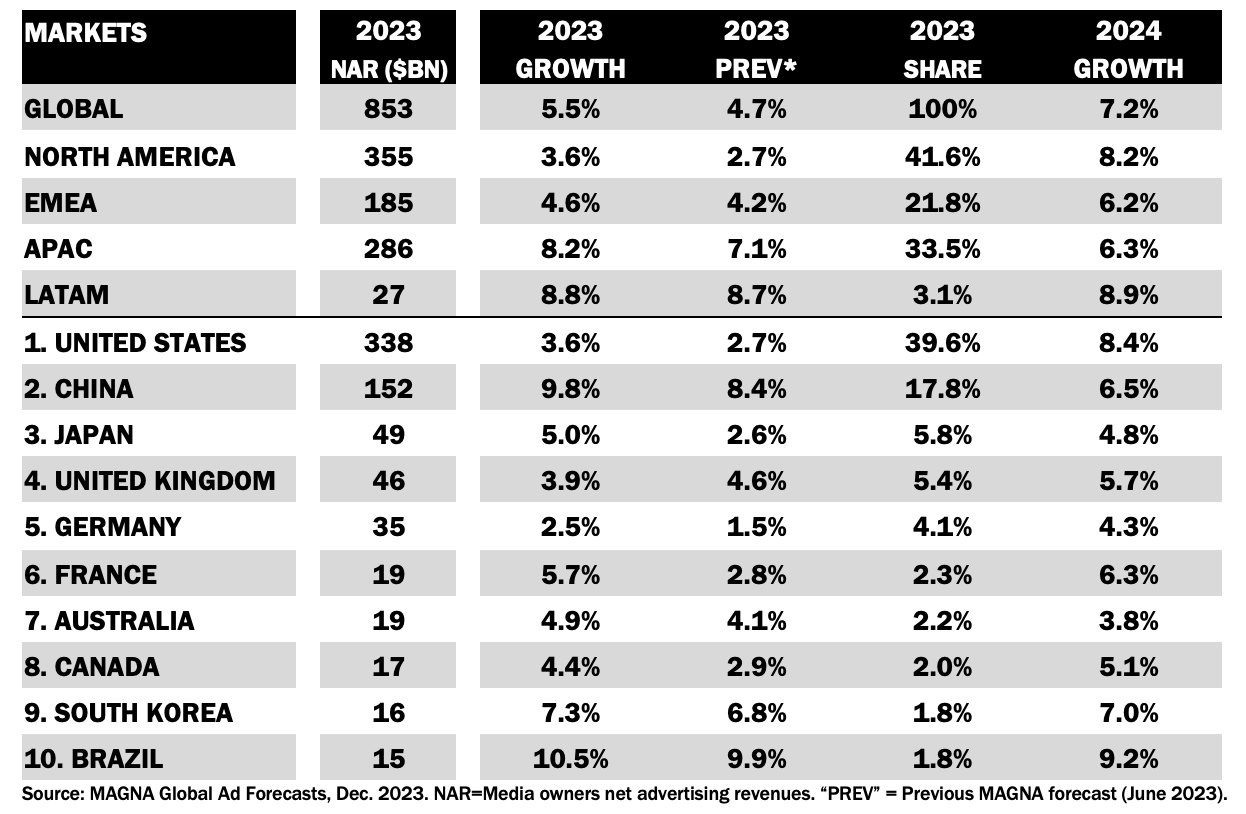

Magna also broke out figures by region, with India due to be the highest-growing market in 2023. The 11th biggest ad market will grow 12 percent this year, according to the forecast, reaching $14 billion. China meanwhile is set to grow 10 percent to reach $152 billion. The US and UK are on track for similar growth rates of around 4 percent, hitting $338 billion and $46 billion respectively.

As for spending segments, automotive spend was up in all markets except the US, although the demand for electric vehicles is expected to boost investment in 2024. Political spending is also set to grow next year due to the upcoming general elections, particularly in countries that allow political advertising on TV, namely India, Mexico and the US.

But there are slowdowns expected in the media and entertainment category, which is likely to feel the effects of this year’s Hollywood strikes; and betting brands, which anticipate tightening advertising regulation in Europe, especially in Spain, Italy and the Netherlands.

Overall though, the report struck a tone of recovery, with global advertising “re-accelerating” during the second half of an otherwise flat year for ad spend.

“The recovery is driven by easier year-over-year comparables and stabilising economic conditions (inflation slowdown), and these improvements mostly benefit pure-play digital advertising formats,” said Vincent Létang, EVP Global Market Research at Magna. “Search formats are driven by retail media; social and video formats are recovering to double-digit growth thanks a better monetisation of the fast-growing short vertical video impressions.”