Disney+ lost 2.4 million subscribers in the quarter ending 31st December 2022, marking the SVOD service’s first losses since launching in 2019. The streaming division lost more than $1 billion, prompting Disney CEO Bob Iger to announce 7,000 job cuts, representing 3.6 percent of the company’s global workforce.

The figures beat analyst forecasts of 3 million subscriber losses, expected due to price hikes on the ad-free version of Disney+ as the service introduced its cheaper ad-supported tier. Hulu and ESPN+ fared better, gaining 800,000 and 600,000 subs respectively.

Total revenues for the quarter ($23.51 billion) also narrowly beat expectations ($23.33 billion). Shares rose 4.7 percent following the earnings report.

The Two Mouseketiers

The results are almost the mirror image of Disney’s previous quarter, in which subscribers were up but revenues missed expectations. Disney stock fell 44 percent over the course of 2022, and CEO Bob Chapek was swiftly replaced by former boss Bob Iger.

“The market has legitimate concerns about consumer confidence,” comments Sophie Lund-Yates, Lead Equity AnalystHargreaves Lansdown. “Inflation’s grip remains tight on Disney+’s core customers,” she notes, leading to churn from its premium offering.

While still early days for the AVOD version, uptake could pick up pace in the coming months as consumer budgets remain squeezed. “The ad-supported tier is a clever way to entice and keep hold of customers who are struggling in the current climate, but this doesn’t cancel out the threat of competition,” says Lund-Yates. “Netflix is also rolling out a similar service, so the winner will be the service that has the most compelling content slate.”

According to Ampere Analysis, the ad-supported tier is mostly populated (56 percent) by subscribers who downgraded from the premium tier. And of the new sign-ups, the vast majority (82 percent) had previously churned from Disney+. “So far, uptake of Disney+’s ad tier has been similar to Netflix’s in terms of relative proportion, with Netflix’s ad tier making up 0.4 percent of its user base in the US,” adds Ampere Analyst Mayssa Jamil.

Though a long way off Disney’s goal of having 70 percent of its user base concentrated in the ad tier (as it is on Hulu), Jamil considers this a plausible long-term target, “particularly due to the attractive price of the ad bundle, and based on consumers on other platforms being quite tolerant of light ad-loads.” Ampere finds that over half of those on the ad tier are Disney Bundle subscribers, which packages Disney, Hulu and ESPN+ without ads for $12.99 per month.

Dis-content

Disney also aimed to reach 215-245 million subs by 2024, and while streaming remains Iger’s “number one priority,” Disney is now looking to save $5.5 billion in costs.

“Chapek’s departure was at least in part to do with the enormous costs that piled up trying to get Disney+ to where it needed to be,” observes Lund-Yates of Hargreaves Lansdown. “With the streaming service such an important part of Disney’s overall investment case these days, the board felt it had to move swiftly in order to address both growth and margin concerns in the division.”

Meanwhile tensions rumble between the Disney board and activist investor Nelson Peltz, who has accused Disney of overspending on streaming and been pushing for Iger’s departure “within two years.” The CEO has now offered to reinstate a dividend for shareholders, as advocated by Peltz’s Trian Group. “We are pleased that Disney is listening,” Trian said in a statement.

As part of those plans to counter losses from its streaming business, Disney is rumoured to be considering licensing its content to rival media outlets. This would represent a significant shift in strategy for the company that has traditionally found value in the exclusivity of its content, and according to Parrot Analytics, a step in the wrong direction.

“Demand for original series on Disney+ has driven Disney’s global streaming success over the last three years,” finds the research firm. “Since early 2020, the global demand for Disney+ Originals has grown 380 percent. This has helped lead to a 390 percent increase in global subscribers over the same time, showing the key link between demand for original series and SVOD subscription growth.”

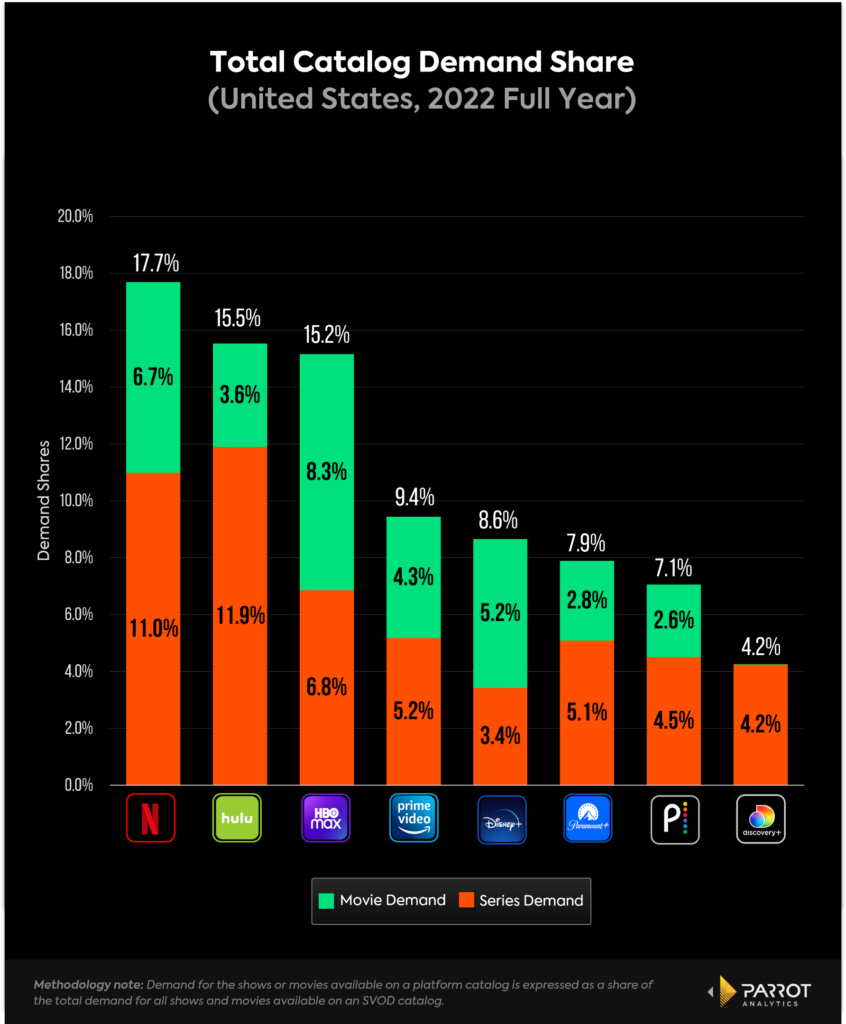

The total demand for Disney+ and Hulu content exceeds that of Netflix, the analysts revealed, suggesting the two streaming services be combined. “Hulu fills in the audience demographic gaps that Disney+ currently lacks: namely, older and more female audiences,” notes Parrot Analytics. “The two platforms combined would create the ultimate four-quadrant service.”