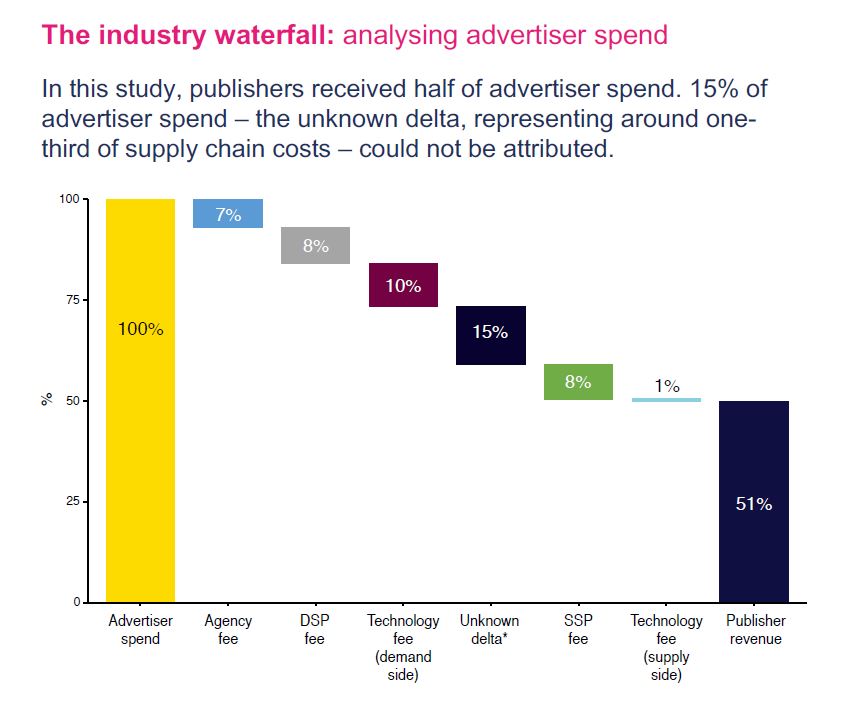

Fifty-one percent of programmatic ad spend in the UK ends up in publishers’ pockets, with the rest being swallowed up by agency and tech fees, according to advertiser trade body ISBA’s ‘ Programmatic Supply Chain Transparency Study’, released today. And out of the remaining 49 percent of programmatic ad spend, fifteen percent couldn’t be attributed to any specific part of the supply chain. This fifteen percent accounts for one-third of all supply chain costs which come between the advertiser and the publisher. ISBA says the study highlights the complexity and lack of transparency in the supply chain, and has called for far-reaching reform of programmatic trading as a result.

Fifty-one percent of programmatic ad spend in the UK ends up in publishers’ pockets, with the rest being swallowed up by agency and tech fees, according to advertiser trade body ISBA’s ‘ Programmatic Supply Chain Transparency Study’, released today. And out of the remaining 49 percent of programmatic ad spend, fifteen percent couldn’t be attributed to any specific part of the supply chain. This fifteen percent accounts for one-third of all supply chain costs which come between the advertiser and the publisher. ISBA says the study highlights the complexity and lack of transparency in the supply chain, and has called for far-reaching reform of programmatic trading as a result.

ISBA described its study, carried out by PricewaterhouseCoopers (PwC), as “an end-to-end industry market audit”, designed to explicitly show how much ad revenue each part of the supply chain is swallowing up in the UK.

The study found that demand-side tech fees were the largest identifiable supply chain cost, taking ten percent of total ad spend. Supply-side platform (SSP) and demand-side platform (DSP) fees meanwhile each accounted for eight percent of total spend on average, while agency fees accounted for seven percent. Sell-side technology platforms take just one percent of ad spend, according to ISBA’s data.

ISBA hopes that by providing hard data on how much of the pie each part of the supply chain takes, advertisers and publishers will be able to better asses their value. It’s easy to dismiss various ad tech fees as ‘ad tech taxes’, but it’s important to remember that these intermediaries can add significant value to both advertisers and publishers.

ISBA hopes that by providing hard data on how much of the pie each part of the supply chain takes, advertisers and publishers will be able to better asses their value. It’s easy to dismiss various ad tech fees as ‘ad tech taxes’, but it’s important to remember that these intermediaries can add significant value to both advertisers and publishers.

But ISBA says the ‘unknown delta’ – the fifteen percent of ad spend which couldn’t be attributed – is worrying. These hidden fees account for around a third of all supply-chain costs. And ISBA says they are getting lost somewhere within a massively complicated supply-chain, without adding any discernible value.

For the study, PwC collected data from fifteen advertisers, eight agencies, five DSPs, six SSPs and twelve publishers, representing approximately £0.1 billion of UK programmatic media spend. The auditor says that it identified over 1000 distinct supply chains, and when tracking impressions end-to-end from advertiser to publisher, it traced 290 of these separate chains.

Alongside this complexity, ISBA says PwC encountered a lack of understanding and consistency among ad tech companies as to how they could legally share data and what permissions were needed. The auditor also found a lack of uniformity on data storage and formatting, and said that data captured by DSPs for an impression is often not equally captured by SSPs, hindering impression matching.

ISBA also says it encountered a general reluctance from some tech companies to let PwC look at their data. Earlier this month in a written statement to the UK’s Competition and Markets Authority (CMA), ISBA said its study was significantly delayed by tech companies throwing up legal barriers. “The apparent intransigence of parties to comply with the study and the lack of consistency in process to access data and corresponding legal frameworks has been a key learning,” said ISBA.

ISBA says the study shows that standardisation is needed across a range of contractual and technology areas, to facilitate data-sharing and drive transparency, and that the industry must work together to investigate the ‘unknown delta’. To kickstart progress on these goals, ISBA is convening a “cross-industry taskforce” to begin work on studying the causes of the unknown delta, and launching an independently-led effort to work on standardisation and data sharing.

Phil Smith, director general of ISBA, says the study marks the first time that programmatic advertising’s supply chain costs have been properly mapped out. “The publication of this study marks an important moment in our understanding of online advertising supply chains,” he said. “It is the first time anywhere in the world that an attempt has been made to map a system which is not capable of being audited.”

“The challenge now is for industry to come together, as they will in the new taskforce, to drive industry standards and create transparent supply chains, to allow companies and consumers to benefit properly from online advertising,” he added.

Graeme Smith, head of media at BT Group, said the “big hole in the value chain” identified by the study is a significant concern, and the BT would consider cutting back on programmatic spend if the problem isn’t fixed. “We desperately need to see a common set of standards adopted and more openness in this market, so that every penny spent is accounted for,” he said. “If this happens, we’ll invest more in the channel; if not, we will cut back and reshape our trading approaches”.