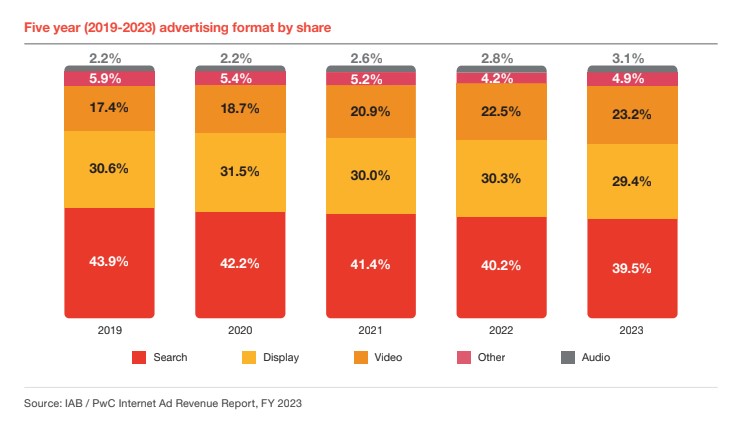

Total digital ad spend in the US grew 7.3 percent in 2023, reaching $225 billion, according to the IAB and PwC’s latest Internet Advertising Revenue Report. And video is a significant driver of this growth, having had the fastest growth rate in recent years, powered by the influx of CTV inventory. Video revenues grew by 10.6 percent in 2023, reaching $52.1 billion. This means video now accounts for 23.2 percent of all digital ad revenues in the US, and it’s expected to continue growing at a high rate in the coming years, according to the report.

Video was not the only high growth area in 2023. Of the main categories measured in the report, audio saw a higher growth rate of 18.9 percent. But it’s a much smaller part of the market, with total revenues of $7.0 billion.

Search and display meanwhile grew at slower rates but, given their size, added significant revenues. Nonetheless video added more revenues last year ($5 billion) than any other category ($4.4 billion for search, $2.6 billion for display, and $1.1 billion for audio).

This continues an extended growth streak for video. Back in 2019, video accounted for 17.4 percent of total digital ad revenues, not far from half of display revenues (which made up 30.6 percent). Now however video makes up 23.2 percent of digital ad revenues, much closer to display which now sits at 29.4 percent. And qualitative data collected by the report projects that video as a whole will continue to grow, with respondents to the IAB and PwC’s surveys saying they anticipate further increases in revenues generated across online video, CTV, and OTT next year.

CTV powers video’s growth

The growth of connected TV is inevitably a large contributor. CTV and OTT made up 42 percent of total video ad revenues last year. CTV and OTT is projected to be the fastest growing media channel in 2024, as combined spending on TV and CTV is expected to grow by $12 billion between 2023 and 2027.

The report says that last year’s Hollywood strikes, coupled with decreased viewership of scripted shows and reruns, has redirected ad dollars away from traditional broadcasters and towards independent and non-unionised streaming and social platforms. Upcoming negotiations for live sports rights could accelerate the shift of ad dollars towards CTV further.

The report highlighted NBA league broadcasting rights which are up for negotiation at the end of the 2024-25 season, prompting both traditional sports broadcasters and streaming players to expand live sports streaming. Meanwhile players across the board are increasingly monetising sports-related content outside of live broadcasters, such as sports influencer-led content and highlight packages.

Formats proliferate, but concentration increases

As mentioned, CTVs growth is opening up opportunities for smaller players outside of traditional broadcasters to create and monetise TV content. Meanwhile retail media, another area seeing high growth (which has some crossover with video and CTV) is also bringing new businesses into advertising.

Nonetheless, the dominant companies in digital advertising are capturing an ever growing share of ad revenues. The top ten companies (not named in the report) captured 79.8 percent of all digital ad revenues in 2023, up from 76.6 percent in 2019. Meanwhile companies outside the top 25 are competing for just 12.4 percent of all internet ad revenues, down from 16.3 percent in 2019.