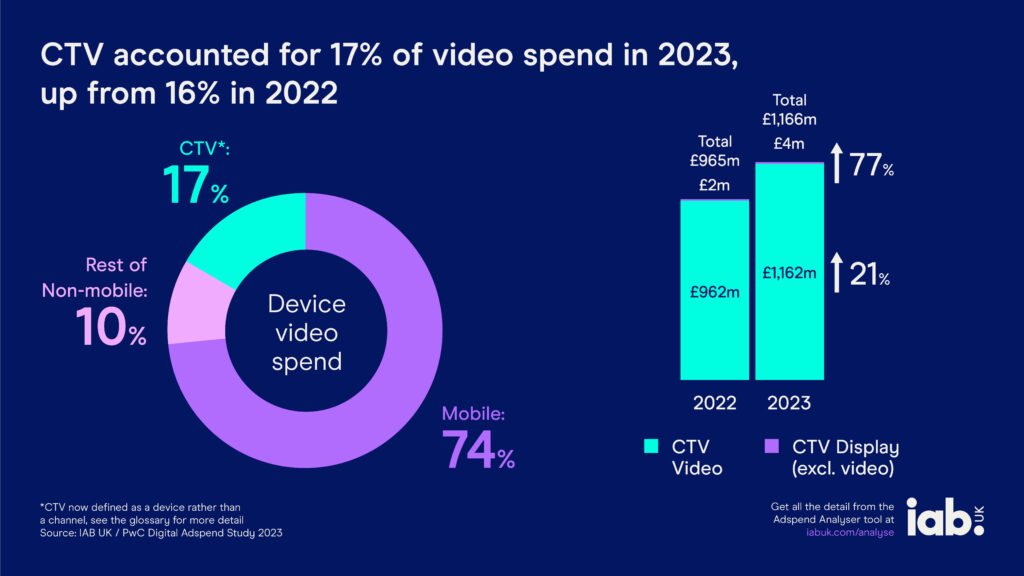

CTV spending surged in the UK last year, according to the latest IAB Digital Adspend report, as advertisers look to invest in cookieless environments. Conducted alongside PwC, the study found that ad spend on CTV devices (£1.2 billion) grew 21 percent YoY, accounting for 17 percent of all video spend in 2023.

The reseach showed that the UK digital ad market grew 11 percent YoY, reaching £29.6 billion in 2023. The report notes the growth rate outpaces GDP at 0.1 percent, revealing the appetite among advertisers to capitalise on growing engagement in online entertainment, and its associated digital ad formats.

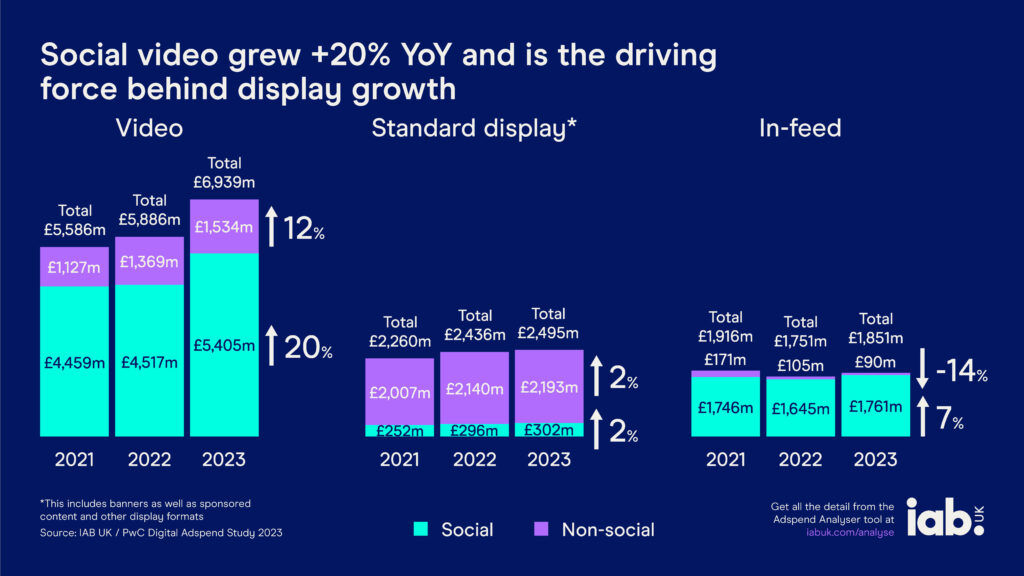

Just behind podcasts (+23 percent) and CTV, social video ad spend also climbed 20 percent YoY, with all three categories outperforming the wider digital ad market. This indicates that ad spend “is following consumer behaviour”, according to IAB and PwC, with 28 percent of the population saying their use of ad-supported online entertainment has risen during the cost-of-living crisis.

But the report suggests the growth of podcast, CTV and social video spending is not just to do with the growing popularity of these channels, but their relative resilience to the impending removal of third-party cookies in Chrome, making them a safer investment for advertisers.

“With the impending deprecation of third-party cookies, digital advertising is undergoing a shift and we know that the year ahead will reshape the industry in new ways,” said James Chandler, CMO of IAB UK. “In that context, it’s encouraging to see advertisers seeking out engaged environments and increasingly investing in a broad array of online solutions.”

Targeted investment

Indeed the loss of targeting capabilities can have signficant ramifications for digital ad spending. In 2022, Apple’s privacy changes saw mobile ad spend slow to 4 percent growth, according to the research. But mobile publishers seemingly managed to restore advertiser confidence last year, and mobile spend accelerated 15 percent to reach £16.7 billion.

And the importance of first-party data come the loss of third-party cookies was evidenced in the continued growth of digital retail media spending (£283 million), which rose 12 percent last year. Meanwhile digital out-of-home spending saw similar growth, up 12 percent for a total £841 million. Display and video also climbed 12 percent to reach £11.3 billion, of which video took 60 percent. However, search continues to take 50 percent of total digital ad spend, totalling £14.7 billion in 2023.

“As well as providing us with invaluable insight on the health of the digital ad market as a whole, the latest Digital Adspend results show how advertisers are embracing the diverse array of digital channels on offer,” said IAB UK’s James Chandler. “Media that are often referred to as ‘emerging’ are taking their place as increasingly established ways to resonate with engaged audiences – whether that’s via the immersive nature of podcasts or high-impact fame factor of CTV.”

“Digital media continues to evolve, showcasing its adaptability and resilience,” added Stephanie Claxton, Senior Manager at PwC. “Growth was not only seen from emerging channels including digital out-of-home, which was included in the report for the first time, and retail media, which weathered the economic headwinds to deliver double-digit growth online; but also established channels including mobile where ad spend increased and search, which maintained its dominant market share.”