UK consumers are looking less to SVOD services as their first port of call when looking for video content, according to research consultancy MTM, with live TV and BVOD services reportedly making a resurgance.

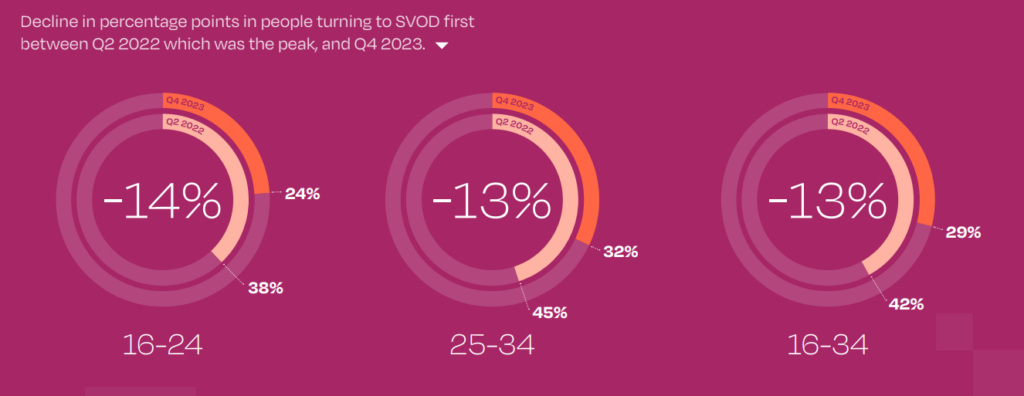

The consultancy’s latest ScreenThink report showed a 13 percent decline in the number of UK viewers turning to SVOD services first. For the 25-34 demographic, 45 percent of consumers prioritised SVOD services in Q2 2022, falling to 32 percent in Q4 2023.

The study noted that Gen Z (16-24) were moving away more rapidly from SVOD-first behaviour, dropping from 38 percent in Q2 2022 to 24 percent at the end of 2023. The report suggested that live TV and BVOD offerings are the main beneficiares of this shift.

Meanwhile Netflix and Amazon Prime Video have seen the biggest losses resulting from this shift, according to MTM. The research found that both SVOD services saw a 6 percent fall in users turning to them first when looking for content.

Examining the causes behind this trend, the research highlighted cost and content fatigue as factors driving a return to cheaper or free TV offerings. Respondents cited cost (20 percent) and running out of content (16 percent) as major reasons for cancelling SVOD subscriptions.

The study also comes ahead of the launch of Freely, an upcoming CTV app which will combine live and on-demand content from UK broadcasters, namely the BBC, ITV, Channel 4 and Channel 5.

Off and on again

The research pointed to another trend stemming from this perception of SVOD services; subscription cycling, or toggling, in other words joining and cancelling services on a short-term basis. Acording to the report, 12.5 percent of UK consumers take this approach, treating streaming services more like a utility than a long-term commitment.

“Consumers are becoming increasingly comfortable with the idea of turning SVOD services off and back on again as and when they need them, with one in eight people currently doing so,” said the report.

For example, Netflix has seen 20 percent of its user base cancel their plan and then re-subscribe at a later date, according to MTM. Apple TV+ was particularly prone to this behaviour, with 26 percent of users reporting they had subscription-cycled the service in the last six months.

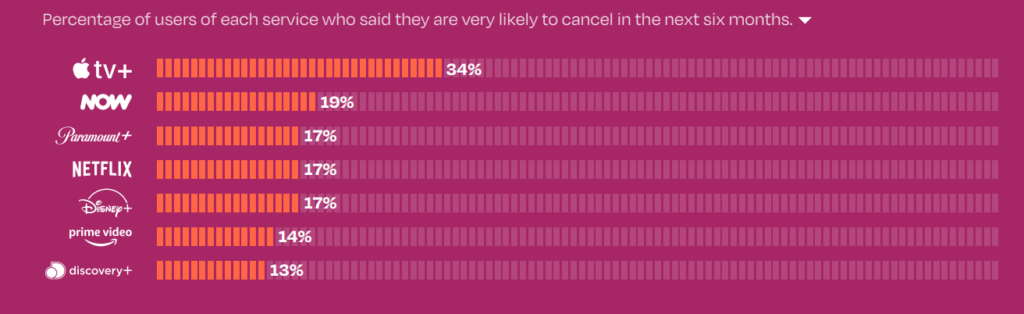

When asked which streaming services they are “very likely” to cancel in the next six months, Apple TV+ came out on top, with 34 percent of current users planning to cancel their membership. But the research also found that 8 percent of UK consumers intend to sign up for Apple TV+ in the next six months, thereby feeding the subscription cycle.

MTM suggested the limited library size was one the main reasons Apple TV+ was ripe for subscription cycling. “Viewers are attracted by the prestige originals but churn quickly after consuming the available content,” said the research.

Known quantities

Netflix on the other hand saw positive effects from the introduciton of its cheaper ad tier and implementation of its password-sharing crackdown. The research showed that the number of Netflix users who pay for the service themselves rose from 59 percent in Q2 2022, to 70 percent in Q4 2023.

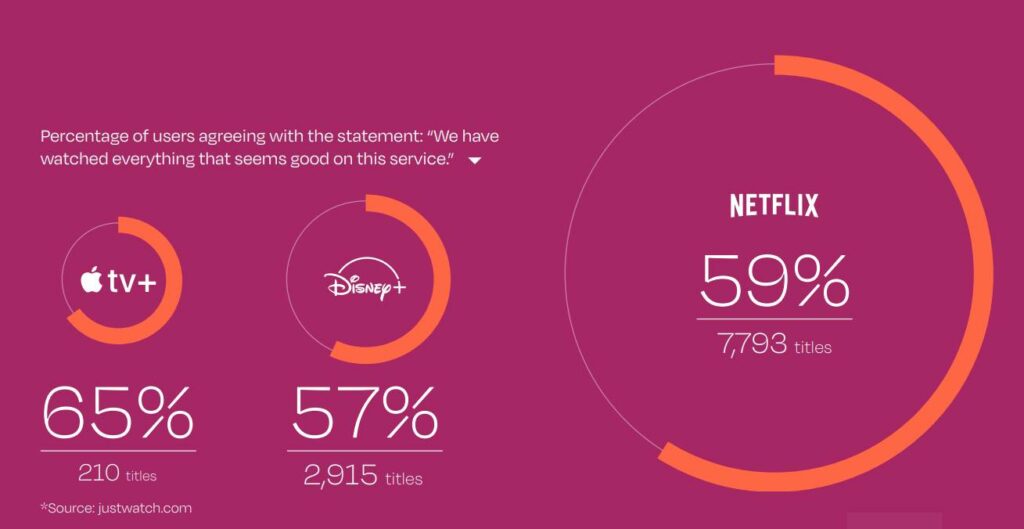

Despite this uptick in paying subscribers, and a library of almost 8,000 titles, Netflix still causes content fatigue among its viewers. The research revealed that 59 percent of Netflix users agreed with the statement: “We have watched everything that seems good on this service.”

Interestingly, Netflix’s content fatigue rate is higher than Disney+ (57 percent), which houses around 3,000 titles, and only slightly lower than Apple TV+ (65 percent), with just 210 titles. Netflix boasts 38 times as much content as Apple TV+, indicating that a vast library cannot necessarily prevent fatigue.

Netflix also saw some depreciation in its perceived value for money, according to MTM, following the introduction of its ad tier and raising the cost of the premium plan. Apple TV+ on the other hand saw its customer satisfaction levels increase over the same period, rising from 53 percent in Q2 2022 to 66 percent in Q4 2023.

And while Netflix has been vocal about driving subscribers onto its cheaper ad tier, Disney+ has seen success in upselling its users onto its ad-free plan. According to the findings, 15 percent of Disney+ subscribers have paid to upgrade to the premium plan, while 17 percent of Amazon Prime Video customers are also planning to pay to avoid ads on the streaming service.