In this week’s Week in Review: Vivendi is considering spinning off Havas, Channel 4 launches new streaming ad formats, and Netflix ad sales could reach $1 billion next year.

Top Stories

Vivendi Considers Splitting Havas and Canal+ into Separate Entities

French media conglomerate Vivendi is exploring splitting into three separate entities: advertising giant Havas, TV business Canal+, and the investment arm that owns the publishing group Lagardère. Analysts estimate the move could increase the companies’ market valuation by around 40 percent.

Currently Canal+ makes up over half of Vivendi’s sales and earnings, while Havas accounts for more than one quarter of the company’s revenues. Spinning the businesses off could translate into valuations of about €6.1 billion for Canal+ and €3 billion for Havas, according to Oddo analyst Jerome Bodin.

The company said it would consider a potential breakup but gave no timeframe for a decision, noting that any plan would need to bring value to all stakeholders and account for tax consequences. Vivendi shares jumped more than 10 percent following the announcement.

Channel 4 Launches New Streaming Ad Formats

Channel 4 announced new ad formats for its BVOD service this week, as the UK broadcaster pivots to a streaming-first strategy. The company said 15 brands trialled the new formats, resulting in an 81 percent boost in long-term brand recall.

The ‘Solus’ format guarantees an advertiser the only pre-roll slot, and the first slot in mid-programme breaks. Compared with regular ad breaks, the product is said to increase immediate brand recall by 73 percent. Meanwhile the ‘Lite’ format places an ad in 60-second breaks, and boosts brand recall by 44 percent, according to the broadcaster.

“We are continually innovating to give our partners the best ways of reaching viewers,” said Jonathan Lewis, Head of Commercial Innovation and Partners at Channel 4. “Our streaming ad innovation further sets us apart in the industry as we generate the commercial returns from our work to prioritise digital growth and become the UK’s public service streamer.”

Netflix Ad Revenues to Overtake Disney+ Next Year

Netflix ad revenues are set to overtake Disney+ next year, according to a Reuters report citing data from Insider Intelligence. The firm forecasts Netflix revenues to jump 50.3 percent next year, to reach $1 billion. That’s compared to 16.1 percent at Disney+, reaching $912 million in 2024. This year however, Disney+ is expected to generate $100 million more in ad sales than its rival.

The report suggested that Netflix’s password-sharing crackdown, as well as price hikes on its ad-free plan, have helped drive customers to its ad-funded tier. Insider Intelligence also noted that Netflix is able to sell ads at a slightly higher price than its rivals, due to pent-up demand from advertisers who had been waiting for the streaming giant to introduce advertising.

The Week in Tech

Google Slams “Flawed” EU Efforts to Break Up its Ad Tech

Google has criticised the EU’s “flawed interpretations of the ad tech sector,” amid ongoing efforts by the European Commission to break up the tech giant’s advertising business. “While we continue our constructive conversations with the Commission, we are opposing the call for divestment, as we don’t believe it is proportionate nor the right solution for our partners,” said Dan Taylor, VP Global Ads at Google. Meanwhile in the US, the Alphabet-owned company lost a landmark case against Epic Games, when a jury decided that Google operates a monopoly in the mobile app store market. “It proves that Google’s app store practices are illegal and they abuse their monopoly to extract exorbitant fees, stifle competition, and reduce innovation,” said Epic Games.

UK Supermarkets Make £300 Million Selling Loyalty Card Data

Tesco and Sainsbury’s make an estimated £300 million each year from selling shopping data to retail networks and TV companies, The Times reported this week. Loyalty card data is used by the likes of Channel 4, Pepsico and Heineken for targeted advertising. Sainsbury’s CEO Simon Roberts has defended the practice, arguing that clean rooms protect customer data. “Our retail media platform [works] with suppliers with anonymised customer data, very importantly, we protect our data incredibly carefully,” he told the Guardian.

Clearcast and Ad Signal to Cut Ad Reporting Times for Barb

Clearcast has enlisted Ad Signal, a video content management specialist, to provide technical support in delivering its contract with Barb. Last week, the TV measurement body announced it had handed ad reporting duties to Clearcast, potentially reducing log time for ads to around eight hours after broadcast. “This will allow advertisers and agencies early access to overnight data enabling them to track and react to their advertising activity quicker,” said Ad Signal.

X Ad Revenues Down by More Than $2 Billion

X (formerly Twitter) is on track to bring in $2.5 billion in ad revenues this year, down from over $4.5 billion last year, according to Bloomberg. Since Elon Musk’s takeover, the company’s quarterly revenues have slumped from more than $1 billion to around $600 million. The last 12 months have seen an exodus of large advertisers concerned about antisemitism and hate speech on the social platform.

Perion Acquires DOOH Company Hivestack for $100 Million

Ad tech firm Perion has acquired Hivestack, a digital out of home (DOOH) advertising business, for $100 million in cash. The Canadian DOOH company offers an ad server, DSP and SSP to clients including Uber, Colgate and Lego. “Hivestack’s DOOH technology platform stands out by offering brands and advertisers what they crave the most: high-visibility creative, precise targeting, immediate impact, wide reach and measurement,” said Perion CEO Tal Jacobson.

DoubleVerify and IAS Bring Brand Safety Measurement to YouTube Shorts

YouTube has introduced media measurement capabilities from DoubleVerify (DV) and Integral Ad Science (IAS) to its Shorts product. Both companies will assess brand safety and suitability on YouTube Shorts videos, ensuring the associated ad inventory meets GARM standards. “Our innovative offering on YouTube Shorts provides YouTube advertisers with the tools they need to boost clarity and confidence in their media investment and verify brand-content alignment,” said DV CEO Mark Zagorski.

The Week in TV

Combined Disney+ and Hulu Would Own Most Popular Titles in US

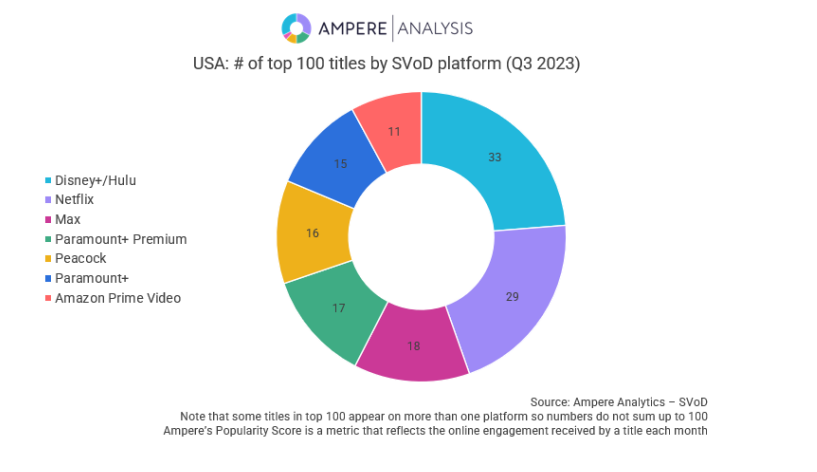

A combined Disney+ and Hulu streaming service would carry one-third of the 100 most-popular titles in the US, Ampere Analysis found this week. The combined service, due to arrive early next year, would have the largest share of the most-popular titles, based on Ampere’s engagement data. Its content library would comprise around 9,000 titles, leapfrogging Netflix (8,391) but still shy of Amazon Prime Video (10,892). “Rivals will have to ensure their offerings remain competitive as the battle for viewing time intensifies, especially as the need to pull in advertising dollars is now also central to the streaming mix,” said Joshua Rustage, Analyst at Ampere Analysis.

Ad Revenues Heat Up at Caffeine’s Sports Business

Caffeine, a streaming service for live sports, has reached 60 million monthly active users (MAU), the US company announced this week. The milestone marks a significant jump for the AVOD service, which stood at 5 million MAU this time last year. Alongside the expansion of its user base, the company has also witnessed 140x revenue growth over the last six months. Read more on VideoWeek.

Shari Redstone in Talks to Sell Paramount Stake

Media mogul Shari Redstone is in talks to sell a controlling stake in National Amusements, the parent company of Paramount Global, Bloomberg reported on Monday. Reports suggest Redstone has been in discussions with media company Skydance, though a deal is yet to be confirmed. A sale of the TV business, which includes MTV, CBS and Showtime, could generate $13.5 billion, according to Bloomberg.

Video Subscription Prices Up by 25 Percent in Germany

The cost of viewing all major sports and entertainment offerings in Germany has surged by almost 25 percent since mid-2022, according to research from TeraVolt. The agency estimated that a theoretical “all-in” package would cost €257.68 per month, rising by €50 over the past year. “The industry must adapt to offer more streamlined and cost-effective ways for consumers to access the diverse range of content they desire,” said TeraVolt CEO Tobias Künkel. “Ad-based product tiers are an important part of the solution here.”

French TV and CTV Ad Revenues Could Climb 5 Percent Next Year

French TV and CTV ad revenues are due to climb by 5 percent next year, according to Médiamétrie and NPA Conseil, hitting €3.8 billion in 2024. The AVOD Market Report cited the rise in FTTH homes and next summer’s sporting events, as well as the upcoming launch of TF1+ and Warner Bros. Discovery’s Max. The report found that French TV and CTV revenues totalled €3.5 billion in 2022, and could reach €3.6 billion in 2023.

Netflix Breaks Silence on Viewing Figures in Wake of Hollywood Strikes

Netflix released its first global viewing data on Tuesday, as the streaming giant seeks to increase transparency in the wake of the recent Hollywood strikes. The company has traditionally been cagey on viewing figures, making it harder for talent to negotiate performance-based royalties, but now pledges to release these reports twice a year. The report revealed that The Night Agent was the most-watched show on Netflix in H1 2023 (812 million viewing hours), followed by Ginny & Georgia (665 million) and The Glory (623 million). Netflix co-CEO Ted Sarandos acknowledged that the company’s “lack of data and lack of transparency” had created an “environment of mistrust” in Hollywood.

Nelson Peltz Nominates Himself for Disney Board Seat

Hedge fund Trian Partners is planning to nominate its founder Nelson Peltz to the Disney board, the latest play in a proxy battle between the activist investor and Disney CEO Bob Iger. The entertainment giant has repeatedly pushed back against Peltz’s attempts to secure board representation. Now Trian Partners is stepping up its campaign by nominating both Peltz and former Disney executive Jay Rasulo. “The root cause of Disney’s underperformance, in our view, is a board that is too closely connected to a long-tenured CEO and too disconnected from shareholders’ interests,” Trian said in a statement.

The Week for Publishers

Axel Springer Strikes Major Deal with OpenAI

European publishing giant Axel Springer, which has already experimented extensively with AI, this week announced a new global partnership with OpenAI this week. The deal will feed Axel Springer’s content into OpenAI’s database, allowing ChatGPT to produce summaries of global new content informed by Axel Springer’s media brands. This will include content which sits behind a paywall. “We want to explore the opportunities of AI empowered journalism – to bring quality, societal relevance and the business model of journalism to the next level,” said Mathias Döpfner, CEO of Axel Springer.

Subscriptions Prop Up Falling Digital Publisher Revenues

More than half (58 percent) of publishers reported growth this year, according to the latest Digital Publishers’ Revenue Index (DPRI) from the Association of Online Publishers (AOP) and Deloitte. However, overall digital revenue for Q3 2023 was down by -0.5 percent YoY, totalling £153 million. The DPRI indicated that that digital publisher revenues remain flat in Q3, with notable drops in display (-4.2 percent), video (-14.3 percent) and sponsorships (-25.9 percent). But the losses were largely compensated by ongoing growth in subscription revenues (+11.7 percent).

MailOnline Experiments with a Paywall

The Daily Mail’s online property MailOnline is experimenting with putting a small number of articles behind a paywall each day, pivoting away from its completely ad-supported strategy. The majority of articles will remain free, but around 10-15 articles each day will be paywalled, according to the FT, as the Mail experiments with new revenue streams. MailOnline has built a very strong audience with its paywall-resistant strategy, becoming one of the most visited news sites in the world. But with traffic from social platforms drying up for many publishers, exploring new revenue streams is increasingly crucial.

Jezebel Seeks Direct Revenues After Relaunch

Back-from-the-dead publisher Jezebel, which was shuttered by previous owner G/O Media, but then revived after being bought by Paste Magazine, relaunched this week. And the feminist publication is seeking direct revenues, via things like video sponsorships and live events, according to Adweek, as it searches for a profitable business model under its new owner. G/O Media had claimed that Jezebel has struggled in part due to its coverage of sensitive subjects, which made it hard to make money on the open exchange due to brand safety filters.

Arena Group Fires its CEO After AI Article Scandal

Arena Group, the publishing group which owns Sports Illustrated, has fired its CEO Ross Levinsohn following the discovery that Sports Illustrated had published articles written by seemingly AI-generated authors. Last month Futurism reported that a number of articles in Sports Illustrated were being attributed to authors with AI-generated headshots and biographies – suggesting that the content itself was likely also AI-generated. At the time, Arena Group denied the allegations, saying the articles in question were commercial pieces written by a third-party company, and that content was written by humans who were using pen-names.

The Week For Brands & Agencies

Fossil Fuel Companies Could be Pumping Millions into Greenwashing on TikTok

A new report from Climate Action Against Disinformation (CAAD) has shed light on social media greenwashing by fossil fuel companies, including spending millions on TikTok ads to promote unproven solutions. The study found that oil and gas giant Chevron has run what CAAD calls “pervasive and calculated campaigns” across social media, pumping ad spend into a range of different channels. According to the report, the company spent around $1.8 million on TikTok ads for its “renewable gasoline blend”, marketed as an eco-friendly alternative to “traditional gasoline”. Read more on VideoWeek.

IPG Signs Data Deal with OpenAP

Interpublic Group’s media agency Magna has struck a deal with US media consortium OpenAP which will give it access to linear insights and digital audience forecasting via OpenAP’s dataset. IPG Mediabrands’ clients will be able to build and reach advanced audiences using OpenAP’s OpenID identifier via a direct integration with Acxiom, and will be able to measure cross-publisher and cross-platform reach and frequency at the end of a campaign.

Allianz Appoints GroupM as Global Media Partner

Insurance business Allianz Group has appointed Group as its global media partner of record, the two announced this week. Multiple GroupM agencies will service the account both globally and market-by-market, with Mindshare taking the lead globally and in two-thirds of markets. The account includes responsibility for full-funnel media strategy, planning, buying, and campaign execution.

US Ad Employment Rose Again in November

Total employment in advertising, public relations, and related services in the US rose by 1,200 jobs in November, according to Ad Age’s analysis of data from the US Bureau of Labor Statistics. This is an all-time high for the industry, and is 10,900 jobs stronger than this time last year.

OMG UK Launches New Newcastle Hub

Omnicom Media Group UK is launching a new hub based in Newcastle, which will create up to 170 new jobs over the next three years, the agency announced this week. The new hub will be led by Pete Coates, who joins from iProspect UK. “The Newcastle launch marks an important next step in enabling clients across the UK to leverage OMG’s Agency as a Platform approach, connecting media, content and commerce to deliver better outcomes,” said OMG UK CEO Laura Fenton.

Unilever Investigated Over Greenwashing

The UK Competition and Markets Authority (CMA) is investigating Unilever over environmental claims it calls vague, broad and potentially misleading. The fast-moving consumer goods (FMCG) giant made claims that could exaggerate how recyclable or “natural” its products are, according to the CMA, whose greenwashing remit expanded to include FMCG in January. Unilever, which owns Cif, Dove and Domestos, said it was “surprised and disappointed” by the investigation.

Hires of the Week

Spark Foundry Names Joint MDs

Spark Foundry, a Publicis agency, has appointed Marcos Angelides and Kate Anthony as joint Managing Directors. Former MD Nigel Waring will move to Chief Operating Officer after six years in the role.

iSpot Hires Disney’s David Coletti for Sports Insights

iSpot, a TV measurement firm, has hired David Coletti as VP Sports Research & Insights. He joins from Disney, where he spent more than three years as VP Research & Insights.

UM Promotes Erin Quintana to US CEO

UM, an IPG-owned media agency, has named Erin Quintana as US CEO. She replaces Joe DiMiero, who took on the role in January 2022. Quintana joined UM in 2007, most recently serving as EVP Client Managing Partner.

BBC Taps Absolut CMO as First Chief Brand Officer

The BBC has appointed Charl Bassil its first Chief Brand Officer. Bassil has spent five years as CMO at Absolut Vodka, and will take on the new position in March 2024.

This Week on VideoWeek

Fossil Fuel Companies Could be Pumping Millions into Greenwashing on TikTok

Ad Revenues Heat Up at Caffeine’s Sports Business

Do Homophobia and Transphobia Persist in the Advertising Industry?

The Retail & Commerce Media Guide 2024 is Now Available to Download

Ad of the Week