Ad spend in the UK climbed 1 percent YoY during the second quarter of 2023, according to the latest Advertising Association/WARC Expenditure Report, reaching almost £9 billion in total ad spend.

The AA noted that the advertising industry can be seen as a barometer for the broader UK economy. The growth in ad spend tracks just ahead of GDP, which rose 0.6 percent during the quarter, according to the Office for National Statistics (ONS).

The figures also complete the picture of ad spend for the first half of 2023. AA/WARC found that spend also grew by 1 percent YoY during H1, with £17.5 billion spent over the first six months, compared to £17.3 billion the previous year.

The marginal growth was mainly driven by online formats, said the report. Search spend was up 5.3 percent YoY in Q2, and 5.1 percent in H1, while online display also increased by 5.8 percent and 6.4 percent respectively.

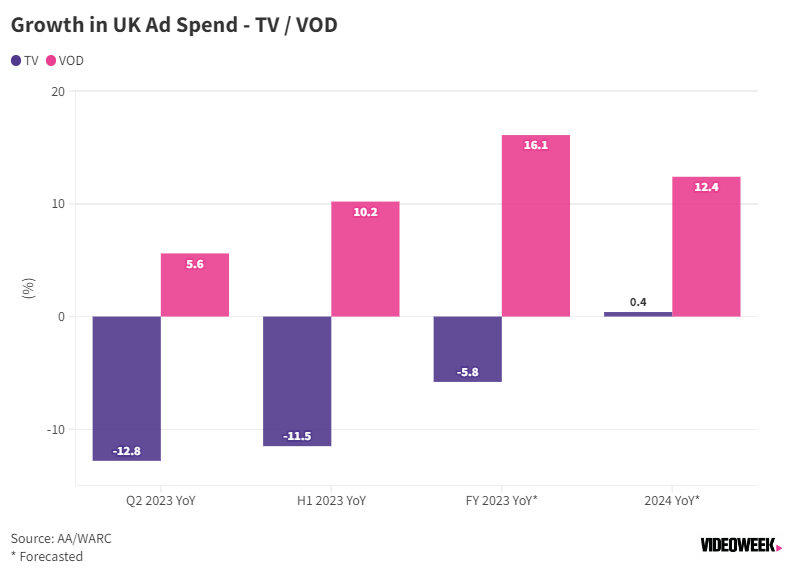

But TV was down by 12.8 percent YoY for the quarter and 11.5 percent for the six-month period, suggesting that advertisers are pulling back from the high-commitment channel amid tough economic conditions.

However, broadcaster video-on-demand (BVOD) spend was up, jumping 5.6 percent YoY during Q2 and 10.2 percent for H1. While this is not enough to offset the decline in linear TV spending, it points to continued investment in BVOD advertising, as UK viewers spend more time with broadcaster’s streaming services.

Bouncing back

Looking forward over the rest of the year, BVOD spend is expected to climb by 16.1 percent YoY in 2023, according to the AA/WARC’s full-year forecast. Search (5.6 percent) and online display (7.4 percent) are also expected to contribute to a 2.6 percent YoY bounce in total ad spend, projected to reach £35.6 billion in 2023.

At the same time, TV is on track for a 5.8 percent YoY decrease in 2023. The decline is softer than in the first six months, suggesting a stronger second half for TV spend, with the FIFA Women’s World Cup, the Rugby World Cup, and Big Brother drawing advertisers to ITV.

Growth is predicted to accelerate in 2024 as well, with total ad spend forecast to increase by 3.9 percent YoY. Again AA/WARC anticipate an uptick in search (5.2 percent) and online display (6.6 percent), while BVOD will continue its double-digit growth, rising 12.4 percent YoY in 2024.

And TV is expected to return to slight growth (0.4 percent YoY) in 2024. While the comparison is favourable next to a weak 2023 for the channel, increasing investment in TV reflects broader signs of economic recovery.

“The UK’s economy continues to skirt with recession as households make cutbacks in the face of stubbornly high inflation and unemployment slowly ticks upwards as activity in the private sector cools,” said James McDonald, Director of Data, Intelligence & Forecasting at WARC. “It is therefore encouraging that, amid this backdrop, the UK’s advertising industry was able to grow during the first six months of 2023, and that the market is on course to be 2.6 percent larger this year overall.”

“Looking ahead to 2024, we expect to see more channels experience growth again, as the ad market grows to £37 billion for the year,” added AA CEO Stephen Woodford. “As we anticipate the General Election next year, the Advertising Association will continue to demonstrate advertising’s contribution to a strong economy, not least that brands that continue to invest in advertising during a downturn are more likely to post better returns when emerging from tough conditions.”