Audience engagement with public service media (PSM) companies’ linear and broadcaster video on-demand (BVOD) services has fallen by 15 percent in Europe’s largest markets over the past six years, according to consumer research carried out by Ampere Analysis. Ampere’s report suggests that adoption of broadcaster-owned streaming services hasn’t been high enough to prevent an overall drop in engagement, highlighting the challenges faced by PSMs in holding onto their audiences.

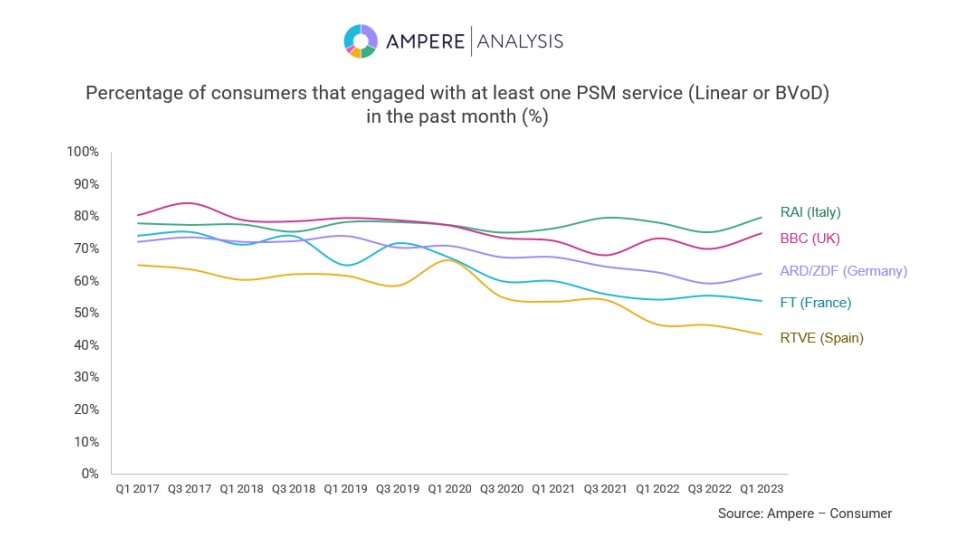

Ampere surveyed consumers across six years, cataloguing what percentage of each market’s population had engaged with at least one PSM service (i.e. either its linear channels or BVOD service) in the last month. The survey covered the BBC in the UK, ARD/ZDF in Germany, France Télévisions in France, RAI in Italy, and RTVE in Spain.

On average across broadcasters, engagement fell by 15 percent between the start of 2017 and the start of this year. But broadcasters’ individual fortunes have varied quite significantly.

For Italy’s RAI, while engagement has fluctuated over the past six year, engagement is currently slightly higher than at the start of 2017. This is likely due in part to strong uptake of its streaming service – Ampere says adoption of BVOD services is notably strong among consumers in the UK and Italy. The BBC meanwhile has seen a fall in engagement of around five percentage points, significantly below the average.

RTVE and France Télévisions on the other hand have both seen significantly larger falls, with RTVE’s engagement rate down by over 20 percentage points.

Shared problems, shared solutions

But while the extent to which audiences have migrated away from PSMs has varied, Ampere says the challenges facing these businesses – and the solutions to those challenges – are similar.

PSMs are by-and-large struggling to balance the need to serve their traditional audience bases while attracting new viewers, and addressing the needs and interests of minority groups (which they’re usually specifically required to do under their remits as public service media companies). At the same time, declining public TV revenues and government-led austerity measures are cutting PSM’s budgets.

Meanwhile they’re competing with digital platforms, many of which have much larger platforms, and which aren’t restricted by PSM obligations. Ampere says specifically that PSMs generally haven’t been able to invest in their own VOD services and programming to the extent they’d need to, in order to hold onto their audiences.

Neil Anderson, who co-authored the report, added that in this competitive environment, too much focus has been placed on audience share. “Success in the PSM sector has traditionally been measured solely by audience share, leading to decisions that prioritise programming based on TV ratings,” said Anderson, senior analyst at Ampere. “This narrow focus on ratings overlooks other crucial aspects that define the relevance and impact of PSM. These include its role in promoting cultural diversity and providing vital support to Europe’s TV production sector.”

Ampere says the solutions will generally be in the hands of policymakers. Short-term funding is one obvious solution. But guaranteed multi-year funding – which would give PSMs more certainty over their income over a longer period, would provide financial stability, enabling PSMs to invest more freely in content and their BVOD services.

Guaranteed prominence of CTV platforms (which is being discussed in multiple markets, including the UK) would help safeguard PSMs’ relevance for audiences. And increasing PSMs’ flexibility around partnerships – enabling and encouraging them to foster more ambitious strategic partnerships with both fellow PSMs and commercial businesses, would also help drive innovation and ensure sustainability.

As Ampere’s Neil Anderson suggested, PSMs’ struggles have wider implications for Europe’s TV market. The six broadcasters included in Ampere’s research account for 40 percent of TV shows ordered across their markets, equating to one third of all European original content spend. As such, a decline among the PSMs would likely have knock on effects for European TV production too.