Europe’s digital advertising market grew by 9.8 percent last year, according to data released today by IAB Europe, reaching an overall market value of €86 billion. And strong growth in digital video, and social video in particular, helped drive this growth.

But the data, released in IAB Europe’s annual AdEx Benchmark report, shows that this high growth was matched by high inflation across the continent. Adjusting for inflation, growth sat at 0.7 percent.

Nonetheless, IAB Europe says the overall picture is positive, noting that growth above tough comparables from 2021 shows a lot of resilience in the digital ad market, especially given poor wider macroeconomic conditions. And the trade group expects a positive picture for 2023 as well, expecting Europe to avoid a recession in its digital ad market.

Europe wide gains, but with real losses

IAB Europe’s market study covered 29 European markets, adding in Estonia, Latvia, and Lithuania since the previous report, and removing Russia and Belarus.

In its previous Benchmark report, IAB had forecasted 10.1 percent growth across these markets, while noting that its outlook was characterised by macroeconomic uncertainty. And this prediction played out fairly accurately, with growth of 9.8 percent.

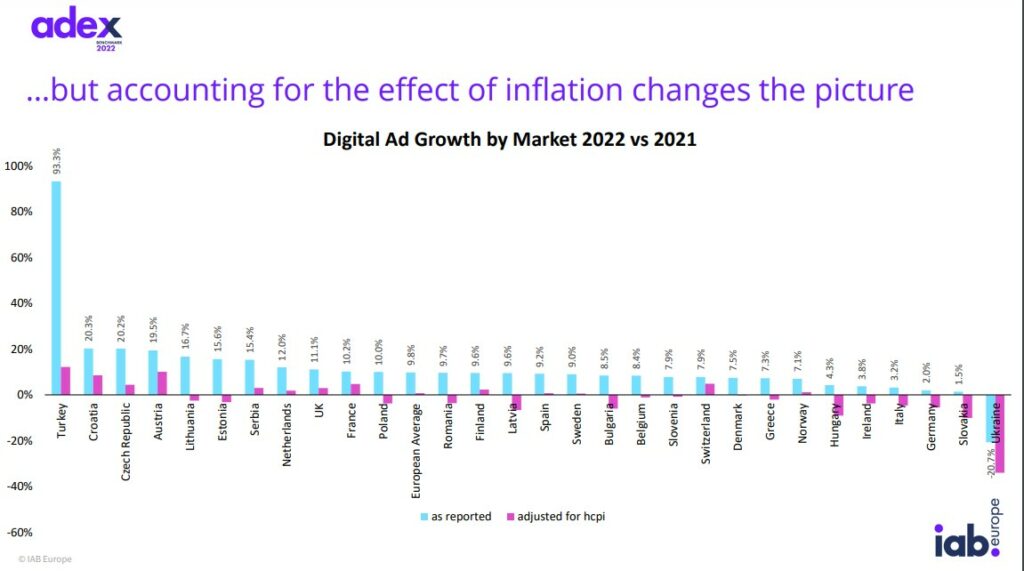

There was significant variation between markets. Turkey was an outlier, with 93.3 percent growth in its digital ad market, while Ukraine (for obvious reasons) stood at the other end of the scale, with a 20.7 percent decline. Other markets sat between 20.3 percent growth (Croatia) and 1.5 percent growth (Slovakia).

When accounting for inflation however, IAB Europe’s data paints a very different picture. Fifteen markets, including Germany, Italy, Ireland, and Poland, saw contractions in their digital ad markets in real terms. And the number of markets which saw real losses actually outnumbered those which saw real gains.

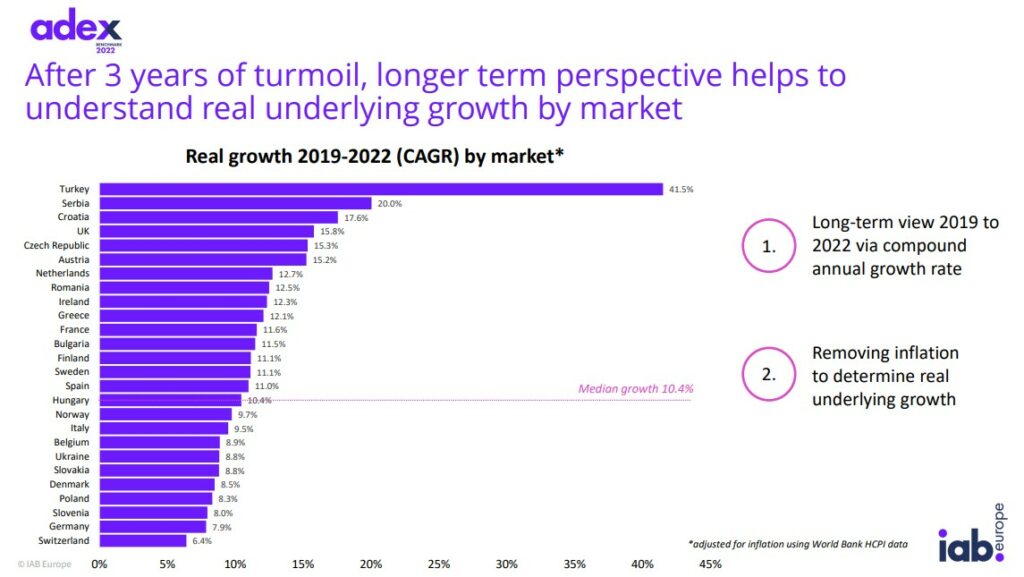

But IAB Europe pointed to longer term data to show that, despite three tumultuous years, real growth has been strong, with median real growth averaging out at 10.4 percent each year since 2019.

Social video and CTV on the rise

Looking at the growth of specific formats, the AdEx benchmark data showed the continued growth of video ad spend within the wider display category (IAB Europe classifies digital video as a subcategory of total display advertising).

Total display ad spend grew by 9.7 percent in 2022, behind search (up 10.7 percent) but above classified and directories (up 5.5 percent). But video grew even faster than search, up 13.6 percent year-on-year (compared to non-video display, which grew 7.0 percent). Video spend hit €18.4 billion overall, accounting for over 42 percent of all display spending.

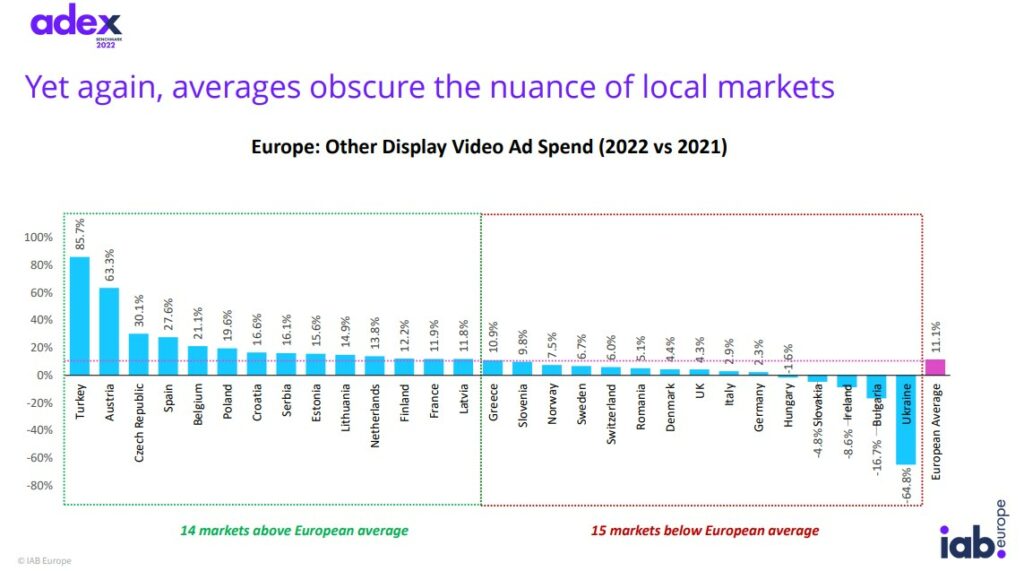

A lot of this growth in video came from social. Social video ad spend was up 15.5 percent year-on-year, reaching €10.8 billion. Non-social video ad spend meanwhile grew by 11.1 percent.

Again though, there was a lot of variation between markets. Four markets (Slovakia, Ireland, Bulgaria, and Ukraine) actually saw declines in non-social video ad spend. Meanwhile Turkey reported 85.7 percent growth, and Austria reported 63.3 percent growth.

The total impact of CTV’s growth is hard to pick out. Only six markets reported data on CTV – with growth across these markets averaging out at 46.6 percent. But even within the few markets which did submit CTV data, this data was not harmonised, meaning ad spend which was bundled into CTV in one of these markets may have been excluded in another.

A positive outlook

Looking ahead to full year growth across 2023, IAB Europe expects growth to be slower than 2022, but for Europe to avoid an advertising recession. The AdEx Benchmark forecasts 4.8 percent growth for 2023, with the total digital ad market reaching €90.1 billion.

And while this might not be reflected in some businesses’ experiences from the start of the year, the report acknowledges that overall ad demand was weak in Q1. This is expected to change however, with a gradual improvement expected over the rest of the year.