Video ad revenues reached $47.1 billion in 2022, according to newly released IAB data, as budgets shift away from search and towards digital video. Connected TV and retail media are also expected to grow this year, due to the scale and addressability offered by these media channels.

Conducted by PwC, ‘IAB Internet Advertising Revenue Report: Full Year 2022’ revealed that advertising revenue slowed last year, as macroeconomic pressures impacted marketing spend. Nevertheless, online revenues still delivered double-digit growth, driven by diversification in ad spend.

“Advertisers are diversifying their spending to target audiences using fewer identifiable data points,” said Jack Koch, SVP Research and Insights, IAB. “Digital video, digital audio, and the long tail of publishers are benefiting.”

As a result, internet advertising revenues grew 10.8 percent YoY to hit $209.7 billion. The sharpest growth occurred in the first half of the year, rising 21.1 percent YoY in Q1, followed by 11.8 percent in Q2. Revenues slowed in Q3 and Q4 at 8.4 percent then 4.4 percent, as recessionary fears loomed over advertising budgets.

Diversification and democratisation

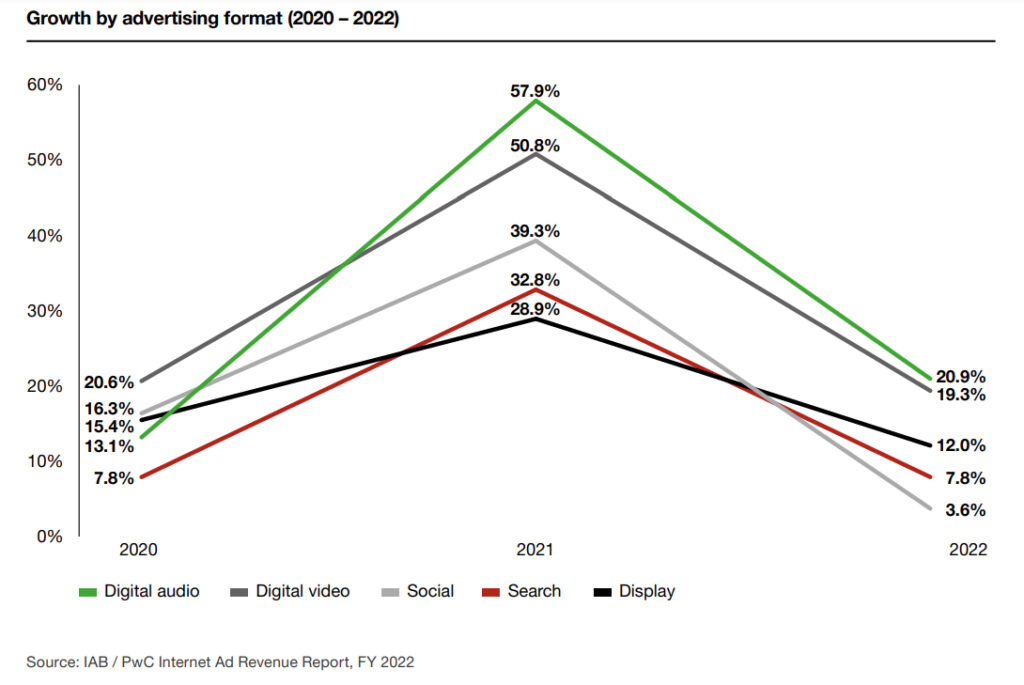

The diversification into digital video, digital audio and programmatic delivered growth against this harsh economic backdrop. Those revenues migrated from search, which grew 7.8 percent YoY but lost overall market share to digital video and display.

The market share of the top 10 companies also fell, according to the data, their share of ad revenues decreasing for the first time since 2016. This indicates the “growing democratisation of advertising revenue across the mid-tier and long-tail publishers,” said the IAB. That fragmentation drove a 10.5 percent YoY increase in programmatic revenues, reaching a total $109.4 billion.

At the same time, social media revenue growth has slowed. While H1 2022 saw social media grow by $1.8 billion YoY, this slowed to $0.3 billion in H2. IAB pointed to the implementation of Apple’s App Tracking Transparency (ATT), which social media firms Meta and Snap also blamed for stagnating ad revenues last year.

That said, mobile ad revenues were up 14.1 percent YoY, reaching a record high of $154.1 billion. IAB forecast further growth in 2023, as digital audio, 5G and VR/AR continue to enhance the capabilities of mobile advertising.

Privacy and premium

The report also warned that advertisers will have to adapt for the legislative challenges facing the industry. “Privacy and regulation will change advertising,” said the IAB. But this need not be cause for concern, as adapting to privacy demands from consumers and regulators will drive the next phase of digital advertising. “This adaptation has become a catalyst for innovation in the industry,” noted the IAB, “leading to the development of novel solutions that balance data-driven advertising with user privacy.”

Part of this trend is the continued shift towards first-party data, hence the rise of CTV and retail media networks; channels that provide advertisers with sophisticated targeting at scale. In addition, the convergence of these channels will shape effective forms of advertising, including shoppable ads, affiliate marketing and direct-to-consumer advertising.

Meanwhile the fragmentation and democratisation of content is forcing marketers to rethink the meaning of “premium content”, as influencers and independent creators amass younger audiences. “While ‘premium’ content once meant ‘Hollywood production’ value, it now more than ever is in the eyes of the beholder,” said the report. “Viewer attention is shifting to content that can match specific interests – regardless of the production value, format, or screen – and creator content is now viewed as premium by many.”

“2023 promises to be a challenging year,” added IAB CEO David Cohen. “But this industry, more than most, is galvanised by change. The job now is identifying where the areas of growth are going to be, follow the consumer and develop solutions that meet and exceed their needs.”