In this week’s Week in Review: WPP leans into AI, Equativ secures new investment, and WBD posts a significant loss.

Top Stories

AI is Already Helping Win Pitches says WPP’s Mark Read

Amid strong industry interest in the potential for AI chatbots like ChatGPT to have a major impact on the ad industry, WPP’s CEO Mark Read says his company’s investment in AI is already helping it to win pitches with clients.

Read told The Guardian that AI is “fundamental to WPP’s business in the future”, adding that WPP has been investing in AI for “a number of years,” and that “it has helped us win new business”. This stands in contrast to comments made by former WPP boss Sir Martin Sorrell, who said at a Campaign event that AI is “a danger signal for holding groups”.

AI was also mentioned on WPP’s earnings call this week as it announced strong Q4 results, and a positive outlook for 2023. Like-for-like revenue minus passthrough costs were up 6.4 percent in Q4, with further growth between 3-5 percent expected for the year ahead. Read said that brands need to exploit the potential of AI would be one factor helping drive WPP’s own growth this year.

Equativ Valued at €350 Million after Bridgepoint Investment

Private equity firm Bridgepoint has taken a majority stake in Equativ, valuing the French ad tech company at €350 million. Equative says the deal will help fund acquisitions and grow its presence in the US, as part of its ambitions to become one of the world’s top three supply-side platforms.

Equativ says it has seen strong growth since debuting its fresh brand last year. The company was founded as Smart AdServer, but grew out its offering over time via its acquisitions of LiquidM and DynAdmic, as well as its investment in Nowtilus. The company booked €92 million in revenues last year, which Equativ said was driven by acquisitions and SSP demand.

“This new chapter with Bridgepoint validates our strategy and positioning and will help to provide additional resources to accelerate our investments and achieve our ambitions,” said Equativ CEO Arnaud Créput.

WBD Loses $2 Billion, Adds 1 Million HBO Max Subs

Warner Bros. Discovery (WBD) posted a $2.1 billion loss in Q4 2022. Despite adding 1.1 million HBO Max subscribers for a total 96.1 million, HBO Max and Discovery+ have yet to turn a profit. The streaming unit reported an operating loss of $217 million in the quarter, though its $2.45 billion revenues beat Wall Street forecasts of $2.39 billion. The company is seeking to deliver $4 billion in savings through 2024. WBD shares fell 1.5 percent following the results.

WBD is looking to “take full advantage” of its franchise properties, announcing new Lord of the Rings films and praising the success of video game Hogwarts Legacy. “I believe that we have an overwhelming advantage in the marketplace with the IP that we own,” said CEO David Zaslav. “To get that advantage, we have to create great content.” He added that the company’s post-merger restructuring is complete, after months of layoffs and project cancellations.

The Week in Tech

Magnite CEO Hails “The Death of the Undifferentiated SSP”

Magnite posted nine percent year-on-year revenue growth in Q4, with revenues reaching $175.4 million for the quarter. The company said that its CTV business continued to drive top line growth with revenue ex-TAC growth of 20 percent year over year.

Meanwhile CEO Michael Barrett said on the earnings call that despite the current upheaval in the SSP market, he believes Magnite is well placed to succeed. “Some industry pundits have concluded that this might be the beginning of the end for the SSP industry,” he Barrett said on the company’s earnings call. “We couldn’t disagree more. What we’re seeing now isn’t the beginning of the end of the SSP, but the death of the undifferentiated SSP. For years, the market has borne the weight of a raft of SSPs with little innovative technology and little more to offer than recirculated DSP demand.”

Criteo Cuts 8 Percent of Staff

French ad tech firm Criteo has cut up to 8 percent of staff, Digiday reported on Tuesday, with the Central London office also set to close down. Anonymous sources suggested Criteo is paving the way for a potential sale. Digiday describes Shopify and The Trade Desk as likely buyers of the $2 billion company.

Skyrise Intelligence and Regital Merge to Form Skyrise

Audience data firm Skyrise Intelligence completed its merger with programmatic marketing specialist Regital. Now known simply as Skyrise, the combined entity will provide advertisers with measurable data insights in a privacy-first environment, the company said. “The ‘Skyrise’ effect offers advertisers and agencies a real-world alternative to buying, planning and measuring media, powered by unrivalled data and insight,” added Skyrise MD Paul Barnard.

Moloco Creates Streaming Media Ad Server

Ad tech firm Moloco has created a new platform to serve streaming media and OTT providers, Axios has reported. The new ad server is said to expand Moloco’s revenue opportunities, while helping streaming media companies grow their business, with customers including On Demand Korea, TimeTree and Tumblr. “You still need to serve a brand advertiser, but you now need to have technology to provide value to a performance advertiser,” said Moloco CEO Ikkjin Ahn. “That needs a lot of data analysis and machine learning. That’s what we are.”

Microsoft Tests Ads in AI-Powered Bing Results

Microsoft has held talks with ad agencies over plans to insert ads into its Bing AI search results, according to Reuters. The tech company is reportedly testing ads in its early version of the Bing chatbot, by inserting traditional search ads into the AI results. Microsoft is also planning an ad format geared towards specific industries, the report suggests, enabling advertisers to serve hotel ads to a user asking the chatbot to find hotels, for example.

The Fresh Market and Firework Introduce Video-Driven RMN

Food retailer The Fresh Market and video commerce company Firework have launched a video-driven retail media network (RMN). Brands can run video ads on the live shoppable stream, for instance alongside recipe tutorials. “This newly expanded partnership is a game-changer, not only for The Fresh Market, but also for the entire retail media network landscape,” said Renee Caceres, VP of US Retail Media at Firework.

Meta Plans Further Job Cuts

Meta is also planning more job cuts, the Washington Post reported this week. Last year the Facebook owner cut 13 percent of its workforce, before CEO Mark Zuckerberg reassured staff that he didn’t “anticipate more layoffs”. Now the tech giant seemingly wants to “deflate the company’s hierarchy,” according to the Post, in a downsizing effort that could affect thousands of workers.

The Week in TV

Netflix Drops Prices in 100 Markets

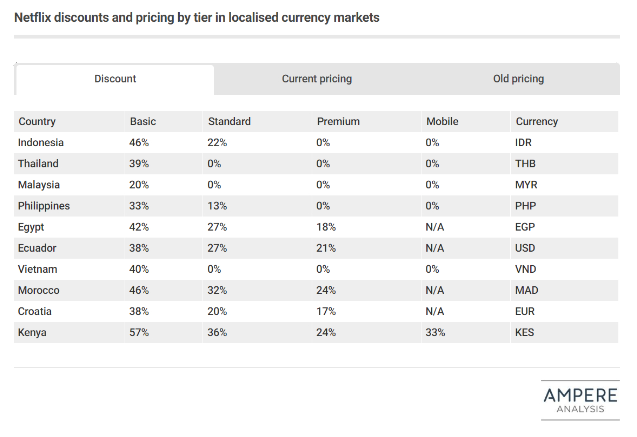

Netflix is dropping its prices in more than 100 territories, Ampere Analysis revealed on Wednesday, affecting over 10 million customers or 4 percent of the company’s user base. Effectively immediately, subscription fees will drop by 20-60 percent in parts of Central and South America, Sub-Saharan Africa, the Middle East and North Africa, Central and Eastern Europe and the Asia Pacific regions. Aligned with Netflix’s password sharing crackdown, the price drops could be intended to “cancel out the extra cost to subscribers currently sharing accounts,” said Ampere Analyst Toby Holleran.

DAZN Eyes Premier League Rights

DAZN is planning a bid for the Premier League rights, CEO Shay Segev has told The Times. The rights would give the sports streaming company a long-sought foothold in the UK market, though Segev noted that “the maths needs to work” to make a costly bid worthwhile. “The question is the economic situation, the competition and whether we will be in a position to be strong enough to position ourselves as the best,” said Shegev. “I am very, very confident that in the mid to long-term we can be a big player in the UK. Whether this takes two years, five years, seven years, time will tell.” The rights are currently shared by Sky Sports, BT Sport and Amazon Prime Video, with the £4.8 billion deal set to expire in 2025.

PPF Becomes Second-Largest Investor in ProSiebensat.1

Czech investment group PPF has taken a 9.1 percent stake in ProSiebensat.1, making it the second-largest investor in ProSieben behind MediaForEurope. MFE holds a 29.9 percent stake in the German broadcaster, and ruled out a full merger or takeover earlier this month. “PPF believes the digital transformation of ProSieben will create value for all shareholders,” PPF said in a statement. “PPF is looking forward to liaising with the management and supervisory board of ProSieben in this digitalisation process.”

Viaplay Arrives in the US

Viaplay landed in the US on Wednesday, making the Nordic SVOD service available in a total 12 markets. The streaming service will also launch in Canada on 7th March, as the company aims to build a presence in 16 countries by the end of 2023. “As the global leader in original Nordic content, we’re excited for US audiences to have access to more new series and films from the Nordic region than ever before, and at just $5.99 with thousands of hours of high quality, exclusive programming, Viaplay offers subscribers an incredible value for their streaming dollars,” said Vanda Rapti, Viaplay Group CCO, North America & Viaplay Select.

BT Sport to Become TNT Sports in WBD Joint Venture

BT Sport will rebrand as TNT Sports in July 2023 under its new joint venture (JV) with Warner Bros. Discovery (WBD). Eurosport will initially remain available in the UK and Ireland, before being rolled into the new brand in future. WBD will also add TNT Sports to its Discovery+ streaming service. “While WBD is excited to contribute its global scale and capabilities, together with its growing portfolio of premium entertainment, we are also determined to ensure we don’t compromise on the inimitable, local style that is at the heart of the way BT Sport has connected with fans over the past decade,” said Andrew Georgiou, JV board member and WBD Sports Europe president and MD. “Remaining authentically local will remain key to our success.”

Ofcom Launches HFSS Advertising Consultation

Ofcom has opened a consultation on advertising restrictions for products high in fat, salt or sugar (HFSS), following the passage of the Health and Care Act 2022. The legislation prohibits pre-watershed HFSS ads on TV and on-demand program services (ODPS), or at any time online, under Ofcom’s new responsibilities. The new rules take effect on 1st October 2025. The regulator is seeking stakeholders’ views before 21st April 2023.

Amazon Renews Champions League Rights in Italy

Amazon Prime Video has seen off competition from Sky Italy and held onto the UEFA Champions League rights in Italy. The deal extends Amazon’s agreement for three more seasons, covering 2024/25 to 2026/27. “Millions of Prime members in Italy have enjoyed our coverage and we couldn’t be happier with how they have responded,” said Alex Green, MD Amazon Prime Video Sport Europe. “This is the most prestigious competition in European club football and we will continue to invest and innovate to provide the highest quality experience for our customers.”

The Week for Publishers

UK Publishers Increase Investment in Ozone

UK publisher alliance Ozone has announced that its shareholders – News UK, Reach, Guardian News & Media and Telegraph Media Group, have provided a new wave of funding for the venture after a strong year. Ozone’s ad revenues were up 61 percent in 2022, spurred by a mix of new ad formats and publisher partnerships. “The investment enables us to build on the exceptional performance we’ve seen in the past 12 months, and focus on delivering better service, products and tools to our advertiser and publisher partners,” said Damon Reeve, Ozone’s CEO.

Google Tests News Blocking in Canada

Google has begun running tests preventing some users from seeing news content in search results, in response to proposed legislation which would force online platforms to negotiate with publishers in order to share their content. The tests follow Facebook’s warning last year that it may similarly block news content on its news platforms in Canada.

Gannett’s Digital Ad Revenues Fell 20 Percent in Q4

US publishing group Gannett, which has reported huge financial struggles as a result of the difficult economic, reported another tough quarter for Q4 last year. Digital advertising revenues were down by 20.5 percent year-on-year, with total revenues down by seven percent. Gannett did however report continued growing subscriptions, with digital subscription revenues up 28.6 percent year-on-year.

The Sun Enters Top 20 US News Sites

The US edition of The Sun newspaper has become one of the top twenty most visited news sites in America, Press Gazette reported this week. The US version of The Sun, which launched in 2020, had 62.7 million visits in January, representing 40 percent growth year-on-year. This placed it ahead of Reuters, HuffPost, BuzzFeed, and CBS.

Reach Experiments with AI-Produced Content

Reach Plc, owner of local UK news titles and the Daily Mirror and Daily Star, has formed a working group to explore the extent to which AI chatbot ChatGPT could be used in its news reporting. CEO Jim Mullen told the Financial Times that the publisher “can see potential to use it in the future to support our journalists for more routine stories like local traffic and weather or to find creative uses for it, outside of our traditional content areas”.

UK Consumer Magazine Circulation Fell in 2022

Combined print and digital circulation for UK magazine brands fell in 2022, according to data from media industry auditor ABC. Combined average circulation sat at 24 million in 2022, down from 26.8 million in 2021.

Ozy Media Founder Arrested for Fraud

Carlos Watson, founder of controversial media startup Ozy Media, has been arrested over allegations of defrauding investors of millions of dollars. Watson has been accused of using a range of tactics to deceive investors about the state of the company, including impersonating a YouTube executive, and falsely claiming that Ozzy and Sharon Osbourne had invested in the business.

The Week For Agencies

Brands’ In-Housing Expectations Don’t Match Reality, finds ISBA Report

While brands are keen to bring more advertising work in-house, those which do are finding that the reality of in-housing doesn’t match their expectations, according to a new report released by advertiser trade group ISBA. For example, 93 percent expected more speed and nimbleness in their advertising as a result of in-housing, whereas only 40 percent said they actually experienced this. The same proportion expected increased cost-effectiveness from in-housing, which only 60 percent found to be the reality.

Dentsu Launches Retail Media Unit ‘Dentsu Shop’

Agency group Dentsu has announced the launch of Dentsu Shop, which it describes as a fully integrated retail accelerator developed to help both retailers and brands. Dentsu Shop will draw on Dentsu’s existing commerce capabilities across CMX, media, and creative to help retailers monetise first-party data and create retail experiences.

IPG Mediabrands Wins Geico Media Duties

Interpublic Group media network IPG Mediabrands has won insurance company Geico’s media account, worth around $1.4 billion according to Adweek. The account had previously been handled by independent agency Horizon Media for nearly thirty years.

Wavemaker Wins $50 Million Global Brand Media Business for Back Market

Renewed tech marketplace Back Market has appointed GroupM media agency Wavemaker to handle global brand media duties, following a competitive pitch process. Wavemaker will help grow its brand across existing European markets, with a particular focus on France, and will also support Back Market’s expansion into the US.

Saatchi & Saatchi adds ITV to Schools Platform ‘Upriser’

Broadcaster ITV has joined Saatchi & Saatchi as a founding partner of ‘Upriser’, a free creative schools platform designed to provide more education around creativity, and to encourage more students to explore pathways into creative careers. Through Upriser, creative businesses like ITV are partnered with local schools, and then work with Saatchi & Saatchi to set up and deliver creative programmes to those schools.

UK Government Launches Promotional Campaign for UK Ad Industry at SXSW

The Department for Business and Trade and UK Advertising Exports Group have paired up to launch a new campaign which will promote the UK’s advertising industry at the SXSW exhibition in Austin next month. The campaign is a first for UK advertising, targeting North America, and features the work of several UKAEG members to “showcase the UK’s global leadership in embracing technology and changing the way brands connect with audiences,” according to the Advertising Association.

Hires of the Week

EssenceMediacom Taps Zenith CSO Richard Kirk

GroupM agency EssenceMediacom has named Richard Kirk its new CSO. He joins from Zenith UK where he has held the position since 2019. Kirk will lead EssenceMediacom strategy alongside Geoff De Burca.

Havas UK Promotes COO and CTO

Havas Media Group UK has promoted Simon Bevan to COO and Lizzie Nolan CTO. Bevan previously served as Chief Investment Officer, while Nolan was EVP Managing Director Strategy & Insights.

Future Enlists Former Buzzfeed President as CEO

Publishing company Future has appointed Jon Steinberg as CEO. He replaces Zillah Byng-Thorne after almost nine years in the role. Steinberg spent four years as President and then COO of Buzzfeed, before North American CEO for Mail Online.

Boots CMO to Chair Advertising Agency’s Front Foot Network

Boots UK CMO Pete Markey will chair the Advertising Agency’s Front Foot network, which represents advertisers, media owners, agencies and tech companies for the UK advertising industry. He takes over from Direct Line marketing exec Mark Evans.

This Week on VideoWeek

YouTube says Multi-Format Content is Key for Winning Audiences at Awards Shows, read on VideoWeek

Barb to Measure Video-Sharing Platforms in Push for Brand-Safe Content, read on VideoWeek

Walmart Earnings Spell Gloom for 2023 but Growth for Retail Media, read on VideoWeek

Half of Population Barely Reached by Linear TV Ads in Samba TV Report, read on VideoWeek

Introducing the Sustainability in Advertising Guide 2023, read on VideoWeek

Ad of the Week

SeLoger, The Seagulls