In this week’s Week in Review: A busy week in earnings seasons shows the first signs of a slowdown in TV ad revenues, the WFA says the industry may be facing its worst ever talent crisis, and contextual tech company Seedtag raises $250 million.

Top Stories

Broadcaster Earnings Show TV Ad Revenues Starting to Slow

Financial results from Snap and Twitter last week showed that global macroeconomic conditions are starting to hurt digital ad revenues (further verified by Facebook’s first ever revenue drop this week). And a flurry of Q2 results from broadcasters this week showed there are initial signs of a slowdown in TV ad revenues too.

British broadcaster ITV posted five percent growth in ad revenue for the first half of the year, but said it expects ad revenue to be broadly flat for the first nine months, suggesting it expects a year-on-year drop in Q3. American broadcast network NBCUniversal posted a one percent drop in ad revenues for the quarter, as did TF1. Streaming hardware manufacturer Roku also reported a “significant slowdown” in TV ad spend during the quarter.

The drops aren’t necessarily as bad as they first seem. Both ITV and TF1 highlighted unfavourable comparisons to last year’s men’s European football championships, while NBCU said ad revenue is up year-on-year when ignoring last year’s NHL playoffs, which it held the rights to.

ITV is also looking ahead to its revamped streaming offering ITVX, saying it expects the service to perform well in the context of rising living costs. It was bad news for NBCU’s streaming offering however, with Peacock’s paid subscription count stalled at 13 million.

Ad Industry Facing “Worst Ever Talent Crisis”

The advertising and marketing industries are potentially facing their “worst ever talent crisis” according to new research from the World Federation of Advertisers (WFA) and MediaSense.

Fifty-four percent of agencies say the industry is facing its worst ever talent crisis, while 48 percent of those surveyed overall (including agencies, advertisers, ad tech companies and media owners) share that sentiment. And 67 percent of those surveyed say that talent shortages are proving to be a major blocker to growth.

Major areas of talent shortage identified by the research were in data and analytics, eCommerce/retail media, and measurement. Poor training, talent management, poor client agency behaviour, and over-specialisation and recruitment by tech companies were all listed as significant causes for the talent crisis.

Seedtag Secures €250 Million in Private Equity Funding

Ad tech company Seedtag announced it has raised over €250 million in funding from private equity investor Advent International. It aims to use the funds to scale its contextual AI technology “LIZ”, advance its expansion in the US and provide capital for further M&A activity.

The investment follows a period of growth for the Madrid-based firm, whose cookie-less solutions make for an appealing proposition in the lead-up to the deprecation of third-party cookies in Chrome. Founded by former Google strategists, Seedtag recently acquired French AI specialist KMTX (previously Keymantics) and secured earlier funding from Oakley Capital, which remains a core investor alongside Adara and All Iron Ventures.

“This investment will massively accelerate our US expansion, boost our growth and reinforce our team and the development of our technology,” said Seedtag Co-CEOs Jorge Poyatos and Albert Nieto. “This move further supports our mission of building the global leading platform for contextual advertising, offering an effective solution for cookie-less advertising on the open web.”

The Week in Tech

Tremor International Agrees to Acquire Amobee for $239 Million

Video and CTV ad tech business Tremor International has agreed a deal to acquire demand-side platform Amobee from Singapore-based telco SingTel for $239 million. The acquisition, which will further strengthen Tremor’s CTV credentials, is Tremor’s third major acquisition in as many years, following its buyouts of Unruly in 2020 and Spearad last year. Read more on VideoWeek.

Meta Posts First Drop in Revenues

Meta recorded its first revenue fall in Facebook’s history, reaching $28.8 billion in Q2 2022 – down from $29 billion the previous year. Meta blamed “weak advertising demand” and the impact of Apple’s privacy changes, warning of persistent downturn in the second half of the year. Commenting on the company’s video push across Instagram and Facebook, CEO Mark Zuckerberg admitted: “Reels doesn’t yet monetise at the same rate as Feed or Stories.” Criticism of the TikTok-inspired redesign prompted Instagram CEO Adam Mosseri to admit the changes are “not yet good,” warning that “more and more of Instagram is going to become video over time.”

👋🏼 There’s a lot happening on Instagram right now.

I wanted to address a few things we’re working on to make Instagram a better experience.

Please let me know what you think 👇🏼 pic.twitter.com/x1If5qrCyS

— Adam Mosseri (@mosseri) July 26, 2022

Google Introduces New Tool to Expose Hidden Ad Tech Fees

Google has this week announced ‘Confirming Gross Revenues’, a new tool created within Google Ad Manager which the tech giant says will help expose hidden ad tech fees, and give buyers confidence that their media spend is reaching publishers. Through the new tool publishers will have access to a new ‘Revenue Verification Report’, which will use data from supply-side platform partners to show the aggregate gross revenue the publisher has received from the buyer. The buyer and seller can then confirm between themselves that the total media costs from the buyer’s reports match the publisher’s revenue attributed to that buyer (once known fees are taken into account). Read more on VideoWeek.

INCRMNTAL Closes $4.1 Million Seed Round

Incrementality measurement platform INCRMNTAL closed a $4.1 million seed round on Monday, bringing its total funding to $5.5 million. The round was led by Play Ventures VC with participation from Heracles Capital. The company uses AI to measure the impact of its clients’ marketing campaigns. INCRMNTAL now plans to double its engineering team of 11, create sales and marketing departments, and launch a self-service integration by the end of the year.

Showheroes and Skyrise Announce UK Partnership

Video production and solutions provider ShowHeroes Group has partnered with Skyrise, a mobile data intelligence company that extracts geolocation insights from over 20 million UK mobile users. This multi-channel, privacy-friendly data will be activated across ShowHeroes’ online video and CTV campaigns, allowing the company to build detailed user profiles based on demographics, interests and brand engagement.

Google Drives Alphabet Revenue Growth

Alphabet fared better than other tech companies in their Q2 earnings, with Google search ads exceeding Wall Street expectations. Repeatedly referencing “uncertain” economic conditions, Alphabet reported Q2 revenue of $69.69 billion – 81 percent of which came from Google’s ad business. Despite narrowly missing estimates of $69.88 billion, the company’s shares jumped 5.5 percent following the results. “Google is relatively well positioned to weather the rough waters that lie ahead,” said Insider Intelligence analyst Evelyn Mitchell.

Spotify Grows Ad Revenues and Subscriptions

The other big winner this earnings round was Spotify, exceeding revenue targets the audio streamer set in Q1 2022. In Q2 its monthly active users grew by 19 percent year over year, premium subscriptions by 14 percent and premium revenue by 22 percent to hit $2.5 billion. Ad-supported revenue reached $360 million, accounting for almost 13 percent of the company’s $2.9 billion total revenue. “We are currently not seeing any material impact on our expectations for users or subs growth from the economic downturn,” said Spotify CEO Daniel Ek. He added that the company has reduced hiring by 25 percent, arguing that “only the paranoid survive.”

The Week in TV

TF1/M6 Merger Threatened by Advertising Competition Concerns

The French competition authority has expressed concerns over the proposed merger between broadcasters TF1 and M6, it was revealed on Wednesday. In a joint statement, TF1 and its largest shareholder Bouygues said l’Autorité de la concurrence has issued the report from its enquiry launched in March. Although the report does not necessarily predict the board’s final decision, it raises “a number of significant competition concerns (especially in relation to the advertising market)”, according to TF1. The group added that the watchdog’s proposed alterations would render the deal futile for the French broadcasters to pursue. Read more on VideoWeek.

Viaplay Subscriptions Drive Revenue Growth

Viaplay added 766,000 paying subscribers in Q2 2022, marking a 69 percent increase on Q2 2021. Viaplay Group recorded 18 percent organic revenue growth year over year, driven by Viaplay (42 percent of sales), linear subscription and other revenues (31 percent of sales), and advertising revenues (27 percent of sales), which rose five percent year over year. The Nordic streamer also raised its year-end subscriber target from 7 million to 7.3 million.

French MPs Vote to Scrap Licence Fee

French MPs voted to scrap the TV licence fee on Saturday, replacing the €138 levy with plans to finance public broadcasting through VAT. The 170-57 vote fell along ideological lines, with Les Républicains and Rassemblement National voting in favour and the Nupes alliance against. Public accounts minister Gabriel Attal called any fee based on the ownership of a TV set “obsolete,” while La France Insoumise MP Alexis Corbière argued “the independence of public broadcasting is a condition of democracy.”

NFL Launches Streaming Service

The National Football League (NFL) launched its own streaming platform on Monday. NFL+ is a paid subscription service exclusive to mobile devices, enabling the NFL to maintain local blackout policies designed to promote attendance. The league is also withdrawing the NFL Game Pass, which “offered many of the same features that the basic NFL+ tier now does,” according to The Streamable, including pre-season games, live game audio and NFL Films archival material.

TalkTV Struggles for Viewers

TalkTV is struggling for ratings, Press Gazette reported on Monday, falling behind BBC News, Sky News and even GB News. BARB data shows the Rupert Murdoch-owned channel reaches three percent of the UK TV viewing population per month for an average visit length of eight seconds – “less than a quarter of the average 35 seconds audiences spent watching GB News,” according to Press Gazette. The report notes that TalkTV’s social media reach is growing, and News UK CEO Rebekah Brooks has suggested the channel leans more heavily on online video. “We must report our stories in the way that audiences want to consume them,” she told staff in an email.

Amazon Ups Prime Subscription Fees

Amazon has announced an increase in Prime subscription fees across Europe. The price hike comes into effect on 15th September and will vary across the continent, from a 20 percent rise in the UK to 43 percent in France. Amazon attributed the move to “increased inflation and operating costs,” as well as upping its content investments. Earlier this month the company agreed to pay £1.5 billion for UEFA Champions League rights, while the platform’s upcoming Lord of the Rings series became the most expensive TV show ever made at $465 million.

Judge Throws Out Apple Suit Against Chicago ‘Netflix Tax’

A Chicago judge has dismissed a case brought by Apple against the City over its ‘Netflix tax’ – a 9 percent surcharge on streaming subscriptions designed to compensate physical retailers for revenues lost to ecommerce. Apple, Sony, the Entertainment Software Association (ESA), and a group representing Netflix, Hulu and Spotify all launched their own lawsuits. Cook County Circuit Court Judge Daniel Duffy threw out the Apple case and the tech giant has not refiled its complaint. But as noted by Digital TV Europe: “Any other city in the US that seeks to implement a similar levy would likely face similar backlash from streaming operators.”

FuboTV Integrates Political Data for CTV Campaigns

Sport-centric streaming service fuboTV announced on Tuesday new integrations with data providers to offer addressable segments for political advertisers. By partnering with i360, L2 and TargetSmart, fuboTV can integrate audience data that represents Republicans, moderates and Democrats respectively. The move forms part of a push by political advertisers into CTV, which “offers the ability to target unique audiences in smaller districts” than linear TV, said i360 VP of Media Mark Positano. “There was a tremendous amount of waste due to lack of targeting.”

TF1 Scores French National Football Rights

TF1 has secured the rights to all the French national team’s matches until 2028, including the UEFA Nations League, UEFA Euro 2024 qualifiers, the FIFA 2026 World Cup qualifiers and UEFA Euro 2028 qualifiers. The deal also includes exclusive free-to-air rights to 25 UEFA Euro 2028 matches. TF1’s partnership with the French Football Federation additionally grants the broadcaster access to behind-the-scenes footage of the French team for the production of series and documentaries. “The TF1 Group is the home of Les Bleus!” said TF1 CEO Gilles Pélisson.

DAZN Wins Triathlon Rights

DAZN has won non-exclusive rights to Professional Triathletes Organisation (PTO) broadcasts over the next two years. The platform will stream live PTO coverage and highlights in Canada, Japan, South Africa, APAC, Australia, New Zealand and MENA. PTO also launched its own streaming service earlier this month in partnership with Endeavour Streaming. It will operate outside of Europe and the Indian Subcontinent, where Warner Bros. Discovery holds PTO rights.

The Week for Publishers

Reach Profits Drop as Revenue Nears Standstill

UK news publisher reach saw year-on-year revenue growth fall from 10.4 percent in Q1 to just 0.3 percent in Q2, leading to a 31.5 percent fall in operating profit. The news publisher blames the impact of energy prices on the cost of printing physical newspapers, as well as weakened ad demand, for the slow growth.

YouTube Reports Slowest Growth Rate in Two Years

YouTube earnings slowed to their lowest pace in more than two years, reporting Q2 ad revenue growth of 4.8 percent – shy of the 7 percent forecast by Wall Street analysts. By way of contrast, YouTube’s ad business grew by 84 percent in the same period last year. Alphabet CFO Ruth Porat said: “In YouTube and Network, the pullbacks in spend by some advertisers in the second quarter reflects uncertainty about a number of factors that are challenging to disaggregate.”

Twitter Sees Revenue Drop as Economy and Musk Drama Hurt Ad Sales

Twitter’s revenues in Q2 were down by one percent year-on-year, short of analyst expectations, though growth was three percent when excluding revenues from MoPub, which the company offloaded at the end of last year. Twitter executives cited advertising headwinds relating to macroeconomic conditions, as well as uncertainty caused by Elon Musk’s potential takeover of the company, for the disappointing results.

Metro and The Independent See Strong Audience Growth in June

The Metro and The Independent saw the strongest growth in digital audiences out of the UK’s largest news brands, according to IPSOS data analysed by Press Gazette. Both titles saw seven percent month-on-month growth in their overall reach, while Mail Online saw a four percent drop, the sharpest fall out of the ten biggest news brands.

ATTN: Launches In-House Agency

Social publisher ATTN: has launched a new in-house creative agency, which will create campaigns for clients across a range of channels including social, TV, and outdoor. The new agency has 60 staff according to Adweek, and ATTN: anticipates that it will account for 25 percent of the company’s overall revenues by the end of the year.

News Article Theft is on the Rise

NLA Media Access, a content licensing business, more than doubled the number of stolen articles it had removed from illegitimate news sites in 2021, compared with 2020. The company took down over 50,000 articles which were illegally copied from other news sites, compared with around 20,000 in 2020.

Reach Opens Up AI Recommendation Tool to Other Publishers

UK publishing group Reach has begun making its AI optimisation and prediction engine, ‘Neptune Recommender’, commercially available to other publishers following its own success with the product. Neptune Recommender analyses user behaviour to serve up personalised recommendations, and has accounted for 40 percent of Reach’s pageview growth this year, according to WNIP.

G/O Media Announced Multiyear Partnership with MGID

Digital media brand G/O Media has signed a new partnership with ad platform, which will see G/O Media use MGID’s multi-format premium demand and brand-safety solutions.

The Week For Agencies

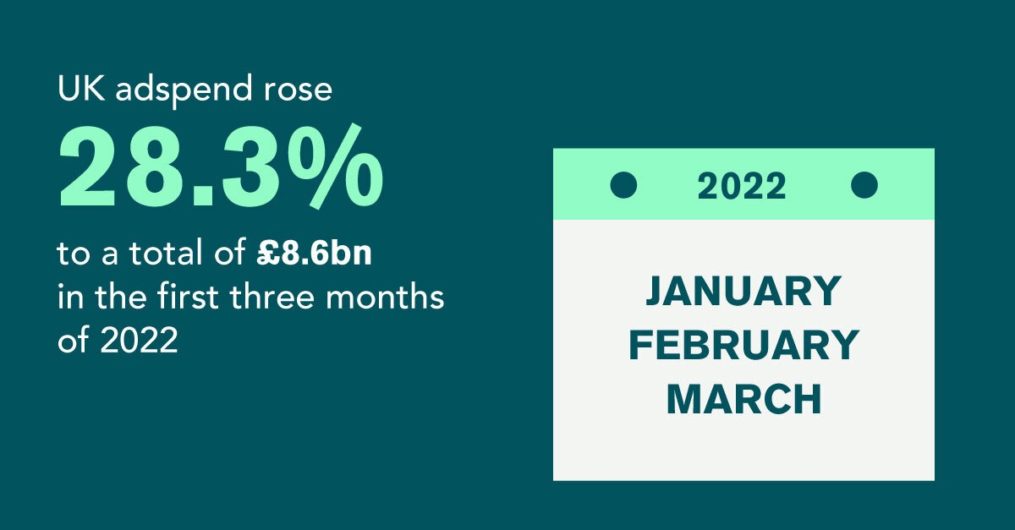

UK Ad Spend had Strong Q1, but Real Contraction Forecasted for 2023

The latest AA/WARC Advertising Expenditure report found that total UK ad spend was up 28.3 percent year-on-year in Q1, continuing a strong post-pandemic recovery. This better-than-expected performance means that total 2022 ad spend is now expected to be up by 10.9 percent. However when accounting for inflation, this will represent 1.8 percent real growth. And while 2023 is expected to see 4.4 percent growth in nominal terms, this would be a 0.9 percent contraction in real terms when accounting for expected inflation.

Dentsu UK and 55/Redefined Aim to Tackle Ageism in Advertising

Dentsu UK this week announced a new partnership with 55/Redefined, an organisation which seeks to “redefine life after 50”, to help tackle ageism in the ad industry. Under the partnership, Dentsu UK is committed to:

- Investing in technical training and re-skilling for over 50s

- Ensuring recruitment processes are accessible for over 50s

- Ensuring that workers aren’t encouraged to retire at a set age

- Communicating and promoting job vacancies fairly

GroupM Launches Data Acceleration Programme ‘The Edge’

GroupM, WPP’s media investment group this week announced the launch of ‘The Edge’, a data acceleration training programme for media specialists within GroupM Nexus in the UK, amplifying data-proficiency and maximise data-led decision making for clients. The 15-month professional learning qualification will be delivered in collaboration with global education provider, BPP, and technical advisory specialist.

PMG and Initiative Split Nike’s $1 Billion Media Account

Nike has concluded its review of its $1 billion media account, putting independent agency PMG in charge of integrated media in North America, while IPG’s Initiative will have charge of integrated media in international markets. PMG has also been chosen as Nike’s global digital capabilities partner.

GroupM Agencies Partner with Good-Loop to Decarbonise Media

GroupM agencies Mindshare, Wavemaker, MediaCom and Essence have partnered with ethical ad tech platform Good-Loop in Australia, allowing their client to use Good-Loop’s Green Ad Tag to measure and offset the carbon footprint of their programmatic media buying.

Ad Net Zero Announces Second Global Summit

Ad Net Zero, an industry initiative to reach net zero emissions from ad operations by 2030, has announced it will hold its second global summit on November 9th & 10th this year. “The Summit, growing from our first ever in Glasgow last year, will review the progress we are making since then,” said Sebastian Munden, chair of Ad Net Zero. “Everybody is invited and content will cover different sectors and different action areas. We will share learning and best practice, providing practical tips on changes we can all make in the way we work and the work we make.”

ASA Rolls Out UK-Wide Marketing Push

The Advertising Standards Authority’s (ASA) is rolling out a nationwide campaign highlighting its work to protect consumers, aimed at increasing public awareness of the ASA’s regulatory role, thereby increasing trust in advertising overall. The UK-wide rollout follows a pilot campaign in Scotland.

Ad Spend and Price Hikes Boost Unilever’s Sales Forecast

Unilever increased its full-year sales guidance this morning, after surpassing its sales forecasts for the first half of 2022. The consumer giant reported underlying sales growth of 8.1 percent, having upped its prices by 9.8 percent, in order to soften the impact of inflation on the company’s budgets. Unilever CFO Graeme Pitkethly the company raised ad spend by €200 million in the first half of the year, in efforts to prevent consumers from switching to supermarket own-brand products. Read more on VideoWeek.

Zenith Wins Nando’s Media Duties in UK and Ireland

Publicis media agency Zenith has been handed media duties for Nando’s in the UK and Ireland following a review, Campaign reported this week.

Hires of the Week

SkyShowtime Hires Roberto Soto and John Heinemann

SkyShowtime made two new senior hires this week. Roberto Soto, who most recently worked at HBO Max, joins as chief strategy officer while John Heinemann, previously of Disney, joins as General Counsel.

Nano Interactive Appoints Matthew Beck as VP, Partnerships

Nano Interactive, a privacy-first ad targeting provider, has hired Matthew Beck as VP of partnerships. Beck, previously of Prohaska Consulting, will head up the company’s global efforts to expand on its SSP, DSP and publisher partnerships.

VidMob Appoints Silvia Gorra as VP Marketing EMEA

VidMob has appointed Silvia Gorra as VP of marketing EMEA. Gorra joins VidMob from Magnite where she spent more than five years as VP international marketing.

This Week on VideoWeek

While Tech Companies Report Slowing Ad Spend, Agencies are Increasing Revenue Forecasts, read on VideoWeek

Tremor International Agrees to Acquire Amobee for $239 Million, read on VideoWeek

Ad Spend and Price Hikes Boost Unilever’s Sales Forecast, read on VideoWeek

TF1/M6 Merger Threatened by Advertising Competition Concerns, read on VideoWeek

Google Introduces New Tool to Expose Hidden Ad Tech Fees, read on VideoWeek

The Industry Reacts to Google’s Crumbling Cookie Timeline, read on VideoWeek

More Than an Advertising Deal: The Likely Ramifications of the Netflix-Microsoft Deal, read on VideoWeek

Ad of the Week

Amazon Books, That Reading Feeling, Droga5