In this week’s Week in Review: Index Exchange’s practice of “bid caching” is revealed, Amazon positions itself as a YouTube rival, and reports emerge that Facebook’s head of news partnerships told publishers Mark Zuckerberg doesn’t care about publisher relationships. To receive an update on the industry’s top stories every Friday, sign up to the weekly Video Round-Up.

Top Stories

Index Exchange Comes Under Fire Over “Bid Caching”

Index Exchange came under fire this week after it was revealed the company has been doing something called “bid caching” for over a year, which has helped it gain an advantage over rival exchanges and deliver higher CPMs to publishers. Bid caching means that when a buyer loses an auction on Index Exchange, the exchange holds onto the bid in case it can be served when the consumer looks at another piece of content. This can be problematic from a buyer’s perspective since they often will bid more for impressions on the first page a user looks at on a particular domain. So if a high bid for a front page impression is cached and then submitted in an auction elsewhere on the same website, the buyer can end up overpaying.

Buyers were seemingly unaware of this practice, and found out this week through sources other than Index Exchange itself. Index has since responded with a blog post in which it claims the practice helps reduce latency and gives buyers a chance to win auctions which they otherwise would have little chance of participating in. The company’s SVO of product Drew Bradstock said he was “surprised” that buyers were upset, saying Index believed bid caching was an industry practice.

Amazon Targets $1 Billion in Ad Revenue on Twitch

Amazon is aiming to turn its gaming-focussed live streaming platform Twitch into a YouTube competitor according to a report from Bloomberg, with Twitch CEO Emmett Shear reportedly targeting $1 billion in ad sales (over double what it currently earns). Twitch currently lags far behind YouTube in terms of audience, drawing in around 15 million viewers per day, compared to 1.9 billion per month on YouTube. But Twitch is seeking to cut this gap, partly by drawing creators away from YouTube and onto its own platform, reportedly offering deals worth millions of dollars per year to established creators while trying to expand its content beyond its current video game-heavy focus.

Facebook Reportedly “Not Interested” in Traffic and Referrals for Publishers

Facebook’s global head of news partnerships Campbell Brown reportedly told Australian media executives this week that the company “isn’t interested” in talking to publishers about their referrals and traffic anymore, according to a report in The Australian. The comments suggest that the platform no longer sees itself as a tool for publishers to distribute content through likes and shares, instead looking to its Facebook Journalism Project to support journalism. Brown also reportedly told the executives that Facebook CEO Mark Zuckerberg personally doesn’t care about news publishers, and that without the help she is offering, publishers will soon be “dying[…] like in a hospice”. Brown has denied making the comments.

The reports might not help Facebook’s campaign to convince the public it is committed to working with publishers to fight problems like fake news. One member of the public in London expressed their scepticism towards this campaign this week by defacing several Facebook ads promoting the company’s stand against fake news.

A street artist has been improving Facebook billboards across London.

h/t @protestencil pic.twitter.com/rqsH9An3V2

— James Herring (@itsjamesherring) August 17, 2018

The Week in Tech

AT&T Completes AppNexus Acquisition

US telecoms giant AT&T completed its acquisition of AppNexus on Wednesday, with AppNexus folding into AT&T advertising & analytics branch under the leadership of CEO Brian Lesser. AT&T said it will continue to invest and build on AppNexus’ technology globally as it integrates with AT&T’s first-party data, premium video content and distribution. The acquisition is part of AT&T’s strategy for monetising content it’s attained through it’s Time Warner merger, with a particular focus on monetising digital and addressable linear inventory. AppNexus CEO Brian O’Kelley told employees in an internal email that the AppNexus brand will be retired in around a month, according to AdExchanger.

Google Targets Move into DOOH Market

Google’s parent company Alphabet is engaged in talks in Germany over a possible move into digital out-of-home (DOOH) advertising according to a report in WirtschaftsWoch, which is a possible precursor to a similar play in the US and UK. Google is reportedly meeting with advertisers to drum up interest, while also meeting with partners who already operate digital billboards.

The company trialled programmatic trading through DoubleClick for DOOH inventory a few years ago, but there have been no developments since then. If Google does enter the market, it will compete with well established OOH companies like JCDecaux, which launched its own programmatic platform VIOOH a few months ago. Google’s access to user location data could hand it an advantage, but it may meet strong resistance from one of the few remaining sectors of ad land that it doesn’t already dominate.

Facebook Makes Vidpresso Acqui-Hire

Facebook this week announced it has acqui-hired interactive video specialist Vidpresso, buying the seven person team and the company’s tech, but not the company itself. Vidpresso’s tech enables features like on-screen social media polling and comments, graphics and live broadcasting, and its services will remain available to its clients and partners which include BuzzFeed, Turner Sports and NBC.

Amazon Tests Mobile Video Ads and Direct Deals Through DSP

Amazon continued its ramping up of its ad offering this week, testing video ads in mobile search results and piloting guaranteed private marketplace buys between its DSP clients and publishers. Digiday reported on Tuesday that video ads in mobile search results are in beta testing, with the videos up to 90 seconds in length and containing audio. Meanwhile AdExchanger claimed that Amazon has enabled a trial of direct deals through its Transparent Ad Marketplace, saying that direct deals can be sold both by Amazon’s sales team and by publishers themselves.

Strong Ad Sales Support Tencent’s Revenue Amid Government Clampdown on Gaming

Strong ad sales growth of 39 percent year-on-year, was one of the bright spots in Tencent’s Q2 financial results — which saw the company’s first profit decline since 2005 — which come during an uneasy period in which the company’s value has plummeted. The year so far has been difficult for the Chinese tech giant, with the company losing roughly $170 billion in market value since January, and this trend continued this week as it posted it’s first drop in profits in over a decade. Read the full story on VAN.

TVSquared Launches Operations in Latin America

TV performance analytics and optimisation company TVSquared opened TVSquared Latin America this week. “While the role of TV is strong in Latin America, the use of real-time TV attribution and optimisation is still in its early stages throughout the region,” said founder and CEO Calum Smeaton. “Our Latin American customer base is spearheading the use of TV for performance – leveraging the channel as a primary driver of immediate, digital response.”

Stringr Partners with Brightcove

Video marketplace Stringr announced this week it will begin using the Brightcove video platform to enable users to source, edit and publish content in one place. “Through this partnership, our clients can now not only request and edit content with ease, but also publish the finished product, without ever exiting the Stringr platform,” said Stringr founder and CEO Lindsay Stewart.

SpotX Highlights TV and Video Trends in White Paper

Traditional methods of TV viewing remain popular due to television’s ability to facilitate a communal experience, according to SpotX’s ‘Global TV and Video Trends‘ white paper released this week. The paper also finds that faster internet speeds alongside greater penetration of connected TV devices and growth of subscription video on-demand (SVOD) services is helping create a new “post-cable era”.

The Week in TV

Viacom Launches New Digital Studios Unit

Viacom this week launched Viacom Digital Studios International, a new unit which will create, distribute and monetise digital content for Viacom’s biggest brands outside the US like MTV, Nickelodeon and Comedy Central. Viacom has chosen Brendan Yam, previously vice president of multiplatform for MTV and Comedy Central International, to run the new business.

Disney Must Offer £14 Per Share for Sky says UK Takeover Panel

The UK Takeover Panel this week stated that Disney will be forced to offer £14 per share for the portion of Sky it doesn’t own after its acquisition of 21st Century Fox is completed, unless Fox has already acquired the remainder of Sky before the Fox/Disney deal finalises. Fox’s attempt to buy the remainder of Sky has been stalled by Comcast’s competing bid, and Disney has been mulling over whether to continue the pursuit of Sky or not.

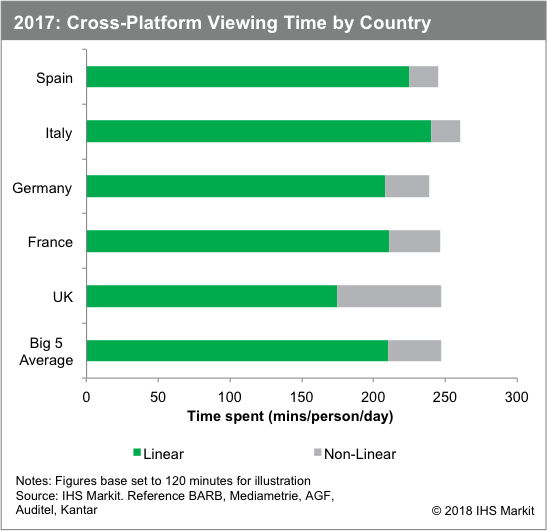

Europeans Spending Two More Hours a Month Watching On-Demand Video Content, says IHS Markit

Europeans are watching two more hours of on-demand content each month compared to last year, according to IHS Markit. IHS Markit’s data show that linear TV viewing time has continued to decline across the UK, France, Germany, Italy and Spain, while time spent on online platforms has increased. Overall, total TV and video viewing time has remained relatively stable across the five markets.

The Week in Publishing

NYT Report Highlights YouTube’s Fake Views Issues

The New York Times released a report this week detailing the apparent ease with which fake views can be bought on YouTube. A Times journalist tested out several sites selling views and likes on YouTube, and claimed that most were able to deliver thousands of views over two weeks. The report highlights that issues still exist for marketers working with influencers on platforms like YouTube, though as VAN has reported, many marketers are shifting away from simply using views as the primary metric for influencer campaigns.

YouTube Set to Surpass Facebook as Second Biggest US Site

YouTube is set to overtake Facebook as the second most visited site in the US, according to research from SimilarWeb. Google is still comfortably in first place according to the study, but Facebook’s traffic has dropped significantly, falling from 8.5 billion visits per month to 4.7 billion over the past two years, while YouTube’s traffic is increasing, reaching 4.5 billion per month. Meanwhile Amazon is poised to overtake Yahoo as the fourth most visited site.

New York Media Considers Selling NY magazine, The Cut and Vulture

US publisher New York media is considering selling off several of its assets including New York magazine and digital properties like The Cut and Vulture. The company has become much more digital focussed since being bought by financier Bruce Wasserstein in 2003, and these potential sales appear to be an effort to continue this modernisation.

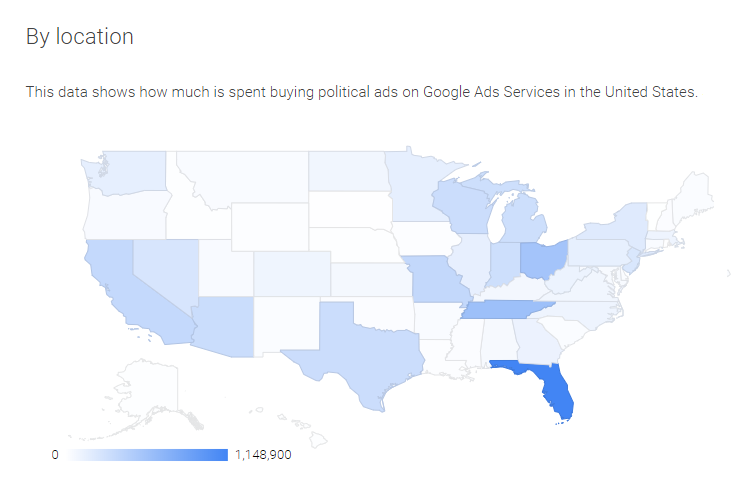

Google Ads Political Ads Section to Transparency Report

Google this week announced it is adding a section on political advertising to its Transparency Report, which shows who buys federal election ads in the US, how much money is spent across states and districts, and who the top advertisers are overall.

The Week for Agencies

WPP Leave London HQ in Break from Sorrell Era

WPP is planning to leave its central London headquarters after 30 years, according to reports this week. The holding group will move from its current location in Mayfair to the south bank of the Thames, though the move may be temporary as the new office its reportedly not large enough to house all staff currently based in the HQ. The move is painted as part of a transition away from the era of Sir Martin Sorrell after his exit as CEO earlier this year. WPP is still looking for a new CEO to replace Sorrell, with IBM’s David Kenny reportedly being tapped up for the role.

Omnicom Buys Second Tech Consulting Shop

Omnicom Group’s Clemenger BBDO this week bought a majority stake in Australian digital transformation agency Levo Digital. The acquisition comes shortly after Clemenger’s purchase of Credera, a fellow tech consulting company, which Omnicom chairman John Wren described as part of the group’s strategy of “making internal investments in our agencies and in new capabilities”.

Hires of the Week

Verizon Installs New CEO

Hans Vestberg has been promoted at Verizon as CEO from his previous position as chief technology officer. Vestberg succeeds Lowell McAdam, who had held the role since 2011, and will continue as chairman of the board.

OpenX Names Todd Parsons Chief Product Officer

OpenX has appointed Todd Parsons as its new chief product officer, a role in which he will be responsible for leading a global product team and guiding product strategy. Parsons joins OpenX from SocialCode, and has also worked for Acxiom and founded two venture-backed startups; Buzzlogic and Aditive.

This Week on VAN

Playable Ads are the Key to Maintaining Momentum in Mobile, read more onVAN

US Operators are “Most Advanced Globally” for Addressable TV, read more on VAN

Strong Ad Sales Support Tencent’s Revenue Amid Government Clampdown on Gaming, read more on VAN

What’s the Role of the SSP in a World Dominated by Header Bidding? read more on VAN

Ad of the Week

Audi, Escape, BBH London

This car commercial takes a sudden turn when the protagonist, in the middle of a large-scale martial arts fight, finds a little respite in an Audi.

https://youtu.be/9cIgRYgv5Ac