In this week’s Week in Review: Schibsted suspends DBM over Google’s GDPR policy, Max Schrems launches first GDPR lawsuits, and Comcast confirms plans to buy Fox assets. To receive an update on the industry’s top stories every Friday, sign up to the weekly Video Round-Up.

Top Stories

Schibsted Suspends DBM

Norway-based publisher Schibsted Media Group announced this week it is suspending its use of Google’s DoubleClick Bid Manager and DoubleClick Campaign Manager, in response to Google’s new rules related to the General Data Protection Regulation (GDPR). Resumé reported on Tuesday that the publisher sent a note explaining its decision to media agencies across Sweden, saying that Schibsted will proceed with campaigns booked in advance up until June 30th, after which time presumably all campaigns conducted through Google will cease. Schibsted reportedly is unhappy with Google’s demands of publishers relating to GDPR compliance, believing that Google is forcing publishers to take legal responsibility for Google’s handling of data.

Privacy Campaigner Launches First GDPR Case Against Facebook

Austrian privacy campaigner Max Schrems launched the first legal cases under GDPR, filing lawsuits worth over $7 billion against big tech companies including Facebook and Google. Schrems’ lawsuits claim that Facebook and Google have both violated GDPR’s terms due to their “take it or leave it” approach to gaining consent, saying that users have been forced to either agree to having their data collected and used for targeted advertising, or else delete their accounts.

The GDPR explicitly allows any data processing that is strictly necessary for the service – but using the data additionally for advertisement or to sell it on needs the users’ free opt-in consent,” said noyb.eu, the pro-privacy group Schrems runs, in a statement. “GDPR is very pragmatic on this point: whatever is really necessary for an app is legal without consent, the rest needs a free ‘yes’ or ‘no’ option.”

Comcast’s Confirms Bid for Fox Assets

Comcast confirmed this week it is attempting to gatecrash Disney’s planned acquisition of 21st Century Fox’s TV and film businesses, saying that any bid it makes will be an all-cash offer worth more than Disney’s current $52.4 billion all-share offer. Comcast’s proposed bid gained backing from activist investor Christopher Hohn, who has built up a 7.4 percent stake in 21st Century Fox, as he urged the company to “immediately engage” with Comcast, according to the FT.

Comcast’s bid would also cover Fox’s stake in Sky. Comcast is also currently competing with Fox to buy the portion of Sky not currently owned by Fox, and the UK’s culture secretary Matt Hancock suggested this week that a Comcast bid for Sky would not face the same level of regulatory scrutiny which is currently holding up Fox’s acquisition attempt.

GDPR Latest

- Several publishers began blocking European access to their domains as GDPR came into force. The LA Times and Chicago Tribune, both owned by publishing business Tronc, were among those to shut down EU access, as well as Pinterest-owned Instapaper. These sites may potentially return to the EU in the future, with Tronc saying it is “committed to looking at options that support our full range of digital offerings to the EU market”. VAN previously reported the risk of publishers shutting down EU access to their domains, as American Media blocked European access to its properties a few weeks back with no explanation given.

- Google met with publishers on Thursday in an attempt to address concerns over Google’s requirements of publishers under GDPR, but the four trade groups who sent the letter of complaint to Google which sparked the meeting refused to attend.

- The IAB proposed a new framework for selling data, aiming to make the source and quality of data more transparent, to aid with GDPR compliance.

The Week in Tech

Realeyes Raises $16.2 Million to Expand AI Offering

Realeyes, a tech company which uses artificial intelligence to read emotions, on Tuesday announced it has raised $16.2 million in growth funding. The company says it will use the funding to grow its AI team and to drive further development of its emotional tech platform. The funding round is the biggest held by Realeyes so far and was led by previous investor Draper Esprit, which was joined by Karma Ventures and Harbert European Growth Capital. Realeyes says the money will also enable it to expand into industries beyond advertising, including healthcare and education among others. Read the full story on VAN.

Sourcepoint Launches Consent Management Platform

Sourcepoint on Wednesday revealed its consent management platform, which it has added as a module within its Dialogue platform. Sourcepoint says the feature will give publishers a set of tools to collect and mange consumer data preferences in compliance with the General Data Protection Regulation (GDPR). The company says the CMP is fully compliant with the IAB’s Consent Management Framework and compatible with DoubleClick for Publishers, and that there will also be support for non-IAB vendors.

Location Sciences Launch Tool for Location Data Authentification

Location Sciences today announced the launch of ‘Verify’, a new product which it says will authenticate the accuracy and precision of location data used in location-based ad campaigns. Location Sciences say advertisers and agencies will be able to used Verify to understand location signal accuracy, POI radius accuracy, footfall, and audience profile matching. “Our team has significant mobile media and publisher experience,” said CEO Mark Slade. “As a result, we were well aware of some of the challenges in distinguishing the good from the bad. We know there are some excellent location providers in the market, however the opaqueness of location data and programmatic execution, combined with the significant premium for location-based inventory, means the market is open to potential abuse.”

Adobe Buys Ecommerce Platform Magento for $1.68 Billion

Adobe announced this week it’s entered into an agreement to buy ecommerce platform Magento Commerce for $1.68 billion. Adobe says the acquisition will allow commerce to be integrated into the Adobe Experience Cloud, delivering a platform which it says will serve B2B and B2C customers globally. Analysts say the acquisition fills what was previously a hole in the Adobe Experience Cloud offering, providing a sales point to finish transactions started with Adobe’s own digital marketing tools. The deal is expected to close in Q3 this year.

TVTY and Ecselis Launch Amazon Campaign Synced with TV Ads

TVTY and Ecselis this week announced they have launched a campaign for Philips which promotes real-time products on Amazon synced with TV ads. From April to June, Philips will sync its sponsored products with Amazon TV spots in an effort to retain consumers’ attention who are watching TV and using other devices at the same time. The companies say that eight product categories will be concerned, and the campaign will cover large events like Mother’s and Father’s day.

The Week in TV

Netflix Passes Disney as Most Valuable US Media Company

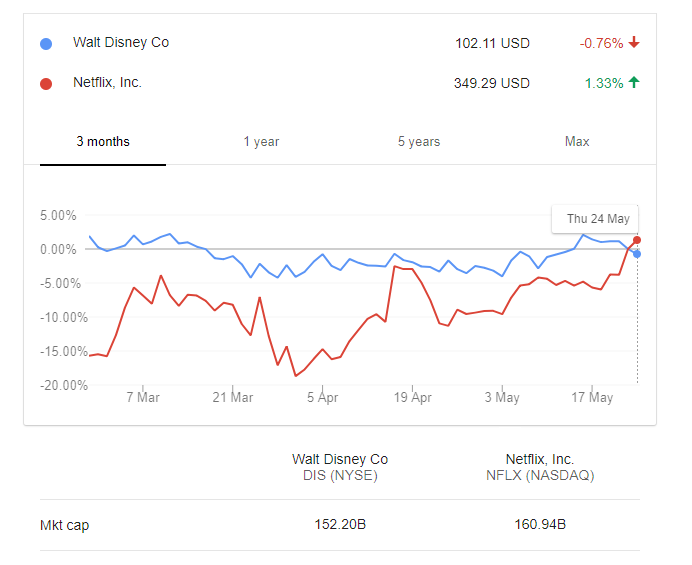

Netflix surpassed Disney as the US’s most valuable media company several times this week, in something of a symbolic moment for the streaming platform. Netflix’s strong growth has continued this year as the platform has continued to post better-than-expected subscriber growth and has signed key content deals, including a deal reached this week which will see the Obamas produce films and TV shows for the platform. The two companies traded the top spot over the course of the week – at time of writing, Netflix’s market cap was $160.9 billion while Disney’s sat at $152.2 billion.

Spanish Broadcasters Confirm HbbTV-Based Platform

Spanish broadcasters RTVE, Atresmedia and Mediaset confirmed their plans this week for a new joint HbbTV-based free to air platform, called LOVEStv, which will start its testing phase on June 14th. The service will be available to anyone who owns an HbbTV compatible receiver, and is designed to help the three broadcasters compete with the likes of Netflix, and other digital competitors.

Altice Approves of Separation of US and European Business

Altice shareholders voted this week to approve the separation of Altice USA from the company’s European business, which will become Altice Europe. The news follows positive Q1 results posted by the Netherlands-based telecoms company last week, which saw Altice USA reach revenue of $2.3 billion for the quarter, up 1.2 percent.

The Week in Publishing

Zuckerberg Faces EU Questioning

Facebook founder and CEO Mark Zuckerberg appeared in front of European lawmakers on Tuesday to answer questions on his company’s data handling policies, though most analysts agree that Zuckerberg got off lightly without having to answer any particularly pressing questions. Zuckerberg was testifying in the wake of his company’s scandal over Cambridge Analytica’s use of Facebook users’ data, but the structure of the meeting has been criticised, as Zuckerberg was left with little time for answering questions and was able to choose which questions he answered live. Zuckerberg apologised again for the data leak, but several EU legislators complained that their questions were left effectively unanswered, with Zuckerberg simply promising follow-ups for some of the more probing queries.

Time Inc UK Rebrands While Meredith Corp Plans Further Title Sales

Time Inc UK is rebranding to TI Media, having been bought by Epiris LLP from Meredith Corporation back in March. The name change will legally take place in June, and is designed to inject new energy into the brand under its new ownership, according to Time Inc UK Executive Chairman Sir Bernard Gray. Meanwhile Meredith Corporation, which completed its acquisition of Time Inc. back in January, is planning to sell off four more publications – Time, Fortune, Money and Sports Illustrated. Vanity Fair reports interest has been high, with 80 potential buyers lining up to pay up to $200 million for the titles individually.

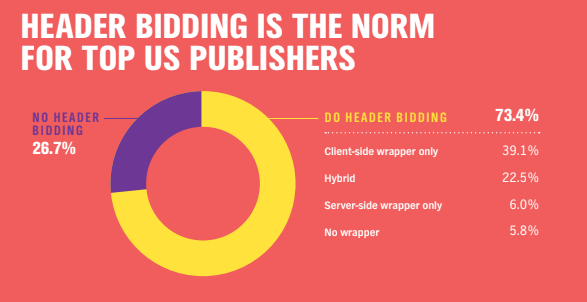

Header Bidding is Boosting Mobile App Inventory says PubMatic

Global app impression volumes monetised by PubMatic grew by 84 percent year-on-year in Q1 2018, thanks in large part to the introduction of header bidding technology for app inventory, according to PubMatic’s Quarterly Mobile Index. The company says that header bidding impression volumes rose 70 percent overall year-on-year, with mobile specifically growing 110 percent. Apps now account for a majority of mobile impressions monetised by PubMatic, with a 59 percent share, according to the report.

The Week for Agencies

Publicis Unveils AI Platform Marcel

Publicis Groupe on Thursday unveiled its new AI platform, named Marcel after group founder Marcel Bleustein-Blanchet, which is designed to connect the company’s 80,000 strong global workforce and create what it describes as a “borderless, frictionless enterprise workforce”. Publicis says Marcel will help it transition from a holding company to a platform, by connecting up employees within all the different agencies that Publicis owns. The AI platform, which has been developed in partnership with Microsoft, will be available initially to Publicis employees as an app on their phones, with plans for it to be developed as a desktop app in the near future. Read the full story on VAN.

Accenture Launches Digital Media Buying Arm

Accenture took another big step into agency territory this week as it launched a new digital ad buying practice, ‘Accenture Interactive Programmatic Services’. The consultancy says the new business will incorporate the planning, buying and management of programmatic ad campaigns. “Consistent with our mission to create, build and run the best customer experiences on the planet, we are enhancing Accenture Interactive Programmatic Services to complement our full suite of experience services,” said Accenture Interactive’s global chief executive Brian Whipple.

Omnicom Creates “Global Experiential Practice Area”

Omnicom on Wednesday launched the Omnicom Experiential Group, which it describes as a connected collection of Omnicom experiential agencies that will form a “borderless experiential network”. The group will include Auditoire, “DOIT!”, GMR Marketing, “Luxury Makers” and TRO, and Omnicom says those involved will retain their individual brands and cultures while working more closely together.

European Digital Ad Market has Doubled in Five Years says IAB Europe

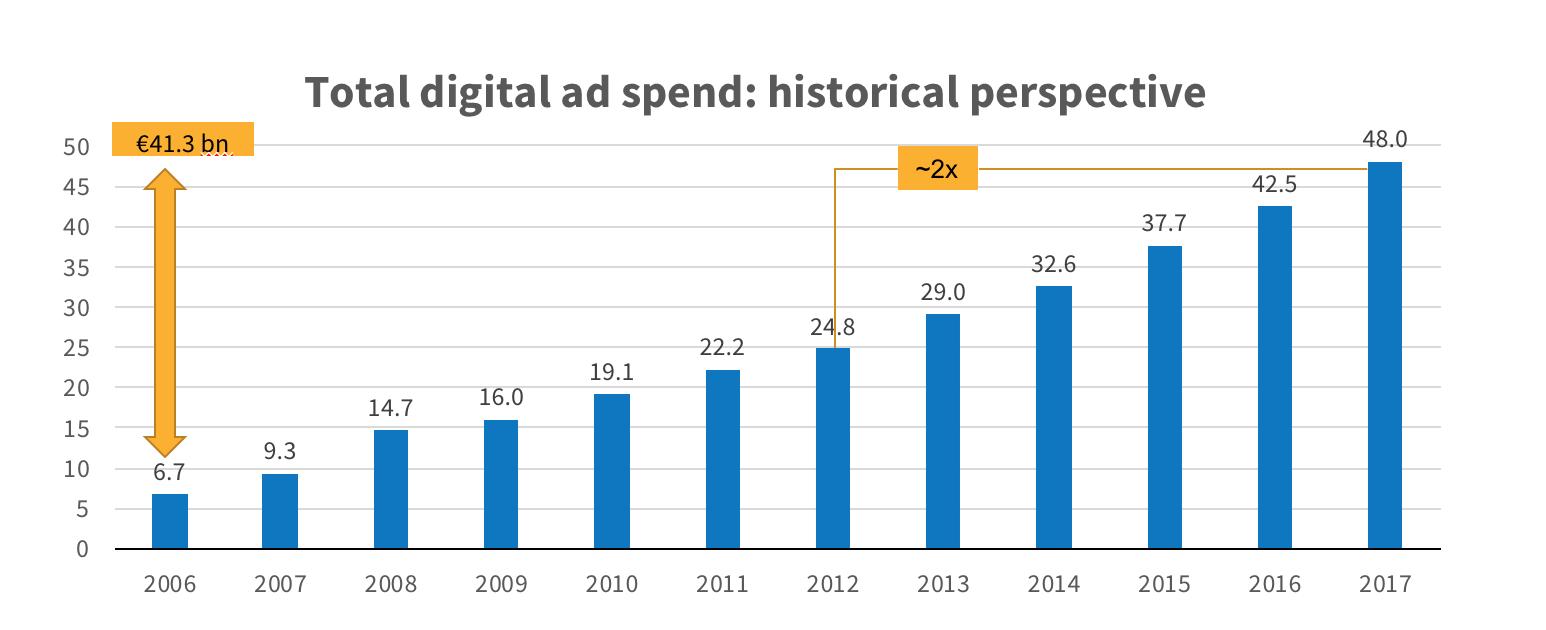

The European digital advertising market reached €48 billion in 2017, compared to €24.8 billion in 2012, according to IAB Europe’s AdEx Benchmark study. The report found that in 2017, digital ad markets grew by double digits in 27 countries. IAB Europe says this growth was driven largely by the growth of social, mobile and video investment – social grew by 38 percent overall, and video grew by 35 percent, four times faster than display. Outstream video in particular fuelled the growth of video, growing by 73.4 percent in 2017.

Partnerships of the Week

Tremor Video DSP and Cuebiq Partner for Geo-Behavioral Targeting on CTV

Programmatic video platform Tremor Video DSP and intelligence and measurement company Cuebiq on Tuesday announced an exclusive partnership to deliver a new geo-behavioral targeting solution on over-the-top (OTT) devices. Tremor says brands which use its Proximity Plus solution – which is powered by Cuebiq’s insights – can now extend this advanced targeting to full episode, fully viewable and fraud-free inventory on the biggest screen in the house via connected TV (CTV). As part of a preferred partnership, MullenLowe Mediahub will be the first agency to execute this audience hyper-targeting for its clients.

Grabyo Partners with Mediacorp for Social Broadcasts

Grabyo this week announced a partnership with Singapore’s Mediacorp to power the company’s live and near-live social video content. Grabyo’s cloud-based video-editing and live production platform will be used to help Mediacorp broadcast its content across web and mobile devices, which the two say they hope will dramatically increase social views and engagement.

Hires of the Week

Amazon Studios Picks Vernon Sanders as Co-Head of TV

Vernon Sanders was hired by Amazon Studios as co-head of TV this week, which will see him manage create and production units for Amazon Prime Video alongside Albert Cheng.

Publicis London Recruits Four New Strategy Directors

Publicis London this week took on Tara Austin as behavioural strategy director, and hired Paulina Goodwin, Charlotte Stone and James Dawkins as strategy directors. All four will report to Publicis London’s chief strategy officer Dom Boyd.

Kantar Media Appoints Louise Ainsworth as EMEA CEO

Kantar Media this week hired Louise Ainsworth, currently CEO of Kantar’s Millward Brown UK research agency, as its new EMEA CEO. Ainsworth will sit on the Kantar Media executive committee, reporting to CEO and chairman Andy Brown.

The Week on Van

Ad Industry Must Remain Flexible and Adaptable After GDPR Deadline, says OpenX’s McPherson, read more on VAN

Realeyes Raises $16.2 Million to Expand AI Offering, read more on VAN

Privacy Pop-Ups 2.0: How Are Publishers Gaining Consent Under GDPR? read more on VAN

Publicis Unveils AI Platform Marcel, read more on VAN

The Industry Reacts to Accenture’s Move into Media Buying, read more on VAN

Ad of the Week

BBC, The Tapestry, BBC Creative

Following ITV’s well put together spot promoting its FIFA World Cup Coverage last week, the BBC released its own ad this week, which beautifully recreates iconic world cup moments in the style of a tapestry.