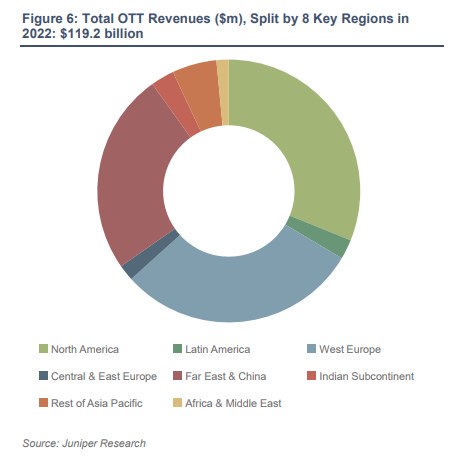

Revenues for over-the-top (OTT) platforms will nearly double over the next five years, according to research released today by Juniper Research, increasing from $64 billion this year to $120 billion in 2022. Juniper says this growth will be largely driven by subscription video on-demand (SVOD) services, predicting that over a quarter of global households will be subscribed to at least one SVOD service by 2022. SVOD services will find success thanks to three strategies according to Juniper: building their content catalogues, shifting to live content, and acquiring sports rights, though there are potential pitfalls associated with these strategies.

Revenues for over-the-top (OTT) platforms will nearly double over the next five years, according to research released today by Juniper Research, increasing from $64 billion this year to $120 billion in 2022. Juniper says this growth will be largely driven by subscription video on-demand (SVOD) services, predicting that over a quarter of global households will be subscribed to at least one SVOD service by 2022. SVOD services will find success thanks to three strategies according to Juniper: building their content catalogues, shifting to live content, and acquiring sports rights, though there are potential pitfalls associated with these strategies.

Juniper’s figures put OTT service revenues at $64 billion this year, but it predicts an increase to $120 billion by 2022. The research firm predicts that SVOD services will be most likely to succeed at what it calls three winning strategies in the battle between OTT services and TV Networks.

Digital players like Netflix, Amazon and Apple have been very publicly spending big on original content, which Juniper believes will help them continue to attract new subscribers. These companies are vastly outspending their TV network rivals; for example, Juniper predicts that Netflix will spend over $6 billion in 2017-18, compared to $1.4 billion spending by the BBC. Some OTT services also have advantages over TV broadcasters where they’re backed by media companies which can provide them with content, as is the case with Disney and Hulu.

While it makes sense for OTT services to try and reduce reliance on non-original content (as shown by Disney’s decision to withdraw its content from Netflix), there are risks with this strategy, as spending doesn’t guarantee success. “Success will hinge on whether these providers can continue to produce hits such as ‘Stranger Things’. As consumers become more fluid in their uptake and loyalty to video services, OTTs could just as easily see users switch off,” said research author Lauren Foye.

Juniper also expects OTT companies to invest in sports rights, which will further help drive up subscriptions and ad revenues. Amazon, Facebook and Twitter have all begun investing in sports, and Amazon are predicted by Juniper to bid for Premier League rights next year. As VAN explained yesterday, these tech giants might have advantages over TV broadcaster for monetising sports content, and would certainly draw in new subscribers with exclusive rights to premium sports packages.

Other live content which is more exclusive to digital platforms could also aid revenue growth. Live social video, like the ‘Live’ features on Facebook and Instagram, and live streaming offered by platforms like YouTube and Twitch “will be increasingly of interest to advertisers” according to Juniper. This ad revenue could be stunted though by brand safety concerns associated with these platforms causing brands to be cautious about advertising next to live, unfiltered content.

As well as the content itself, the OTT model for packaging this content could help OTT services steal customers from TV broadcasters. The fact that OTT services offer ‘skinny bundles’, where subscribers pay for access to a slimmed down packages of content more relevant to their interests, makes them more attractive to audiences according to the research. Juniper says customers switching from cable to SVOD services, as well as new SVOD services launching across the globe, will account for a large amount of predicted growth in OTT revenues.