In this week’s Week in Review: Amazon pips Sky to secure UK rights for ATP Tennis, Snap launches a new ROAS focussed measurement platform, and Google is launching a built-in ad blocker for mobile browsing. To receive an update on the industry’s top stories every Friday, sign up to the weekly Video Round-Up.

Top Stories

Amazon Pips Sky to Secure UK Rights for ATP Tennis

Amazon has beaten Sky to secure the UK rights to men’s ATP World Tour tennis, according to The Guardian. The global streaming giant is believed to have paid up to £10 million a year to secure the rights to the ATP World Tour Masters 1000 and Masters 500 events when Sky’s contract expires next year. The move takes Amazon into premium sports rights outside the US, and raises questions around whether it will bid for other lucrative rights abroad, particularly with English Premier League rights up for renewal next year.

Snap Launches New Measurement Platform

Snap is rolling out a new measurement program to focus specifically on return on ad spend and sales lift. Since its IPO, Snap’s measurement shortcomings have been scrutinised, however tests of the new measure suggest Snapchat can drive significant ROAS. The first marketing mix measurement firms to join Snapchat’s marketing mix measurement program are Analytic Partners, Marketing Management Analytics, Neustar and Nielsen.

Google is Launching a Built-in Ad Blocker for Mobile Browsing

The current version of Google’s mobile browser, Chrome Canary, includes a built-in setting that blocks websites from showing ads that the search giant deems “intrusive”, TechCrunch reports. The barred content includes pop-up ads, interstitials, and autoplay video. The new ad blocker is the default setting for the latest Chrome build, so needs to be disabled, rather than activated.

Financials of the Week

Apple Shares Hit Record High as iPhone Sales Drive Performance

Apple’s published financial results for its fiscal 2017 third quarter ended July 1st show quarterly revenue of $45.4 billion and quarterly earnings per diluted share of $1.67. Compared to revenue of $42.4 billion and earnings per diluted share of $1.42 in Q3 2016. Strong iPhone sales in the quarter suggested buyers have become less inclined to delay purchases for new model releases. The results also show unexpected strength in iPad product lines, and continued growth in service revenue.

The tech giant’s report of better-than-expected sales, revenue and earnings per share, combined with a confirmation that its 10th-anniversary phone lineup is on schedule, pushed Apple Inc. stocks up six percent to an all-time high.

Rubicon Project Reports Q2 Loss and Announces Turnaround Strategy

Rubicon Project has published financial results showing a $11.6 million loss during the second quarter after revenue fell to $42.9 million. In light of their falling revenues Rubicon Project’s Chief Exec Michael Barrett and Chief Financial Officer David Day used the earnings conference call to outline their turnaround strategy. Key facets include:

- To cut its take rates and transition towards a lower margin, high volume business model

- To succeed its existing client-side header bidding solution, Fast Lane, with a new server-to-server side header bidding solution

- To increase in its focus on mobile app inventory

Johnston Press EBTIDA Down Three Million but Profits Up

Johnston Press plc has reported EBITDA at £19.7 million in the first half of 2017. Down from £22.8 million last year. Total revenue for the group, including classifieds, was down 3 per cent to £102.9 million. Operating profit, the company’s preferred measure of performance, came in at £4.9 million, compared to a loss of £211.7 million in the first half of 2016 following a significant writedown. Across the Johnston Press group, digital revenue rose 14.8 per cent over the half year and page views have risen to around 110 million a month.

The group hailed the performance of i, which it acquired last April for £24 million, as evidence of its upwards trajectory. Since the acquisition, circulation revenue at the daily has increased from £4.4 million to £11.0 million, and advertising revenues have jumped from £800,000 to £3.0 million due to the launch of inews.co.uk last year.

Intelsat Q2 Numbers Reflect Price Pressure

Intelsat has published its 2017 Q2 report, showing total revenue of $533.2 million and a net loss of $23.8 million for the three months ended June 30th 2017. CEO Stephen Spengler said that continued pricing pressures for certain wide-beam network services were creating a headwind against year over year growth. Good news came in the form of the successful launch of Intelsat 35e, which began in-orbit testing on July 24th. The satellite is expected to enter into service in Q3/2017.

Mediaset Spain Reports H1 Profit Up Seven Per Cent

Mediaset Spain has reported a first half 2017 net profit of €125.7 million to June 30th, up seven per cent on the same period last year. EBITDA were up five per cent to €168 million. TV ad revenues remained flat at €491.1 million, the same amount for the same period last year. Net profit amounted to €125.7 million, a 6.8 per cent rise on the same period 2016.

Voting Rights Mean Snap Inc Not Eligible for S&P 500

Snap has been blocked from the S&P 500 because of its lack of voting rights for shareholders. S&P Dow Jones Indices said companies with such shareholding arrangements will no longer be eligible as future replacement candidates for the S&P Composite 1500 and its component indices. Existing companies with multiple share classes such as Google owner Alphabet and Warren Buffett’s Berkshire Hathaway will remain in the index.

The Week in Tech

RTL takes 15 Per Cent Stake in Inception VR

RTL Group has taken a 15 per cent minority stake in VR firm Inception, after leading the network’s €13 million Series A funding round. RTL said that Inception will provide VR programming, creative, and distribution capabilities to RTL Group thanks to its content network, interactive technology and content making expertise. Inception said that the funding will help the company to expand its content catalogue, enhance its technology platform and accelerate growth.

Facebook Buys Ozlo to Smarten up Messenger AI

Facebook has acquired AI start-up Ozlo in an effort to beef up its Messenger app, TechCrunch reports. Ozlo’s team will join Facebook’s team to support their work with artificial intelligence and machine learning to make Messenger smarter and more intuitive. It has not been confirmed how much Facebook paid to acquire the four-year old company, whose current app and services are being shut down.

Adsquare Adds Cross-Device Capabilities to Mobile-First Data Exchange

Adsquare is proposing an alternative method to cross-device matching, which starts with device IDs rather than cookies as the core identifier. Adsquare has introduced mobile cross-device capabilities into its exchange through partnerships with Tapad, Drawbridge and Adbrain. Crosswise is coming soon. Rather than building mobile audiences based on cookies adsquare is aiming to help the buy side create segments using mobile ad IDs as the bridge to cookie IDs.

Mozoo Acquires AdinCube in $20m Deal

Mobile monetisation specialist Mozoo has acquired AdinCube, an AI powered in-app mediation technology in a $20m deal, comprised of cash purchase and shares, plus earn out. Mozoo hopes that machine learning technology will optimise buyers, bidders and purchasing metrics and is aiming to scale the product globally.

AltspaceVR Shuts Due to Financial Difficulty

Virtual reality social network, AltspaceVR, is due to close down on August 3. A statement published on the company’s website said the turn of events was “surprising, disappointing, and frustrating”, and added that “we can’t afford to keep the virtual lights on anymore”. The venture-backed firm, which allows people to meet in a virtual environment, blamed a combination of a failed funding round and the “general slowness of VR market growth”.

The Week in TV

Discovery Seals Scripps Deal at $14.6 Billion

The Discovery Channel has snapped up Scripps Networks Interactive in a deal valued at $14.6 billion including debt. The transaction unites Discovery’s reality and natural history fare with Scripps real estate, lifestyle and entertainment stable. Discovery anticipates that it can reap $350 million in cost savings, while gaining scale that will bolster its hand in negotiations with distributors for carriage fees, which have become a significant source of revenue for network owners.

ProSiebenSat.1 Now Generates Half of Revenue Outside Advertising

ProSiebenSat.1 has published results showing that it generated over half of its revenues in the first half of 2017 from non-advertising activities for the first time, helping deliver solid revenue and profit growth for the group. Overall, ProSiebenSat.1 saw its second-quarter revenues grow by nine per cent to reach €962 million, while adjusted EBITDA rose by six per cent to €270 million.

BBC Kids Content for Amazon Video

BBC Worldwide has agreed a multi-year licensing deal with Amazon Prime Video, giving its subscribers in the UK and Ireland access to popular children’s TV series from CBeebies and CBBC. The deal marks BBC Worldwide’s first children’s package on Amazon Prime Video in the territory.

Telefónica Reverses Drop Pay-TV Subscriptions

The launch of new convergent packages on Movistar Plus has begun to reverse the downward trend in subscribers to Telefónica’s IPTV service. In the second quarter of the year, its pay-TV gained 51,000 subs versus a loss of 41,000 the previous quarter. The growth was boosted by new customers and migration from low-value options to the Fusion + Ocio bundle launched in April.

Spanish Government Frustrates US Entrance to DTT

In order to keep the country’s DTT licences in the hands of Spanish companies, The Spanish Government has hindered the entry of Viacom into the DTT business. A deal for Viacom to buy a 25 per cent stake in a DTT licence from Vocento had already been agreed, but the Government vetoed it on the grounds that there is no reciprocity of investments with the US and that the 25 per cent stake surpasses the 20 per cent limit authorised for an International company in a DTT licence.

DISH Joins TiVo Metadata

TiVo has announced that US pay-TV provider DISH has completed its migration to TiVo Metadata. DISH is utilising TiVo’s rich metadata, such as programme information and image-based content, across its product platforms, including linear TV, VoD and DVR.

Deutsche Telekom Reports Over Three Million TV Customers

Deutsche Telekom has reported over three million TV customers in Germany at the end of June, an 8.9 per cent increase year-on-year. The operator said that its service was the only IPTV platform in the German market that posted growth during the period.

Eleven Inks Deal for English Football League

Eleven Sports has secured a new live rights agreement with the English Football League for the next five years covering Belgium, Luxembourg and Poland. The deal gives Eleven rights to show coverage of Sky Bet Championship, League One, League Two and Carabao Cup competitions in the three countries. Eleven will also show games delayed and on repeat.

The Week in Publishing

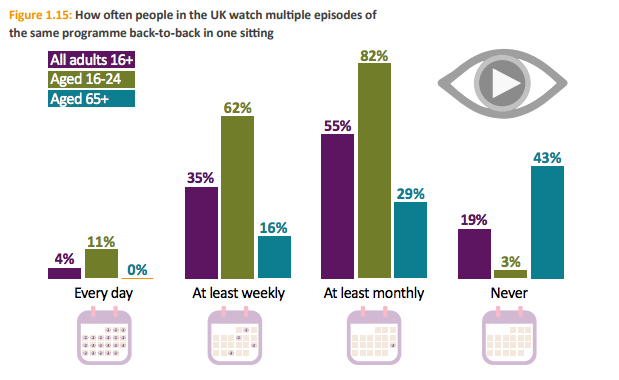

Half UK Youngsters Binge Watch Weekly

79 per cent of UK adults, some 40 million people, now use on-demand services like the BBC iPlayer and Netflix to watch multiple episodes of a series in one sitting, Ofcom reports. But our habits vary considerably by age, with bingeing most popular among young people. Some 62 per cent of 16-24 year-olds view in this way on a weekly basis, compared to just 16 per cent of people aged over 65.

Shares Spike on Reports of SoftBank Plan for Merger of DISH and Sprint

Shares of Dish Network and Sprint have jumped following reports of a possible merger SoftBank is reportedly behind the merger between US cellular telco Sprint, and Charlie Ergen’s DTH operation DISH Network. Shares in Sprint jumped 10.3 per cent on August 1st, and DISH rose 2.3 per cent on the speculation. SoftBank already owns 80 per cent of Sprint.

YouTube Taking New Steps Against Hate Speech and Extremism

YouTube has announced it will apply “tougher treatment” to videos that aren’t illegal but do feature hate speech and violent extremism. The video site says it will start to place videos in a “limited state” when they don’t violate YouTube policies but do contain “controversial religious or supremacist content.”. The videos will remain on YouTube behind an interstitial, so “won’t be recommended, won’t be monetised, and won’t have key features including comments, suggested videos, and likes,” said YouTube in a company blog post.

UK Ad Spend Grows Despite TV Decline

UK advertising expenditure grew 1.3 per cent year-on-year in Q1 2017 to reach £5.318 billion, according to the Advertising Association and WARC. Growth in the overall market came despite a drop of 6.2 per cent in television advertising. Ad spend growth in the UK continues to be driven by internet based advertising, which rose 10.1 per cent during Q1 2017. In turn internet growth was largely driven by mobile, with spend particularly strong at 36.2 per cent growth year-on-year. However, TV ad expenditure is forecast to recover in 2018 with 2.5 per cent growth.

Netflix $20 Billion in Debt

Netflix is more than $20 billion in debt according to The LA Times. The SVoD service has more than doubled its spending this year and is expected to invest more than $6 billion on its slate of programming in 2017. The company has accumulated a $20.54 billion debt in its effort to create and produce more original content. Netflix is said to expect “to be free-cash-flow negative for many years”, whilst it continues to build on subscribers; currently 104 million subscribers use the streaming service.

UK Display Ad Viewability Rate Rose Above 50 Per Cent in Second Quarter

In Q2 2017 the percentage of banner ads served in the UK that met minimum viewability guidelines rose to 51 per cent, marking the first time since Q1 2016 that the viewability level exceeded 50 per cent, according to Meetrics. However, the UK’s viewability rate still trails the other three countries in Europe that Meetrics tracks: Austria recorded 69 per cent, France 58 per cent, and Germany 57 per cent.

Meetrics attributes the UK’s lagging ad viewability to higher penetration of programmatic and automated ad buying, and the comparatively high share of the UK market dedicated to mobile.

Sony Pictures Buys Funimation Stake

Sony Pictures Television Networks has reached an agreement to acquire a majority stake in Funimation Productions, in a deal that values the Japanese anime distributor at around €127 million. Funimation’s catalogue of toons includes Dragon Ball Z, Cowboy Bebop and One Piece. It also operates the FunimationNow SVOD service.

‘How to’ Videos Dominate in Fashion Video Content

Fashion brands attract 53 per cent more views on YouTube than fashion creators, but but creators get seven times more engagement according to a new study by Pixability. Brand receive the most views on ‘how to’ videos, but informative videos attract the highest engagement rate.

Partnerships of the Week

Switzerland’s Sunrise Partners with Sky for Sports

Swiss service provider Sunrise has partnered with Sky to offer its customers sports content via the Sky Sport app. Sunrise is allowing TV and internet customers to watch live sport including Champions League and Bundesliga football, ATP World Tour Tennis and Formula 1 racing, via the app for free for three months. The app is available across a range of devices and Sunrise said it plans to integrate the service into its Sunrise TV Box UHD by the end of the year.

Hires of the Week

Lucky Generals Hire Isaacs to Head Content and Partnerships

Lucky Generals have hired Rob Isaacs as its first head of content and partnerships. Isaacs joins from Adam & EveDDB, where he was content partner.

Media iQ Hires Mahony as CMO

Media iQ has hired Rebecca Mahony as chief marketing officer. Mahony most recently served as CMO for Teads.

TabMo Expands Support for Self-Serve Ad Clients

TabMo has recruited Henna Firdos for the new role of platform operations manager. She joins from location-based mobile advertising company, Blis, prior to which she worked at The Exchange Lab trading across multiple demand side platforms.

This Week on VAN

Leading Analysts have Mixed Feelings about Discovery’s $14.6 Billion Acquisition of Scripps Networks, read more on VAN

A Response to Blockchains’ Critics: Issues of Scale, Transparency and Threats to Intermediaries, read more on VAN

German Media Giants Create ID Alliance to Compete with US Tech Giants, read more on VAN

Ad of the Week: Kia Soul Turbo, The Turbo Hamster Has Arrived, David & Goliath

A little light relief this week in the form of a hamster that makes most of Bruce Willis’ action movie stunts look lame. The turbo hamster is here, and it’s here to sell you cars. Enjoy.