In recent years video advertising has tended to attract negative headlines, but a new study from video and TV ad platform Extreme Reach suggests the industry is finally starting to tackle some of its most challenging problems. The company saw a dramatic improvement in viewability, completion and time spent metrics for video ads, in Q2 2017, which it set out in a benchmark report (which we should stress isn’t independently audited, although it is vetted by the MRC for viewability). Extreme Reach also found that consumer response to video advertising is improving and that they’re seeing increased advertiser focus on mobile.

In recent years video advertising has tended to attract negative headlines, but a new study from video and TV ad platform Extreme Reach suggests the industry is finally starting to tackle some of its most challenging problems. The company saw a dramatic improvement in viewability, completion and time spent metrics for video ads, in Q2 2017, which it set out in a benchmark report (which we should stress isn’t independently audited, although it is vetted by the MRC for viewability). Extreme Reach also found that consumer response to video advertising is improving and that they’re seeing increased advertiser focus on mobile.

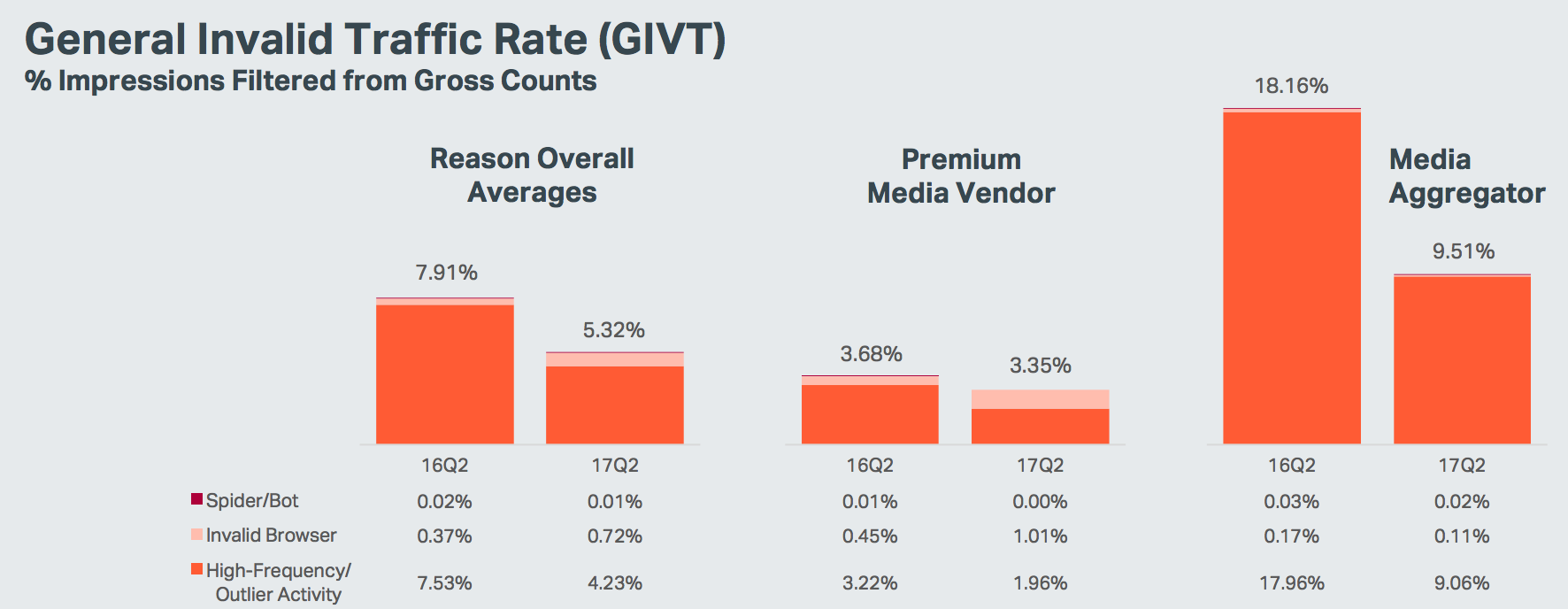

The report compares video ad serving metrics from Q2 2016 to Q2 2017 and when it came to inhuman traffic, it declined for both premium and aggregator inventory, although the most marked decline was on the aggregator side, where amount of inhuman traffic reduced by almost half, from 18.6 percent to 9.51 percent. Overall, what Extreme Reach call ‘General Invalid Traffic (GIVT)’ is down by 33 percent since Q2 2016, suggesting that vendors are being held more accountable for bad inventory:

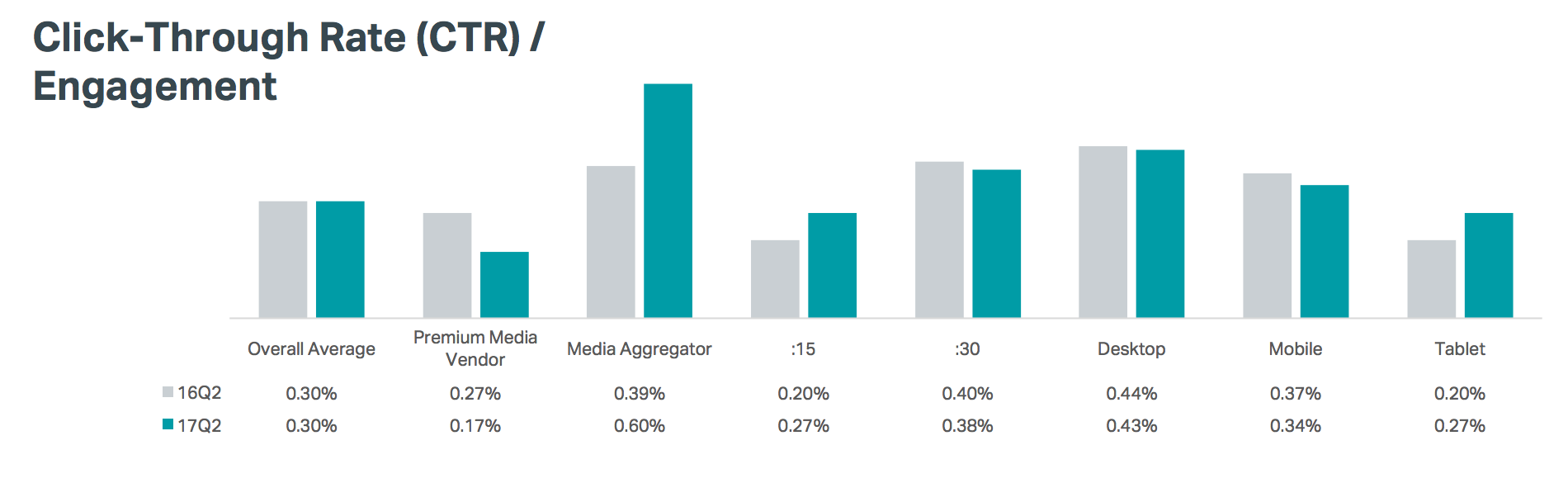

There were also major changes in CTR, desktop inventory saw a major increase in click-through rate (CTR) over the last year. For example, media aggregators, which most commonly run the bulk of their impressions on desktop, saw a remarkable 54 percent increase in CTR, whilst premium publishers saw a 37 percent decrease in CTR.

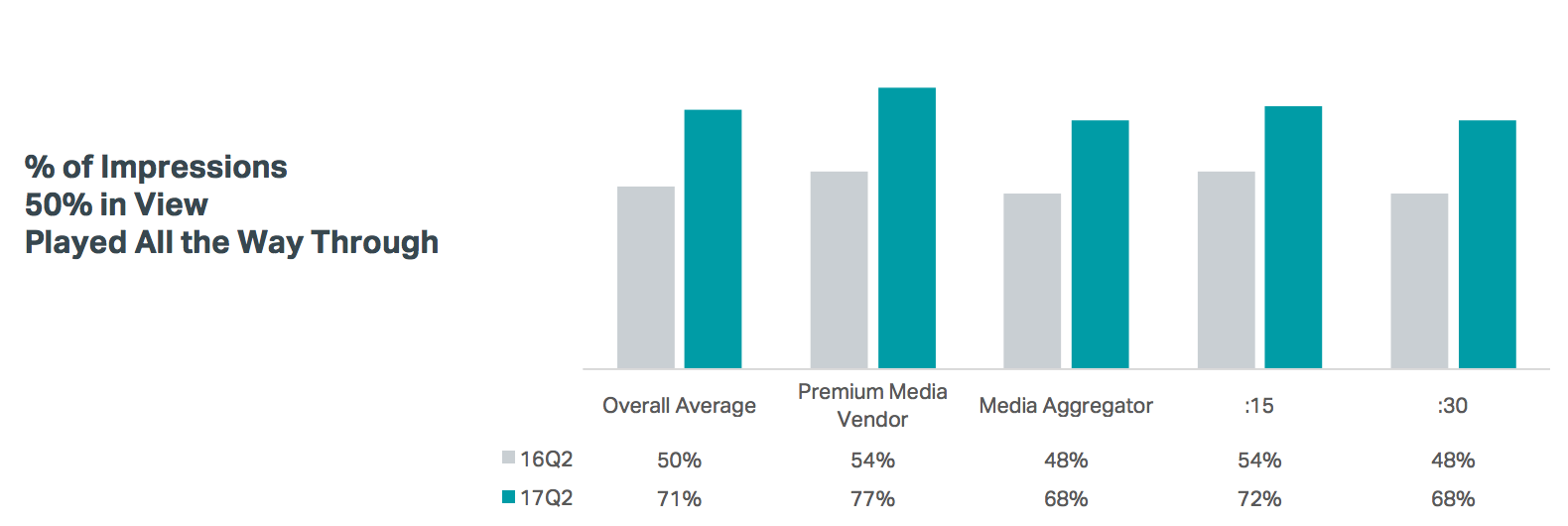

Across the board, both premium vendors and media aggregators both saw major increases when it came to completion rates:

Unsurprisingly, mobile is on the rise. Small video players, which are defined as less than 400×300 in pixels, saw a jump in usage. These players are most popular for mobile impressions.

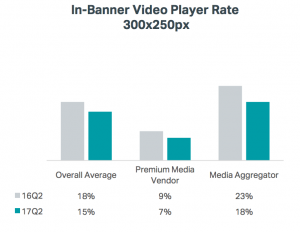

Finally, Extreme Reach also found that in-banner video ads are on the decline. There was a 17 percent drop in video in-banner ads over the last year. Extreme Reach’s report is based solely on quantitative data so they don’t attempt to try to explain the decline, but it seems likely that this can be explained by: (a) the widespread adoption of outstream formats; (b) improved transparency on what size formats advertisers are buying video DSPs; (c) the reduction in fraud we discussed earlier. Whilst plenty of legitimate players use 300×250 (MPU) units for video, they have also been one of the most commonly used formats by the less scrupulous players in the market.

Finally, Extreme Reach also found that in-banner video ads are on the decline. There was a 17 percent drop in video in-banner ads over the last year. Extreme Reach’s report is based solely on quantitative data so they don’t attempt to try to explain the decline, but it seems likely that this can be explained by: (a) the widespread adoption of outstream formats; (b) improved transparency on what size formats advertisers are buying video DSPs; (c) the reduction in fraud we discussed earlier. Whilst plenty of legitimate players use 300×250 (MPU) units for video, they have also been one of the most commonly used formats by the less scrupulous players in the market.